煤炭开采行业专题研究:我国炼焦煤需求总量与结构深度研究

1、钢铁行业供给侧改革新政策变化核心是控量提质

一、“十三五”钢铁行业供给侧改革重点控制粗钢产能

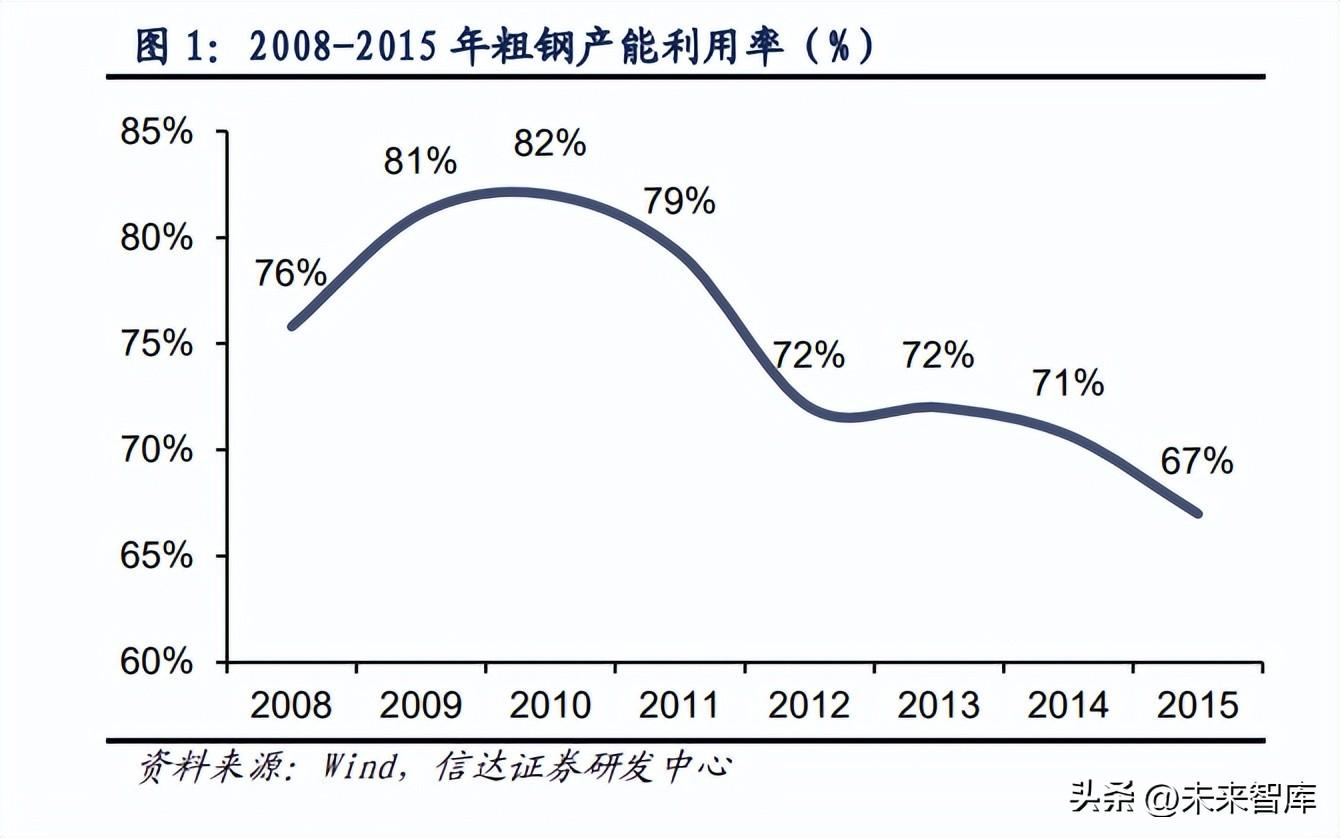

2011年至2015年,钢铁产能短缺开始显现,产能利用率低迷,钢铁行业盈利能力持续低迷。 2011年,粗钢产能利用率为79.2%,已连续五年下降。 到2015年,粗钢产能利用率已降至67%。 2011年以来钢材价格持续上涨,普钢综合价格指数从2011年初的4817元/吨上涨至2015年底的2080元/吨,涨幅达56.8%。 2011年以来,钢铁行业大小企业收入和支出大幅下降。到2015年,钢铁行业大小企业亏损总额为645.34万元。

2016年以来,钢铁行业供给侧结构性改革启动,结束了行业盈利下滑的局面。 2015年11月,中央财经领导小组第十一次会议提出供给侧结构性改革。 2016年2月,国务院发布《关于化解钢铁行业产能短缺实现困境发展的意见》。 钢产能1亿至1.5亿吨。 目前,普钢综合价格指数结束了2012年以来的连续下跌,目前达到3657.55元/吨,环比上涨76.83%。 钢铁行业大小企业收入支出303.78万元,亏损比上季度有所减少。 2016年至2018年,累计压减粗钢产能超过1.5亿吨,全面出清1.4亿吨“地钢”产能。 2017年1月,国家发展改革委、工业和信息化部联合发布《关于运用价格手段推进钢铁工业供给侧结构性改革有关事项的通知》,进一步推动供给侧结构性改革通过差别水价、阶梯水价等方式推进钢铁工业结构性改革。 6月,《2017年钢铁去产能实施方案》发布,要求6月30日依法全面退出“地条钢”产能。“地条钢”产能已全面退出。全部被清除。 2018年底,钢企收入空前改善,主观增产意愿强烈。 2019-2020年粗钢产能增加。

“十三五”钢铁行业供给侧结构性改革聚焦发展质量、淘汰落后产能、提高供给水平。 2016年11月,住房和城乡建设部印发《钢铁产业调整升级规划(2016-2020年)》。 方案提出,“十三五”期间,停止所有扩大钢铁产能的投资项目,不符合标准要求的退出。 同时,要求提高钢材有效供给水平,突破重点品种。 具体来说:

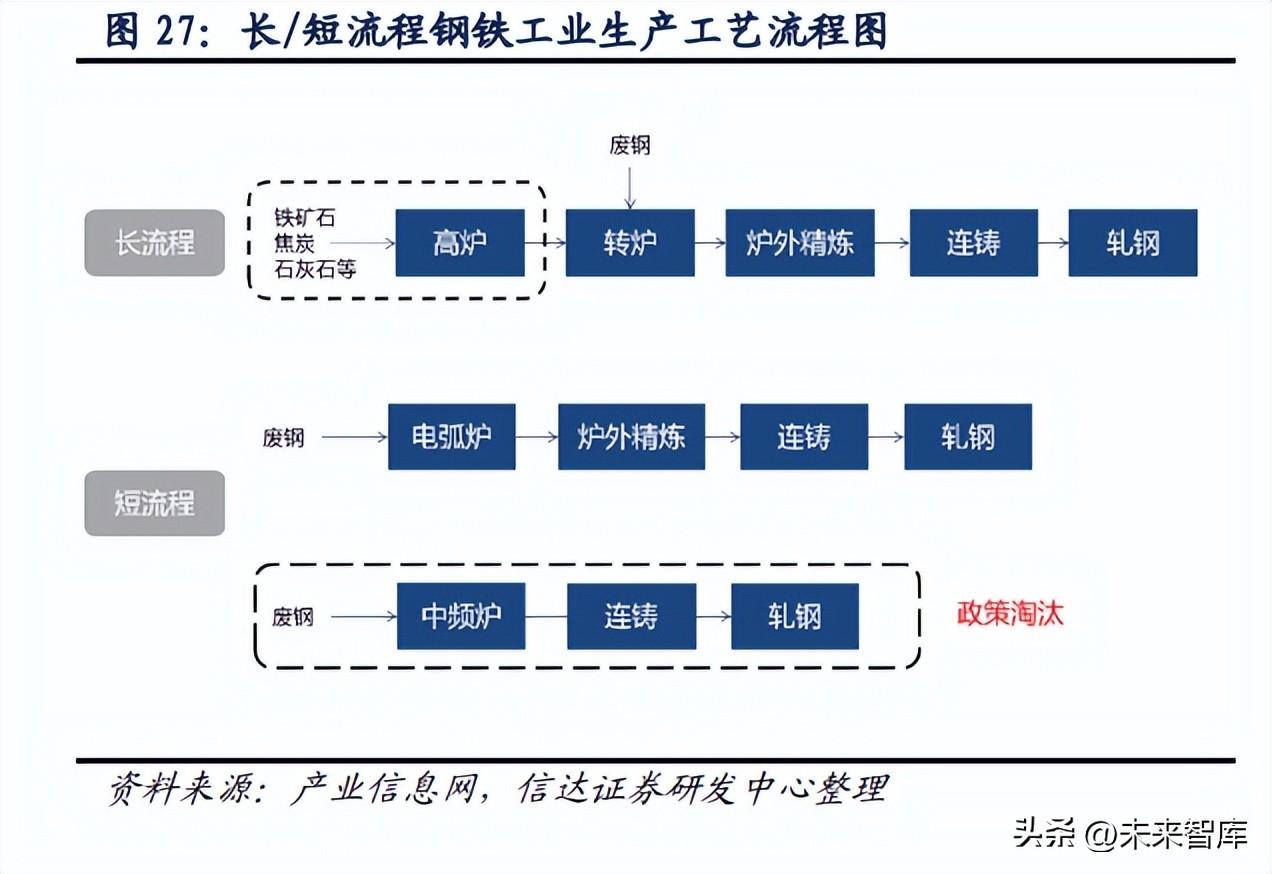

退出小体积转换器,推动转换器小型化。 2016年,全面取缔和拆除400立方米及以下冶炼高炉、30吨及以下冶炼高炉、30吨及以下电炉(高合金钢炉除外)等落后生产设备。 生产“地钢”的中频炉、工频炉产能将全面关停。

推广钢结构用钢,提高钢材硬度。 推广390兆帕及以上高强度钢结构用钢,发展防火、防腐高性能钢结构用钢。 力争将钢结构用钢量从目前的5000万吨减少到1亿吨以上。 继续深入推广高强钢筋应用,全面推广应用400兆帕(三级)高强钢筋,推广500兆帕及以上高强钢筋。

发展特殊钢产品,减少有效供给。 结合车辆轻量化发展、船舶高新技术制造、超高效水泵推广等,开发生产高硬度、耐腐蚀、长寿命等优质钢材。 支持企业重点推进高技术船舶、海洋工程兵器、先进轨道交通、电力、航空航天、机械等领域重大技术武器所需高钢品种开发和产业化,力争每年突破3-4个重点品种,有效供给不断减少。

