21日钢材行情!调价:22家钢厂价格变动!预测:钢价趋弱运行