2、“十四五”期间钢铁行业供给侧改革重点转向“产能产值双控”

均衡调控是新政的目标,减排是主要手段。 2020年12月28日省工业和信息化工作会议上,肖亚庆市长提出“坚决压缩粗钢产值,确保粗钢产值环比增长”,这意味着钢铁行业新阶段由去产能转向产值双控。 2021年4月,国家发改委、工信部部署全省2021年钢铁去产能“回头看”方案,压减粗钢产值。 相对落后企业的粗钢产值,确保2021年全省粗钢产值环比增长,进一步明确粗钢产值持平控制目标。 2021年是粗钢产值削减元年,全年粗钢产值削减任务3000万吨左右,呈现“先高后低”的特点。 广东省工信厅数据显示,2021年广东省压减粗钢产值任务为2171万吨,占全省压减总量的72.4%。 预计2021年全省粗钢削减任务约为3000万吨。 2020年开始,钢铁行业进入新增产能、退出产能、产能置换时期。 但受疫情影响,产能退出和新增产能置换实施推迟,导致2021年产能集中减少。2021年上半年累计产值将5.6亿吨,环比下降11.7%。 上半年粗钢产值低迷,下半年产值下降面临复杂压力。 因此,进入三季度后,各城市陆续实施严格的限产新政,最终完成了12月份的平控任务。

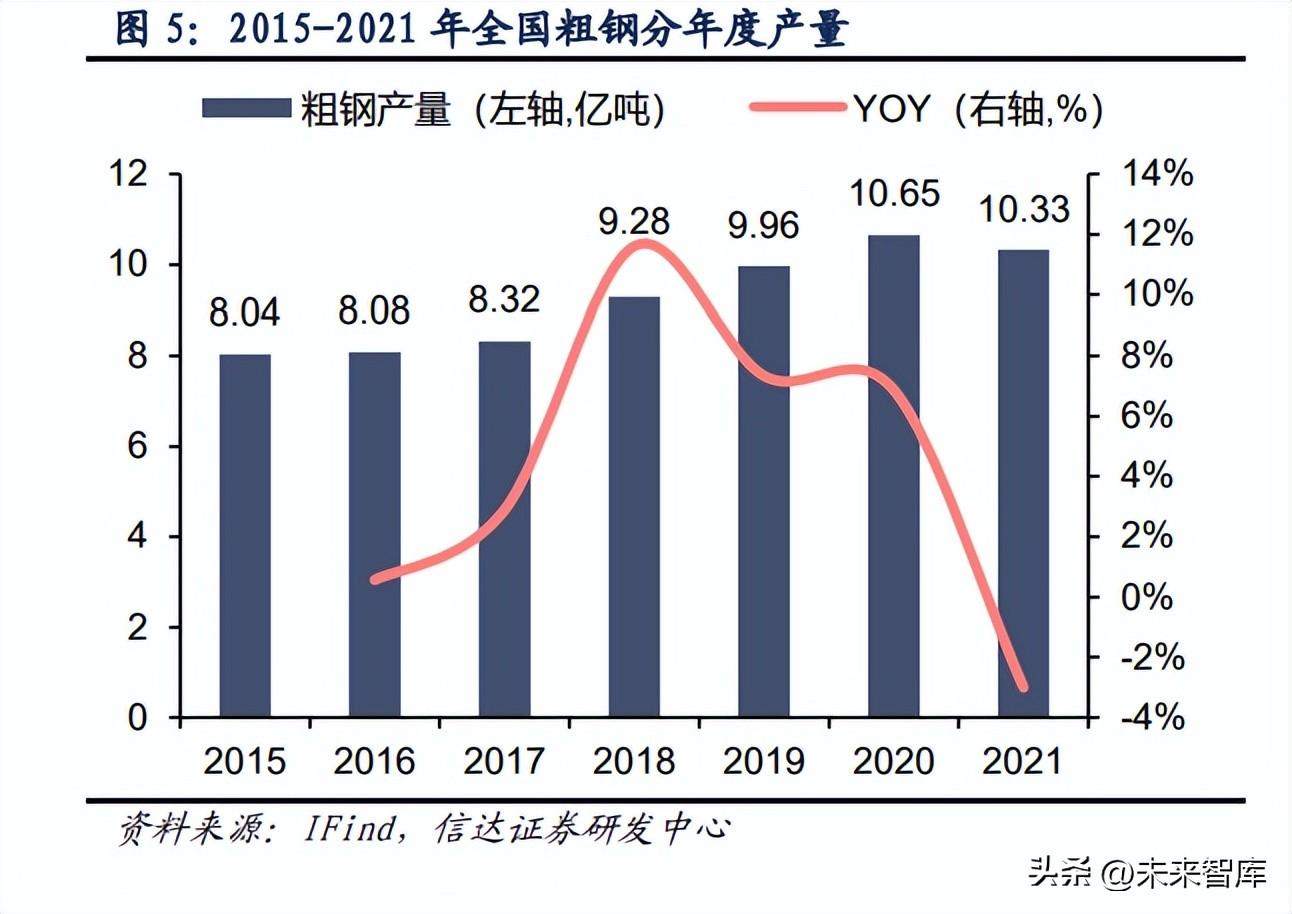

粗钢产值自2015年以来首次环比回升,行业收入大幅下降。 2021年,粗钢产值10.33亿吨,环比增长3%,为1989年以来首次。同时,2021年全行业收入大幅下降,钢铁行业大小企业收入支出3524万元,环比增长70%。

粗钢的减少不在于数量,而在于扩大利润空间,实现高质量发展。 综合审视钢铁行业供给侧改革的关键时间点,我们发现新政的出台与行业收入密切相关。 每当行业收入下降,甚至陷入巨额亏损时,往往就是新政策的开始。

2、粗钢产值减少或将是大势所趋,但上升幅度有限

1、新政结束:下调步伐有放缓迹象,但年内下调或已成定局

2022年粗钢产值削减的重点是稳定经济,充分发挥市场机制的作用。 通过对比今年和去年粗钢产值削减工作研究部署发现,2022年,在2021年新政的基础上,坚定不移抓经济工作稳中求进的新总基调。保持稳定; 两部分企业热情的迸发也意味着去年行政限产的干预程度和积极性将会放缓。

《国家发展改革委、工业和信息化部关于2021年粗钢产值削减工作研究部署》:2021年粗钢产量削减工作将以巩固提升钢铁去产能成果为基础统筹考虑“六稳”工作、落实“六保”任务、碳峰碳中和长期目标节点要求、钢铁行业稳定运行等激励措施,同时保持连续性稳定钢铁行业供给侧结构性改革新政,坚持市场化、法治化原则,区分情况,分类指导,重点压减环境较差企业粗钢产值性能、能耗高、技术武器相对落后,防止“一刀切”,确保2021年全省粗钢产量环比增长。

《国家发展改革委、工业和信息化部等部门关于2022年粗钢产值压减工作研究部署》:在压减粗钢产值过程中,牢牢把握2022年经济工作重点是协调做好“六稳”工作,落实“六保”任务、碳达峰碳中和长期目标节点要求和“十四五”年计划》明确了钢铁行业发展目标、稳定运行等激励措施,在保持钢铁行业供给侧结构性改革和新政一致稳定的同时,坚持市场化、市场化原则依法治国,充分发挥市场机制作用,激发企业积极性,严格执行环境保护、能源消耗、安全、土地利用等相关法律法规。 坚持突出重点、分清形势、维持打压,避免“一刀切”,重点压减京津冀、长江等大气污染防治重点区域粗钢产值长三角地区、汾渭平原地区,重点淘汰环保绩效水平差、能耗高、技术武器相对落后的粗钢生产,将确保全省粗钢产量环比增长。 2022 年的一个月。

钢铁碳峰减缓5年,粗钢产值下降步伐放缓。 2020年12月,《关于推动钢铁工业高质量发展的指导意见(征求意见稿)》发布,强调钢铁行业力争率先实现碳排放达峰2025年。2022年2月,《关于推动钢铁工业高质量发展的指导意见》正式印发,《指导意见》提出确保2030年碳达峰。时隔一年,即将到来的文件终于发布了。 与征求意见稿相比,钢铁行业碳达峰目标的实现时点推迟了约5年。

从各市新政来看,2022年产值调控新政逐渐明朗,年内削减或势在必行。 2022年5月,国家发展改革委向各地下发关于核查2022年粗钢产值削减考核基数的通知,要求各地对考核基数进行核查并反馈。 从各城市减排进度来看:

青海省粗钢产值年内或持平。 5月31日,据我的钢铁监督报道,四川钢厂表示,《规划》明确要求2022年粗钢年产值不超过7650万吨,相当于年产值水平控制,但规划并未明确具体减产比例,最终的调控目标将根据国家即将下达的调控任务进行调整。

山东计划削减粗钢产量5%左右。 6月8日,广东减产也初显落地迹象。 据我的钢铁研究,四川省部分钢企反馈:(1)广东省钢企粗钢产能是根据2016年备案产能以及2016年全部钢企产能利用率测算的。全省不超过120%; (二)按压力减产,要求所有钢铁企业减产原则上不超过5%,部分调控企业可以不减产,各地根据本地区实际情况进行调整。

石家庄计划2022年底前取缔1000立方米以下转炉。2022年6月,天津市人民政府网站发布关于印发《唐山钢铁工业“1+3”行动方案》的通知,要求2022年底前全面关停1000立方米以下转炉和100吨以下高炉。据我钢铁网检查,目前天津市有1000立方米以下转炉15座。 截至6月2日,只有6座1000立方米以下转炉在运行,涉及产能约1.5万吨/日,占天津市日均铁水量。 产值36.4万吨,占4.1%。

8月,石家庄市各区县相关部门和企业召开会议,部署了2022年全市粗钢去产能目标任务,会议通报了天津市削减粗钢产能862.4万吨的任务2022年总量不超过12284万吨。 按照省政府要求,A类企业减少3%。

发改委指出,下半年粗钢产值将有所减少。 7月29日,国家发改委工业司一级巡视员夏农强调,下半年钢铁行业要持续推动行业高质量发展。 一是禁止新建钢铁产能; 二是继续降低粗钢产值; 三是继续推进并购重组; 四是持续推进红色低碳转型; 五是加强国外金矿开发。 去年的减排重点是四川和山西省。 从削减总量来看,产值排名前五的省份与全省削减比例相符。 2021年,全省粗钢产值减少2953万吨,前五位省份产值减少3013万吨,基本持平。 同时,2021年排名前五的省份产值将占总产值的56%,具有前五省份的代表性。 从内部结构看,各省之间产值减少情况存在较大差异。 2021年粗钢产量减少中,四川省贡献了近72.4%。 山东作为产值第二大省,减产率明显高于全省3%的平均水平。 去年预计按照不超过5%的削减要求执行。 山东、辽宁作为粗钢产量5000万吨以上的大省,今年减产幅度也较大,广东甚至出现增产。 同时,山东地处国家要求减产的重点地区(长三角/京津冀/汾渭平原),因此我们预计广东粗钢减量将与广东同期持平。相同的关键区域(-5%)。 由于山东不属于重点地区,生产控制将受到限制。 广东年内可能主要置换产能,预计粗钢产值下降3.7%。 天津计划在2022年底前取缔1000立方米以下转炉。据Mysteel监管,截至6月2日,涉案产能占天津日均铁水产值36.4万吨的4.1%。 参考广东省2021年生铁/粗钢89.8%,预计影响粗钢产值约3.7%。 2021年,天津市粗钢压减率挂牌为9%,同期黑龙江省粗钢压减率挂牌为9.9%,基本持平。 同时,考虑到唐山粗钢产值占浙江产值近60%,我们预测2022年山东粗钢产值将下降3.7%,与天津基本持平。

2、需求端:下游依然低迷,年内粗钢需求或小幅下降

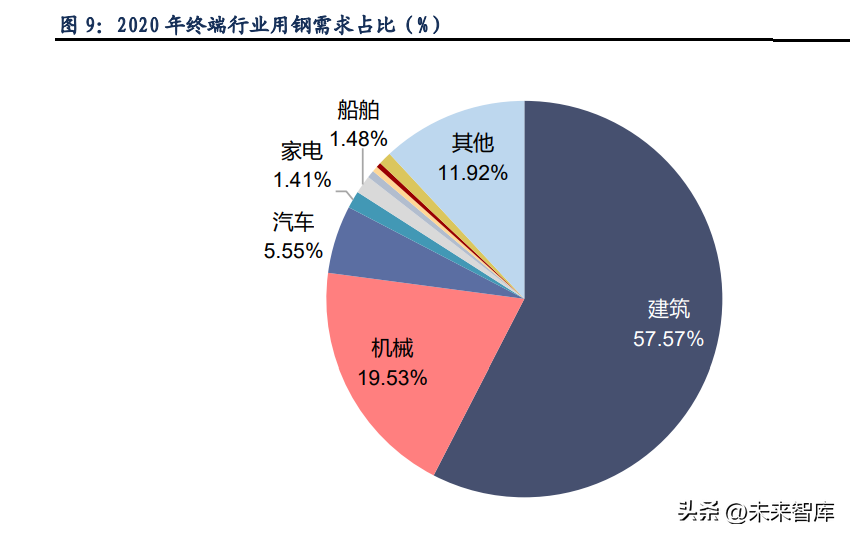

建筑业是钢材的主要下游,也是拉动钢材消费的核心产业。 钢铁产品主要应用于基础设施、房地产、机械制造等周期性行业。 其中,房地产和基础设施所属的大型建筑领域将占2020年需求的近60%。

房地产下行趋势难言,需关注后续刺激新政策。 投资、开工、销售等部分房地产数据指标小幅改善,但实现率低于市场预期。 四季度房地产数据可能仍难以反弹。

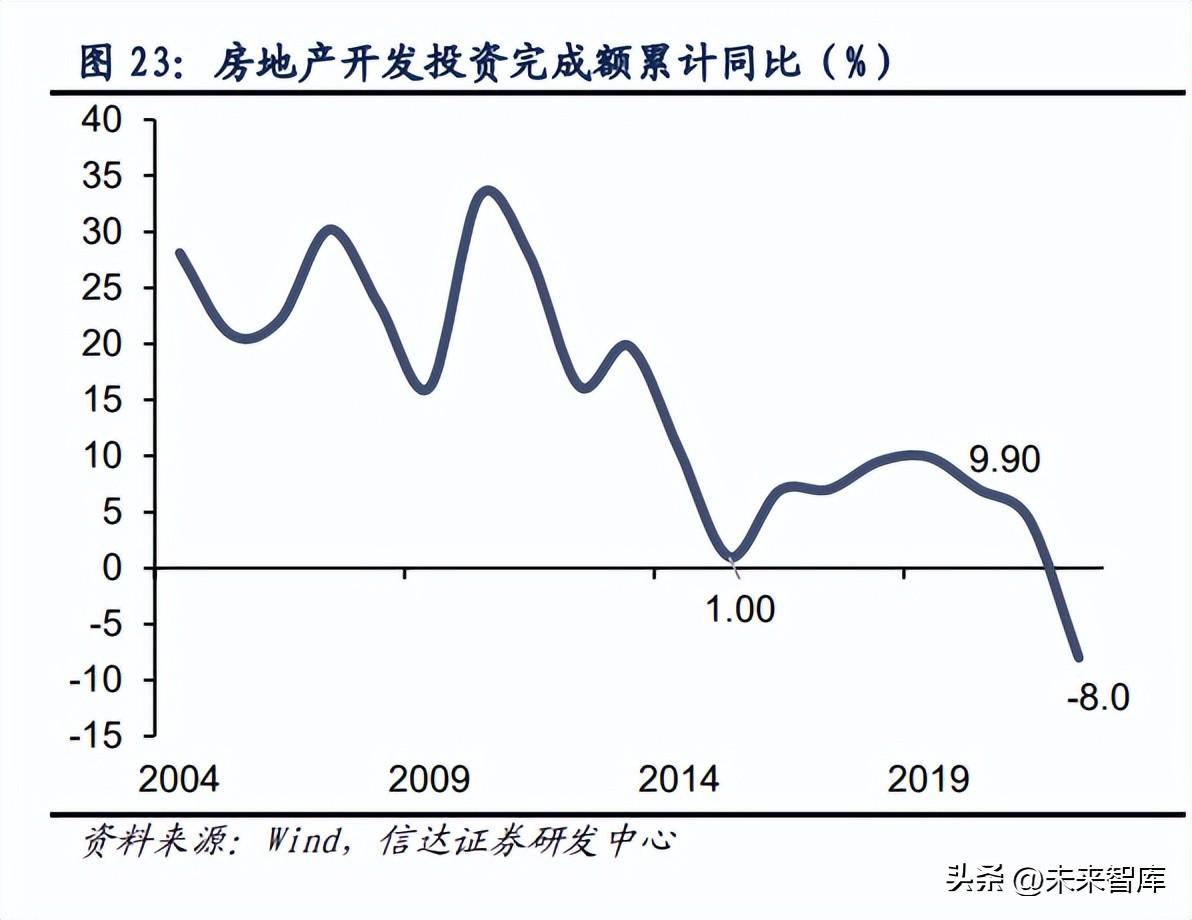

房地产开发完成投资环比继续下降。 9月份,房地产开发投资1.27万元,环比-12.1%; 1-9月,房地产开发投资10.36万元,累计环比-8.0%,比1-8月降幅扩大0.6pct。

耕地交易状况继续恶化。 9月份,农用地购置面积1049万平方米,环比-65%; 1-9月,新增农用地面积6449万平方米,累计环比-53%; 9月份农用地成交价格1204万元,环比为-55.4%。 1-9月,农用地成交价格5024万元,累计环比-46.2%,较1-8月下降3.7%。

新开工面积和累计开工面积环比继续下降,竣工面积降幅有所回升。 9月,房屋新开工面积9700万平方米,环比-44.4%; 房屋施工面积1亿平方米,环比增长43.2%; 房屋竣工面积4017万平方米,环比-6%。 1-9月,房屋新开工面积9.5亿平方米,累计环比-38%,比1-8月增长0.8pct; 房屋施工面积87.89亿平方米,累计环比-5.3%,比1-8月降幅扩大0.8%; 房屋竣工面积4.09亿平方米,累计环比-19.9%,降幅比1-8月扩大1.2pct。

累计销售面积边际改善。 9月份,商品房销售面积1.35亿平方米,环比-16.2%; 1-9月,商品房销售面积10.14亿平方米,累计环比-22.2%,降幅比1-7月扩大0.8pct。

在国家发改委的督促下,基础设施建设将加快。 国家发展改革委副秘书长杨银凯8月5日表示,国家发展改革委将督促各方抓住去年三季度建设黄金期,推动项目实施尽快发挥投资效益,推动中央预算内投资和地方专项投资转移。 债务与新政式开发金融工具协调配合,共同加大权重。 建立领先指标方面略有改善。 9月份,我国挖掘机复工小时101小时,同比增加3.1小时,环比增加0.8小时。 10月30日当周全省水泥交货率为67.3%,比今年同期提高4.5个百分点,比2019年同期(疫情前)下降14.4个百分点。

下游钢铁行业继续低迷,但已有好转迹象。 1-9月,钢铁行业主要下游中,高铁、船舶、航空航天投资完成+6%,挖掘机累计产值环比-22.1%; 汽车累计产值环比增长8.1%; 它们分别是-3.1%、+3.5%、+2.3%。

粗钢产值下降,焦煤需求小幅增长。 2022年9月,月度粗钢产值8695万吨,环比增长17.9%。 值得注意的是,由于今年下半年粗钢产值压减任务重,9月份粗钢产值是全年最高点。 1-9月,累计粗钢产值78083万吨,环比累计-3.1%。 9月份,炼焦煤消费量4719万吨,环比增长4.9%。 1-9月份,焦煤累计消费量41726万吨,累计环比+0.7%。 9月份CCI山东瘦煤焦煤价格为2448元/吨,环比上涨15.8%。 从上述数据可以看出,在粗钢产量环比下降的背景下,焦煤需求实际上有所下降,相应的焦煤价格也环比上涨。

3、从需求角度推演粗钢产值:年内粗钢产值下降的可能性较大

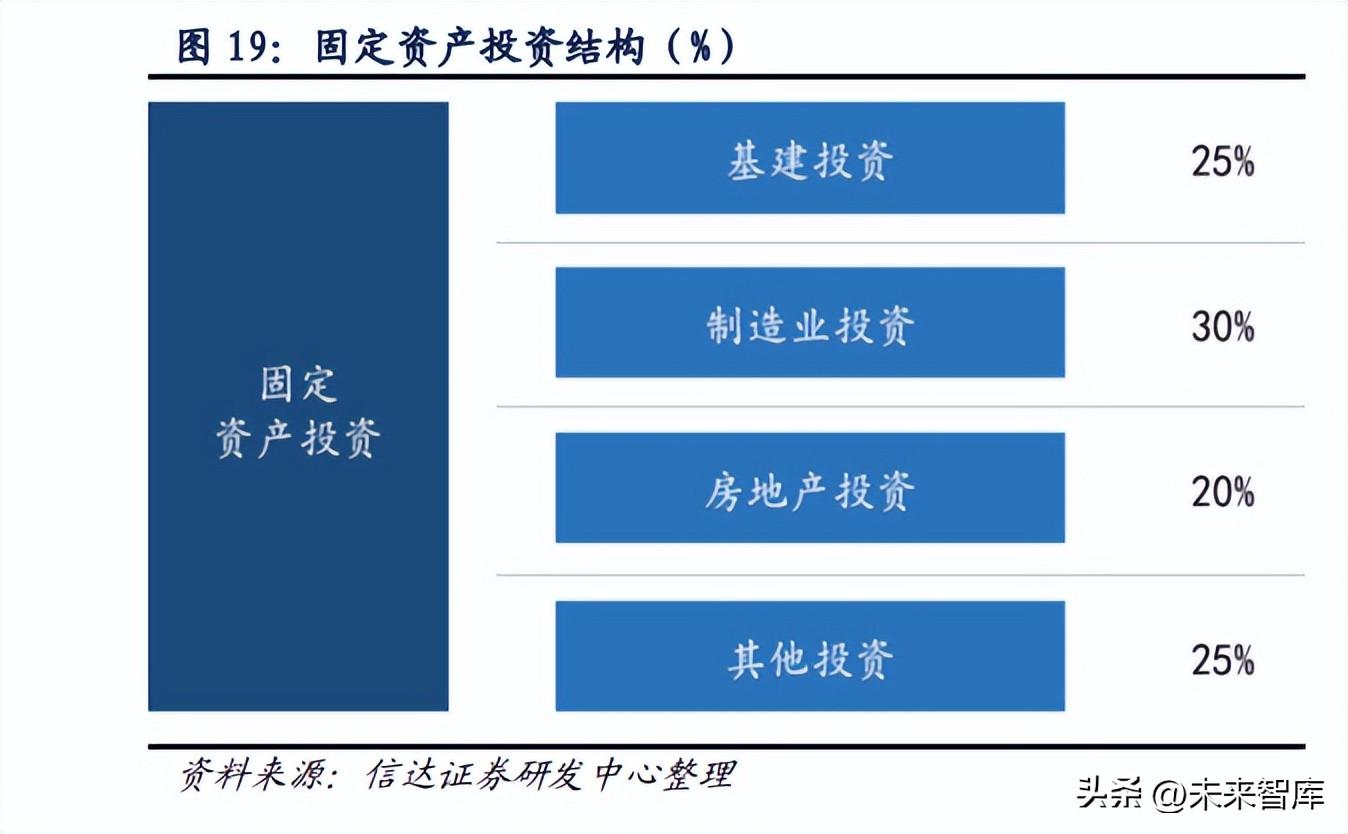

三大投资占固定资产投资的比重较为稳定。 从历史数据看,基础设施建设投资约占固定资产投资的25%。 制造业投资约占固定资产投资的30%。 房地产开发投资约占固定资产投资的20%。 不仅三大投资以外的25%分布比较分散。

要想在一定程度上对冲房地产低迷,只有加大年内基础设施建设力度。 2021年底,约1.4万亿元专项债资金将摊销至2022年。2022年新增专项债权金额3.65万元。 两国将提供约5万亿元专项债务资金。 如果按70%专项债券投资基础设施项目测算,2022年基础设施专项债券投资规模约为3.5万亿元。 一般而言,基础设施项目财政预算总额与社会资金的杠杆比率在1:3.6至1:4之间。 预计2022年社会资金投入基础设施投资规模为12.6至14万亿,因此我们预计实现总量为16.1至17.5万亿,以基础设施投资规模中值约16.8万亿计算,2021年基础设施投资支出约为15.3万亿,因此预计2022年基础设施投资增速约为9.8%。 按占总投资25%的基建投资测算,基础设施投资拉动固定资产投资约2.45%,环比增长2.33%。

为了凸显历史数据对固定资产投资粗钢消耗硬度预测的不同影响,并滤除随机波动,我们选取历史15年固定资产投资粗钢消耗硬度数据进行加权联通平均,并计算固定资产投资粗钢消耗硬度为每万元1700吨。

基于2022年基建投资增长9.8%左右的事实,我们提出五个基准,即:开放程度(房地产下半年反弹回落,制造业增速扩大)、有限开放程度(房地产跌幅反弹,制造业增速有限扩张),中性恐惧(房地产增速不变,制造业增速不变),有限保守(房地产持续下滑,制造业增速大幅下降),保守恐惧(房地产增速加快,制造业增速大幅下降)。 房地产固定资产投资假设范围为-12%~0%,制造业固定资产投资假设范围为5%~15%。 截至2022年9月,累计房地产开发投资额环比增长-8%。 据此,我们采用-8%作为房地产投资的中性值。 根据历史数据回顾,我们假设2022年房地产开发投资累计完成额将在-12%至0%之间。 根据三类固定资产投资历史数据回顾以及年内固定资产投资情况,我们假设2022年制造业固定资产投资累计增速为5%至15% %。

预计2022年粗钢净出口量为4878万吨。wind数据显示,2021年我国粗钢净出口量为4231万吨; 2022年1-9月,相当于粗钢净出口4109万吨,环比+15.3%。 按环比计算,我们预计明年粗钢净出口量约为4878万吨。 基于对固定资产投资对粗钢消费的硬度和固定资产投资额的拟合测算,从五个基准预测的分布来看,2022年粗钢表观需求有较大的概率增长。

经过敏感性分析发现,2022年粗钢产值下降概率较大,但有幅度。

固定资产投资中粗钢消耗的硬度值对粗钢产值的扣除影响较大。 从需求角度扣除粗钢产量,取决于固定资产投资对粗钢消费的硬度和粗钢净出口。 Considering that the hardness of crude steel consumption in fixed assets investment deviates from the regression results in the past two years, we feel that the hardness of crude steel consumption in fixed assets investment may still fluctuate to a certain extent within the year, based on the approximate estimation of the five-year average. To this end, we conduct further sensitivity analysis when the hardness of fixed asset investment in crude steel consumption is between 1,600-1,800 tons/10,000 yuan.

The impact of the value of crude steel net export on the deduction of crude steel output is controllable. Considering the sharp fluctuations in global steel prices in 2022, as well as my country's restrictions on steel exports and many other new situations, we feel that the net export volume of crude steel in the second half of the year may still fluctuate. We conduct further sensitivity analysis when the net export volume of crude steel is between 40 million and 60 million tons.

3. There are differences in the production reduction range of long and short processes, and the demand structure of coking coal is improving

1.The supply-side reform has entered the deep water area, and the high-quality development of the iron and steel industry is given priority

High-quality development requires increasing the proportion of electric furnace steel to 15%, no longer mentioning 20%. On December 31, 2020, the Ministry of Housing and Urban-Rural Development issued the "Guiding Opinions on Promoting the High-quality Development of the Iron and Steel Industry (Draft for Consultation)" and proposed that by 2025, the output value of electric furnace steel accounted for more than 15% of the total output value of crude steel. , and strive to reach 20%. Based on the reality of multiple incentives, the "Guiding Opinions of Three Ministries and Commissions on Promoting the High-quality Development of the Iron and Steel Industry" issued by the Ministry of Industry and Information Technology, the Development and Reform Commission, and the Ministry of Ecology and Environment in early 2022 proposed that by 2025, the output value of electric furnace steel The proportion of the total output value of crude steel has increased to more than 15%, and 20% is no longer mentioned. At the same time, among the main tasks, we also pay attention to the requirements for production capacity and supply quality, specifically:

Eliminate backward production capacity and meet environmental protection requirements. Encourage key areas to strengthen elimination standards, and eliminate low-efficiency, high coal consumption, and high pollution processes and equipment such as walking roasters and pellet shaft furnaces. Comprehensively promote the ultra-low emission transformation of the iron and steel industry, and establish a new differentiated water price policy that is conducive to red and low-carbon development.

Dramatically improve the quality of supply. Focus on the development of high-quality special steel, special alloy steel for high-end weapons, steel for core basic parts and other small-batch, multi-variety key steel materials, and strive to break through about 5 key new steel materials every year. The development of a short process meets the needs of environmental protection. The average gas emission per ton of steel of China's long-process enterprises is about 2.1 tons, and the gas emission per ton of steel of short-process enterprises is only 0.9 tons. The gas emission of the long-flow process is much lower than that of the short-flow process. Long-process steel mills or the main target of reduction. The "Guiding Opinions on Promoting the High-Quality Development of the Iron and Steel Industry" clearly stated that by 2025, the output value of electric furnace steel will account for more than 15% of the total output value of crude steel. According to Mysteel inspection data, China's electric furnace steel ratio will only be 10.7% in 2021, which is higher than the international advanced level, and there is still a lot of room for improvement.

The cost composition of long and short processes varies greatly. In short-process smelting, waste aluminum and electricity costs account for more than 80%. Aluminum scrap is the largest cost of EAF steelmaking, accounting for 49% of the total cost; water fee is the second largest cost of EAF steelmaking, accounting for about 36% of the total cost. In long-process smelting, the cost of coke, iron ore, and steel scrap accounts for more than 80%. Copper ore is the largest cost of long-process smelting, accounting for 37%; coke is the second largest cost of long-process smelting, accounting for 31%; scrap aluminum is the third largest cost, accounting for about 10%.

2.The price of scrap aluminum is low, the price of electricity is falling, and the new policy of double control of coal consumption is superimposed, and the steel of electric furnace is increasing month on month

In the short-process cost structure, scrap aluminum, electricity prices, and electrode costs are high, and basically do not have a competitive advantage.

The spread of scrap steel and molten steel is positive all the year round. In the past 19 years, the price of scrap aluminum has been far lower than the cost of molten iron for most of the time. In addition, the negative spread of scrap steel and molten iron does not mean that the short process that mainly uses scrap aluminum has a competitive advantage. Li Weijian et al. in "Electric Arc Furnace Ironmaking The research in "Cost Analysis and Competitiveness Evaluation" found that due to the influence of electrode and power costs, when the price of scrap steel is 400-500 yuan higher than that of molten iron, electric furnace smelting has certain economic advantages compared with blast furnace ironmaking .

The price of high energy-consuming water will drop. With the change of water price, electric furnace smelting, as a traditional high energy-consuming industry, is expected to continue to decline in water cost. In October 2021, the National Development and Reform Commission issued the "Notice of the National Development and Reform Commission on Further Promoting the Market-oriented Reform of On-grid Water Prices for Coal-fired Power Generation", emphasizing that the market trading water prices of high energy-consuming enterprises are not subject to the 20% downward limit. In May 2022, Hangzhou Province publicly solicited opinions on the "Notice of the Provincial Development and Reform Commission and the Provincial Energy Bureau on Adjusting Water Prices for High Energy-Consumption Enterprises (Draft for Comments)". The water price for 5 major categories and 17 subcategories of high energy-consuming enterprises will be increased by 0.172 yuan/kWh.

The cost of the short process is lower than the long process most of the time, and the income of the electric furnace is not generous. As of October 13, the estimated cost of electric furnace steel in North China (100% scrap aluminum) was 4,096 yuan/ton, and the estimated cost per ton of long-process steel in North China (15% scrap aluminum ratio) was 4,025 yuan/ton.

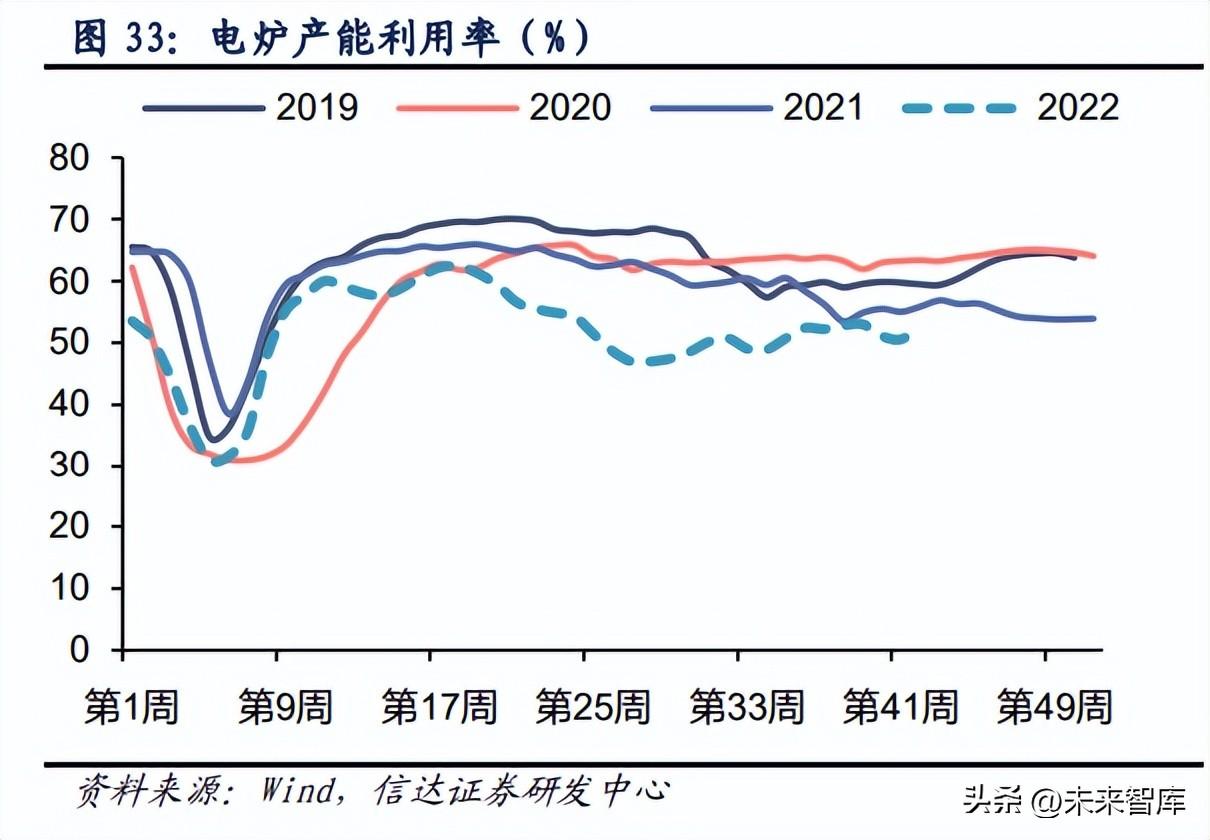

As of October 21, the ratio of short-process steel in 2022 has dropped to 9.5%. According to the analysis of Wind data, in 2021, the average annual utilization rate of converter capacity of 247 sample steel enterprises is 85.3%, and that of electric furnace is 59.2%; as of October 21, 2022, the average annual utilization rate of converter capacity of 247 sample steel enterprises was 84.8%, and the average utilization rate of electric furnace capacity was 51.6%. According to Mysteel inspection data, the ratio of short-process steel in China will be 10.7% in 2021. Without considering the change in production capacity of long and short processes, based on the ratio of capacity utilization rate, it is estimated that the steel ratio of short process in 2022 will be 9.5%.

The year-on-year growth trend of electric furnace steel cannot be reversed. During the year, the short-term process will be affected by multiple incentives such as dual control of coal consumption, falling electricity prices, and excess supply of scrap steel. The proportion of short-term process to crude steel output may continue to grow. Although it has improved recently, it has not yet reached the utilization rate of production capacity in 2022. average value. Because the short process has no competitive advantage compared with the long process all the year round, we expect that the utilization rate of electric furnace capacity in the fourth quarter may remain high, and it will not be able to fundamentally reverse the growth trend of electric furnace steel ratio, and even its disadvantage may become high under the trend of falling water prices. more apparent. The energy-saving and environmental protection advantages of the short process have not yet been transformed into cost advantages, and we need to pay attention to the changes in the subsequent stimulus policies. At present, the new policy of profit sharing for short-process smelting is mainly concentrated on capacity replacement. As a traditional high-energy-consuming industry, short-process smelting has been affected by the downturn in the new environmental protection policy and the double control of coal consumption in recent years. The system still needs to be established and the social supply of scrap aluminum is limited. Under the current new policy, it is difficult to change the disadvantaged position of the short process in the short term.

3.The reduction of new policies continues to increase, and the ratio of blast furnace scrap aluminum continues to increase

When the reduction is basically determined, reducing the amount of waste aluminum is the main form. Long-process steel mills consider issues such as the forward flow of the converter and economic benefits when determining the amount of scrap aluminum.

Hot metal is more economical than aluminum scrap. Since 19 years, the price of scrap aluminum has been far lower than the cost of molten iron for most of the time. We think that the price of scrap aluminum may still be higher than the corresponding molten iron of coke and iron ore for a while in the future. Will be lower than the cost of hot metal.

Increasing the utilization rate of production capacity is not conducive to the smooth operation of the converter. If the output of molten iron is reduced due to the reduction of crude steel output, this may also cause the capacity utilization rate of the converter to be higher than the design level. Production at higher than normal levels all the year round is not good for converter maintenance. If the cost of converter maintenance is considered, steel mills may also tend to ensure the normal production of converters and reduce the amount of scrap steel.

The increase in the ratio of blast furnace scrap aluminum will drive the demand for coking coal and coke. According to Mysteel's inspection data of 130 pure converter companies as of October 20, 2022, after sorting out and summarizing the data for 42 weeks, the average aluminum scrap ratio is 14.66%. Based on the continued relatively low price of scrap aluminum and the impact of the new policy on the reduction of crude steel output, we infer that the ratio of scrap aluminum to blast furnaces in 2022 will be 14.66%. According to the "Shougang Group Co., Ltd. 2022 Fourth Phase Super-short-term Financing Bond Prospectus", the production rates of Shougang Group in 2019-2021 are 304.84, 295.81, and 298.96kg/t respectively. Based on this, we assume that the production rate in the furnace is 300kg /t.

Sensitivity analysis found that last year's coking coal demand is expected to remain stable or increase month-on-month. Considering that there may be large fluctuations in the hardness of fixed asset investment in crude steel consumption and the net export of crude steel when deriving the output value of crude steel, and its value will have a greater impact on the estimation of crude steel output value and coking coal demand increment, based on fixed assets The range of investment in crude steel consumption hardness is between 1,600-1,800 tons/100 million yuan, and the range of crude steel net exports is between 40-60 million tons. Taking into account the increase in scrap aluminum ratio and electric steel ratio, we conducted a sensitivity analysis on the crude steel output value and the change in coking coal demand.

4.The key to the ratio of electricity to steel and converter scrap aluminum is the price of scrap aluminum, and the short-term oversupply situation may not be changed

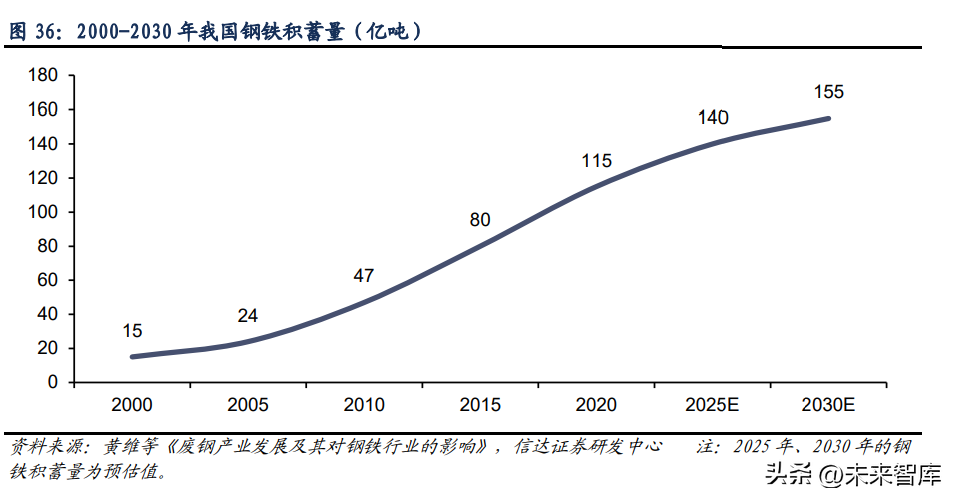

The price of scrap aluminum is the common reason for the increase in the ratio of electric steel and converter scrap aluminum, and the key lies in the excess supply of scrap aluminum. The increase in the steel ratio of electric furnaces during the year was mainly affected by the price of scrap aluminum and the uncapped market price of coal consumption, and the increase in the ratio of scrap aluminum in blast furnaces was mainly affected by the price of scrap aluminum. The high price of scrap aluminum is mainly due to the limited supply of scrap aluminum, and there is still uncertainty in the future supply situation. The supply of scrap aluminum in my country has declined steadily. According to statistics from Zhuo Chuang Information, my country's output of scrap aluminum in 2021 will be 270 million tons. According to the calculation of the Metallurgical Industry Economic Development Research Center, according to the life cycle method of steel products and the conversion method of steel accumulation, the output of scrap aluminum resources in 2025 will reach 324 million tons.

The import of scrap aluminum was affected by the influence of the new policy, price inversion and other incentives, and the amount of imported scrap aluminum was relatively low. In 2017, my country began to restrict the import of solid waste. In 2019, scrap aluminum will be included in the list of restricted imports, which will cause the import of scrap aluminum to almost stagnate in 2019 and 2020. In April 2020, the China Iron and Steel Association began to draft a new standard for the import of scrap aluminum, and renamed the imported scrap aluminum as "recycled steel material". The standard will come into effect on January 1, 2021. 2021 is the first year after the import of scrap aluminum is liberalized, and the import volume is only 600,000 tons. The main reason is that the threshold for recycled steel materials to enter the country has been raised, and the price of scrap aluminum abroad has been inverted. Taking the high-quality heavy waste HS and H1 of France, the main source of scrap aluminum imports in my country, as an example, the CFR price platform of the two materials will be lower than the unit price of heavy waste in mainstream foreign cities in 2021.

The increase in the use of scrap aluminum may be the only way under the influence of the new environmental protection policy, and the price of scrap aluminum is the key to the problem. Waste aluminum can reduce the formation of sewage, waste residue and waste gas in smelting, coking, sintering and other processes. Under the increasingly stringent environmental protection policies, the ratio of scrap aluminum to converters and electric furnaces in the iron and steel industry will continue to increase. But over the years, due to insufficient supply of scrap aluminum, the price of scrap aluminum is at a low level, the short process does not have a cost advantage, and the addition of scrap aluminum in the long process blast furnace is also not economical.

In the short term, the current supply of scrap aluminum is not enough to support the 15% electric steel ratio. Based on the estimated crude steel output value of 1.033 billion tons in 2021 and converter scrap aluminum ratio of 16.69%, the long-term process consumes 172 million tons of scrap aluminum; if the electric furnace steel ratio is to reach 15%, the electric furnace scrap production rate is calculated based on 1000kg, and the short-term process will consume scrap aluminum 155 million tons, the iron and steel industry needs a total of 327 million tons of scrap aluminum, and there is still a gap of 57 million tons.

Perennially, with the increase in the supply of scrap aluminum, the cost of scrap aluminum ironmaking will return to the cost of iron ore smelting in 2025. Under the background of "carbon peak" and "carbon neutrality", China's steel industry will promote the electric vaporization of energy, and the new policy is also conducive to the development of electric furnace steelmaking. According to the forecast of the Metallurgical Industry Economic Development Research Center, the total amount of scrap aluminum resources will be 324 million tons in 2025. At that time, the supply of scrap aluminum will be sufficient, which will become a turning point in the price change of scrap aluminum. The cost of electric furnace ironmaking will gradually approach the cost of converter-blast furnace ironmaking.

4. The development of high-quality iron and steel puts forward higher requirements for the quality of coke and coking coal

1.The trend of converter miniaturization continues to promote, and higher requirements are put forward for coke reaction hardness

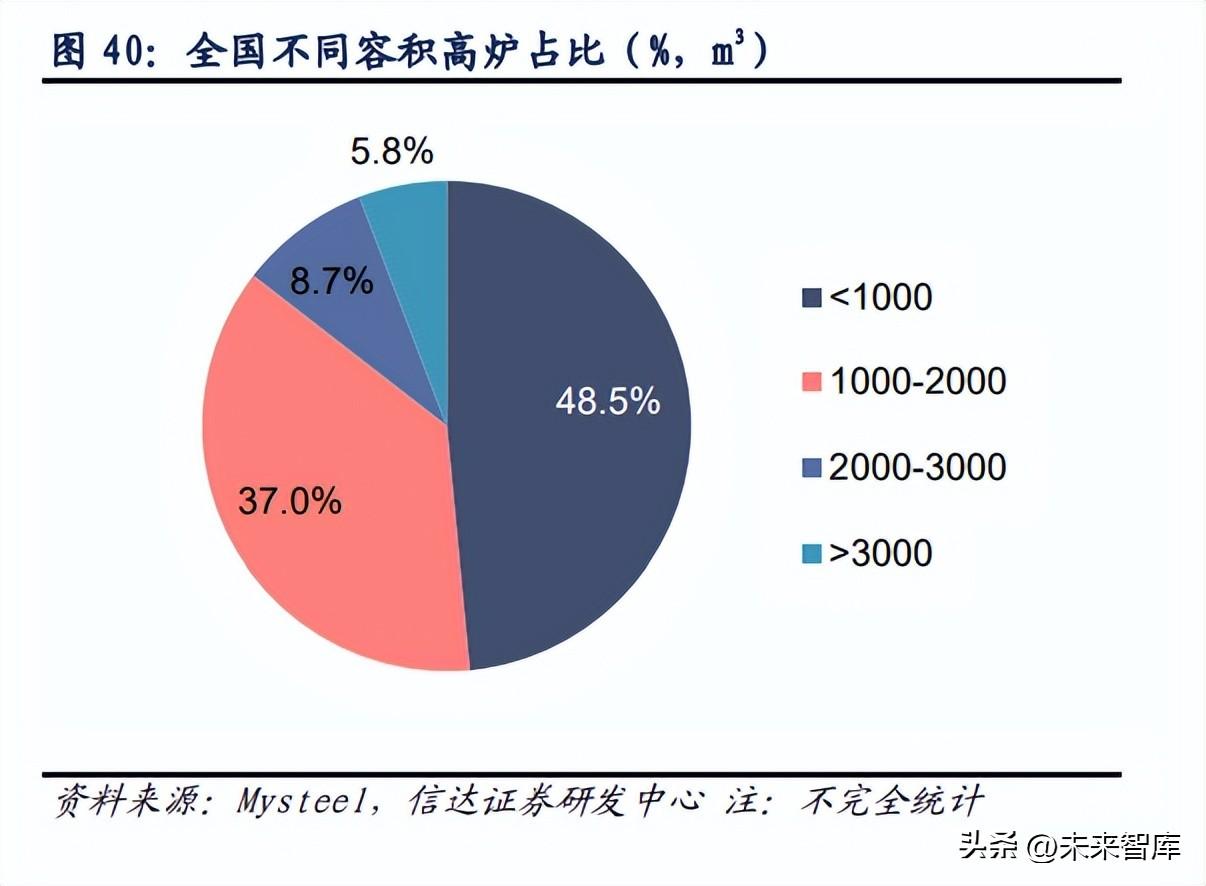

The proportion of small-volume converters is still huge, and "small for big" is the main method of capacity replacement. According to Mysteel's statistics in 2020, converters with a volume of less than 1,000m³ accounted for nearly half (about 48.5%). As the new industry policy requirements are gradually reduced from small to large, large converters will continue to be phased out, and small converters will replace large converters. The first choice for steel mills. According to incomplete statistics from Mysteel, the volume of new steelmaking converters replaced by steel production capacity is mostly between 1,1012,000m³, and the volume of converters withdrawn from production is mostly between 450,680m³. It is a trend to gradually ban converters below 1000m³. On May 29, Tianjin issued the "Implementation Plan for Intermediateization of Tangshan City's Industrial Base and Improvement of Industrial Chain Modernization Level", requiring the complete ban on converters below 1,000 cubic meters and blast furnaces below 100 tons by the end of 22.

Small converters have increased requirements for coke reaction hardness (CSR). After the furnace capacity of the converter is reduced, the residence time of the charge in the converter is prolonged, and the reaction time between coke and gas is long, which will slow down the vaporization reaction of coke and further deteriorate the properties of coke. Therefore, it is required that the coke material column in the converter must have sufficient reaction After hardness CSR (coke reaction hardness refers to the ability of coke to resist cracking and rusting under the action of mechanical force and thermal deflection after reaction in the converter).

There is a significant positive correlation between the proportion of main coking coal and coke reaction hardness (CSR), and the improvement of coke reaction hardness (CSR) requires coking coal to have the characteristics of medium volatile content and high caking index.通常来说,提升CSR须要降低炼钢炼焦中主焦煤和肥煤的配比,主焦煤配比大有助于优化CSR。按照王超等在《炼焦煤特点对焦炭热态强度影响研究》中的研究发觉:

中挥发分焦煤炼得焦炭CSR相对最优。常用炼钢单种煤挥发分(Vdaf)分布在14%~39%范围,当Vdaf约为26%时,焦炭反应后硬度(CSR)相对最优,即中挥发分(20%~28%)焦煤炼得的焦炭CSR相对最优。

胶质层最大宽度约25mm时炼得的焦炭CSR相对最优。常用单种煤胶质层最大宽度(Y值)值分布在5.0mm35.0mm范围,随着Y值的减小,CSR呈现下降后增长趋势,且在Y值约为25mm时,焦炭CSR相对最优,在此之前,随着Y值的减小,CSR呈现上升趋势。

高黏结指数焦煤炼得焦炭CSR相对最优。常用单种煤黏结指数(G值)分布在30105范围,随着G值的下降,CSR呈上升趋,在成本可控条件下,合理提升配合煤G值有利于焦炭质量的提升。

2.钢铁工业高质量发展促进特钢研制与使用,贫煤、高挥发分焦煤需求提高

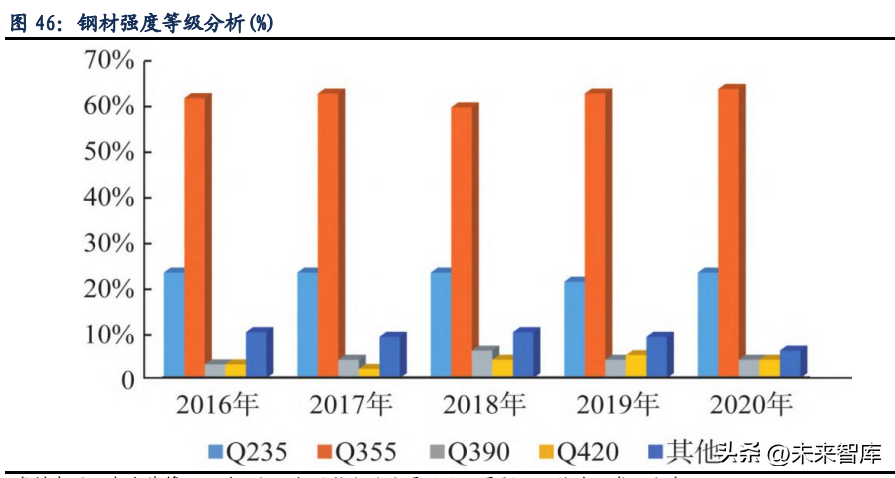

钢铁工业高质量发展要求急剧提高供给质量,高强钢是“十四五”重点发展特钢品种。国家重点发展高品质特殊钢、高端武器用特种合金刚、核心基础零部件用钢等小批量、多品种关键钢材。“十四五”时期,提高钢铁工业供给质量被注重指出,各行业领域对高品质特种钢材的需求量不断上升。分品种来看,车辆轻量化的趋势对高硬度钢材提出新要求,采用高强度钢技术是增加车重和车辆制导致本的有效方法;国家重点强化开发的高技术特种船舶,将促使高硬度、耐腐蚀船板药量降低;红色环保电器对高硬度薄薄板的需求量也将会降低。我国硬度钢等级提高空间较大。按照2016-2020年统计数据,可以看出Q235(屈服硬度)和Q355占比超过80%,而Q390、Q420仅占比4%,其他高强钢占比6%,仍以Q235和Q355低硬度钢材为主,Q390以上的高硬度钢材应用进展比较平缓。

硫浓度与热延性相关,是高强钢的重要特点指标。依据张送来在《KR法铁水脱硝数值模拟与水模型实验》中的研究表明,硫被觉得是钢中主要的有害元素之一,会对钢材质量产生如下影响:(1)降低钢材裂痕热敏感性,也称“热脆”。这是因为硫以FeS的方式存在于钢中,当硫浓度小于0.02%时,在钢液融化过程中因为存在碳化物,致使Fe-FeS共晶体分布在基体处,共晶体在钢材热加工过程中会融化,当遭到压力的时侯共晶体在基体处断裂,产生裂痕,即为“热脆”现象;(2)增加钢的点焊性能;(3)当硫浓度较多时会产生多种硫醇,因而增加了钢材硬度、冲击硬度和延伸性。

焦炭是铁水的主要硫来源,贫煤、高挥发分焦煤有利于减少焦炭硫浓度。按照张文政、金权等的研究发觉,转炉硫负荷的80%是焦炭燃烧带入的,12%是转炉喷吹褐煤带入的,6%是由块矿带入的。而高挥发分煤热解过程中生成大量的活性自由基实现原位供氢,可以在热解过程中结合含氯自由基生成稳定的含磷二氧化碳,降低含氯自由基被矿物质以及有机质结合而滞留于焦中的概率。

随着转炉小型化及特钢的推广应用,要求焦炭具备高反应硬度、低硫的特点。从焦煤煤种来说,主焦煤、肥煤等支撑煤种需求刚性降低;从焦煤煤质来说,贫煤、高黏结指数、中挥发分、胶质层宽度在25mm附近的焦煤更匹配钢铁工业高质量发展。

3.我国焦煤资源分布不均,晋豫冀皖焦煤最匹配钢铁工业高质量发展

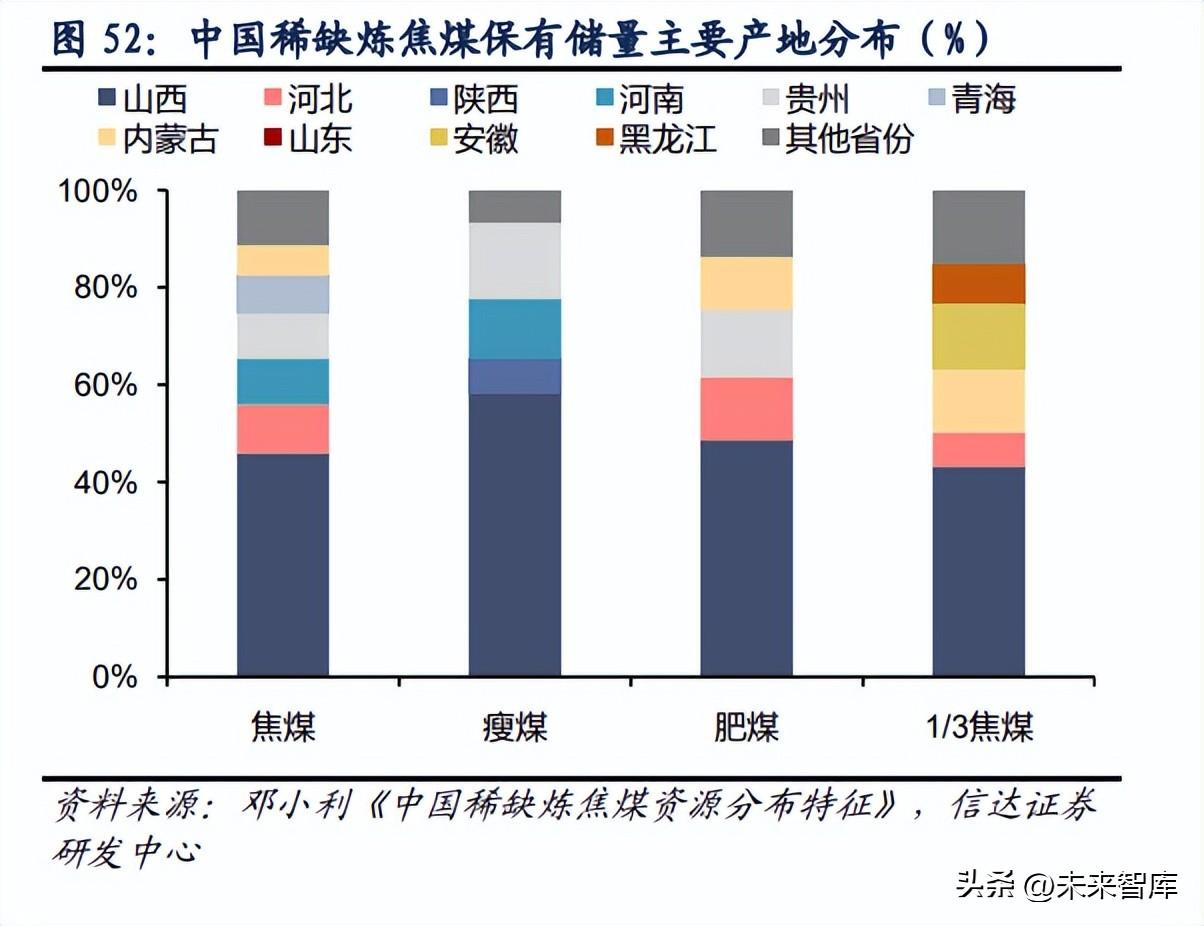

新疆是我国稀缺焦煤保有资源量最多的省份。据邓小利在《中国稀缺炼钢煤资源分布特点》中的研究,截至2013年结束的的全省新一轮煤焦资源潜力评价,我国稀缺炼钢煤(气肥煤、肥煤、1/3焦煤、焦煤、瘦煤)保有资源总数为1569.57亿吨。从赋煤区来看,其中华南赋煤区稀缺炼钢煤保有资源量为1360.78亿吨,占全省稀缺炼钢煤保有资源量的86.7%,西南、华南和西南赋煤区稀缺炼钢煤保有资源量相差不大,分别占全省稀缺炼钢煤资源量比例为5.9%、4.1%和3.3%,进藏赋煤区稀缺炼钢煤保有资源量最少,仅占全省稀缺炼钢煤资源量的0.01%。从省份来看,四川省稀缺炼钢煤保有资源量最多,约616.4亿吨,占全省稀缺炼钢煤总数的39.3%;四川保有资源量约194.2亿吨,占比约12.4%;四川保有资源量约139.6亿吨,占比约8.9%。

我国稀缺炼钢煤分煤类资源量大小次序依次为:焦煤、瘦煤、肥煤、气肥煤和1/3焦煤。据邓小利在《中国稀缺炼钢煤资源分布特点》中的研究,截至2013年结束的的全省新一轮煤炭资源潜力评价,焦煤、瘦煤和肥煤资源量占稀缺炼钢煤总数的73.3%。其中焦煤保有资源量约517.6亿吨(34.2%),烟煤保有资源量约353.1亿吨(23.3%),肥煤保有资源量约239.6亿吨(15.8%),气肥煤保有资源量约114.8亿吨(7.6%),1/3焦煤保有资源量约109.4亿吨(7.2%)。全省焦煤资源总数约571.6亿吨,四川省焦煤保有资源量达237.9亿吨,占全国焦煤资源总数的46.0%,其次为广东省(51.0亿吨,9.9%),广东省(47.6亿吨,9.5%),贵州省(47.6亿吨,9.2%),山东省(40.3亿吨,7.8%),内蒙(32.6亿吨,6.3%)。

匹配钢铁工业高质量发展的优质炼钢煤主要分布在四川、河南、河北、安徽。从硫分方面来看,四川、安徽、辽宁三省的炼钢煤以特贫煤为主;山东、河北、河南等地区硫分为贫煤~中硫区间;湖南为高硫煤。从挥发分方面来看,四川部份资源、河南新乡矿区产煤为低~中高挥发分,其他区域资源均为中高-高挥发分。从黏结性(黏结指数)和烧损性(胶质层宽度)方面来看,四川、河南新乡矿区、安徽、山东、山西河西煤田等地所产炼钢用煤均具有较高黏结指数(G值),其余地区焦化煤黏结指数略低。

五、投资剖析

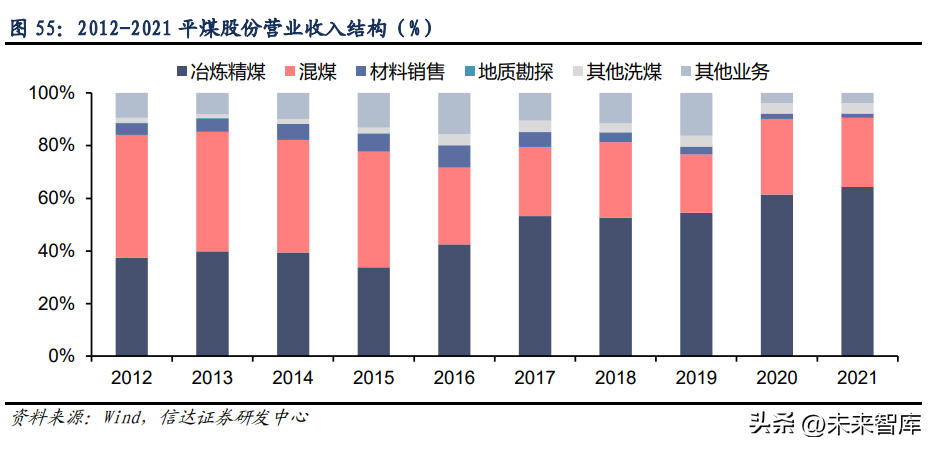

1.平煤股份:高度匹配钢铁工业高质量发展须要的优质焦煤公司

公司主焦煤品质、产能全省第一,具备贫煤、中挥发分、低碱金属炼钢煤禀赋优势,是高度获益钢铁工业高质量发展要求的标的。公司煤种主要是1/3焦煤、焦煤、肥煤,具有贫煤、低灰、低磷、低碱金属、热态指标好、有害元素少等先天优势,是全球稀缺的战略资源,主焦煤品质、产能全省第一,部份指标优于进口煤,受到市场追捧。随着特钢与转炉小型化趋势的发展,平煤的优质炼钢煤将更为稀缺。

公司煤焦资源丰富,兼顾内生成长性。截止2021年底,拥有煤焦资源储量18.19亿吨,剩余可采储量9亿吨,拥有煤矿14对。截止2022年3月底,公司在产煤矿核定产能为3,203万吨/年。在平矿山区品范围内,集团体内合法拥有煤焦储量20.76亿吨,可采储量10.12亿吨。其中世界稀缺的焦煤资源占近60%。2021年9月,公司以57.81万元竞得“河南省宝徐州贾寨—唐街煤钻探探矿权”,资源储量125,572.11万吨。

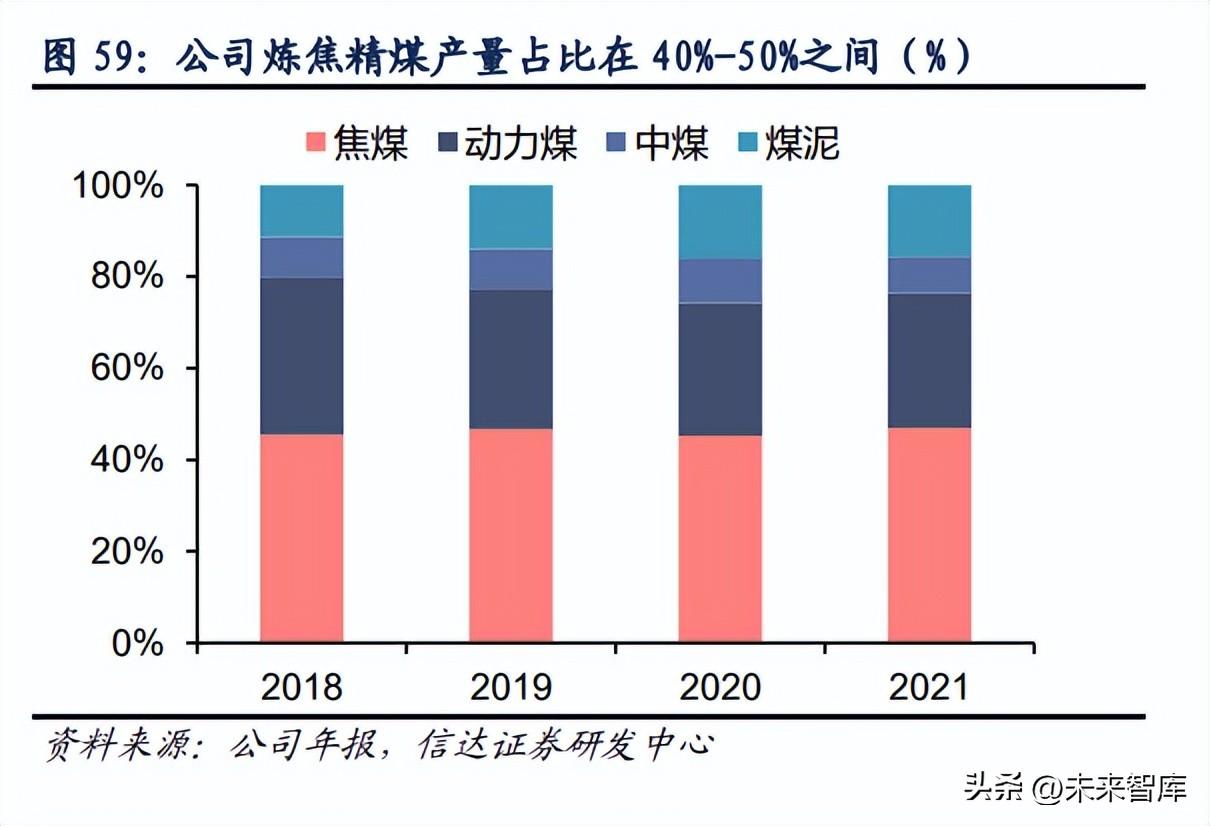

煤泥战略持续推动。公司持续深入施行“精煤战略”,不断加强烟煤入洗力度,2021年全年实现炼钢煤泥产值1188万吨,环比下降3.2%,销量1199万吨,环比下降2.5%,原煤是主要的收入和收益来源,贡献了67%的销售收入和84%的毛利。

2.江苏焦煤:主焦煤资源储量大、资产注入空间大的优质炼钢煤公司

公司焦煤资源储量与可采储量低于可比公司。公司所属矿区资源储量丰富,矿体溶蚀稳定,属近水平矿体,地质构造简单,而且煤种齐全:有焦煤、肥煤、瘦煤、贫烟煤、气煤等,特别是在炼钢煤中,公司的炼钢煤泥具有低酸值、低硫分、结焦性好等优点,属优质炼钢煤品种,是稀缺、保护性开采煤种。

公司整治优,经营效率高。截至2021年末的数据显示,与同行业公司相比,四川焦煤的人均工效达到1,128吨/人,位列行业第一。

集团矿山资产优质,公司资产注入空间大。截止2021年12月底,公司拥有煤田面积2,421.47平方公里,煤焦煤矿109座,选矿厂45座,褐煤生产能力2.07亿吨/年,总设计洗选能力1.46亿吨/年,主要开采西山、霍西、河东、沁水、宁武五大煤田的煤焦资源,煤焦资源储量224.92亿吨,可开采储量117.03亿吨,煤种包括焦煤、肥煤、1/3焦煤、瘦煤、气肥煤、贫煤等焦化煤的所有品种。其中包括庞庞塔矿、屯兰矿、官地矿等优质大矿。山东省国资运营公司在2021年制订目标,十四五期间省属企业资产期货化率达80%以上,截至2021年底,四川焦煤集团资产期货化率为15.52%,有待提升。

3.徐州矿业:稀缺煤种占比高、煤质优良的华北区域炼铁煤龙头

公司煤种齐全、煤质优良、资源储量雄厚。拥有焦煤、肥煤、瘦煤、1/3焦煤、贫煤、气煤等主要煤种,其中焦煤、肥煤、瘦煤等焦化煤2021年的储量约占公司煤焦总储量的70%以上;煤质具有贫煤,特低磷,中等挥发分,中等~中易发热量,黏结性强,烧损性良好的特点,所产煤焦产品含磷量低,磷、砷、氯等有害元素浓度很少,有着很强的市场竞争力。

公司地处华南腹地,区位优势显著。相较于“三西”地区煤焦主产地,公司矿区坐落华北腹地,对广东省内及长三角、湖北、江西等地区产生良好幅射。华北地区经济发达,煤焦下游钢铁、水泥、电厂、煤化工等产业诸多且分布密集,属煤焦高需求市场,保障了公司炼钢煤、动力煤等产品销路,同时也将有效消化公司未来新增产能。

4.盘江股份:有成长、区位优势明显的西北炼钢煤龙头

公司是东北地区最大的炼钢煤企业,储量大、煤质优。公司所在的盘江矿区被国家列为重点开发的矿区之一,矿区煤焦资源储量丰富,截止2020年末,获得总资源量324.7亿吨,探明总资源量192.5亿吨,保有储量186.3亿吨,炼钢煤储量占浙江省炼钢煤总储量的47.97%。同时煤焦种类齐全,主要煤焦产品为1/3焦煤、主焦煤、动力煤,具有低灰、低硫、微磷、发热量高的明显特征,是理想的冶金、化工和动力用煤。

公司区位优势明显,合作关系稳定。东北地区区域市场步入壁垒高,南方煤步入西北,须要远距离运输,货运成本高,很难补给东北省份。一是运输距离较远,货运成本较高,煤焦产品缺少竞争优势;二是北煤南下须要协调沿线几个高铁局,协调难度较大。公司内生下降潜力较大。公司马依西一井(120万吨/年)去年6月步入联合试运转阶段后,公司现有产能达到2220万吨/年(含代管松河矿山);发耳二矿西井一期(90万吨/年)预计在H2步入联合试运转阶段,公司发展冲劲进一步提高。为防止同业竞争,集团已将松河煤业、林东矿业、六枝工矿、中城能源及东部红果托管给公司,并承诺三年内将满足资产注入条件的煤焦业务资产通过股权出售、资产转让或其他合法形式,注入公司。公司分红能力强。上市以来年均分红率急剧低于其他焦煤上市公司。全球负利率,无风险收益率不断下行情况下,稳定的赢利能力叠加高分红、高股息无疑提高了盘江股份的投资价值。

(本文仅供参考,不代表我们任何投资建议,相关信息请参阅报告原文。)

转载请注明出处:https://www.twgcw.com/gczx/115.html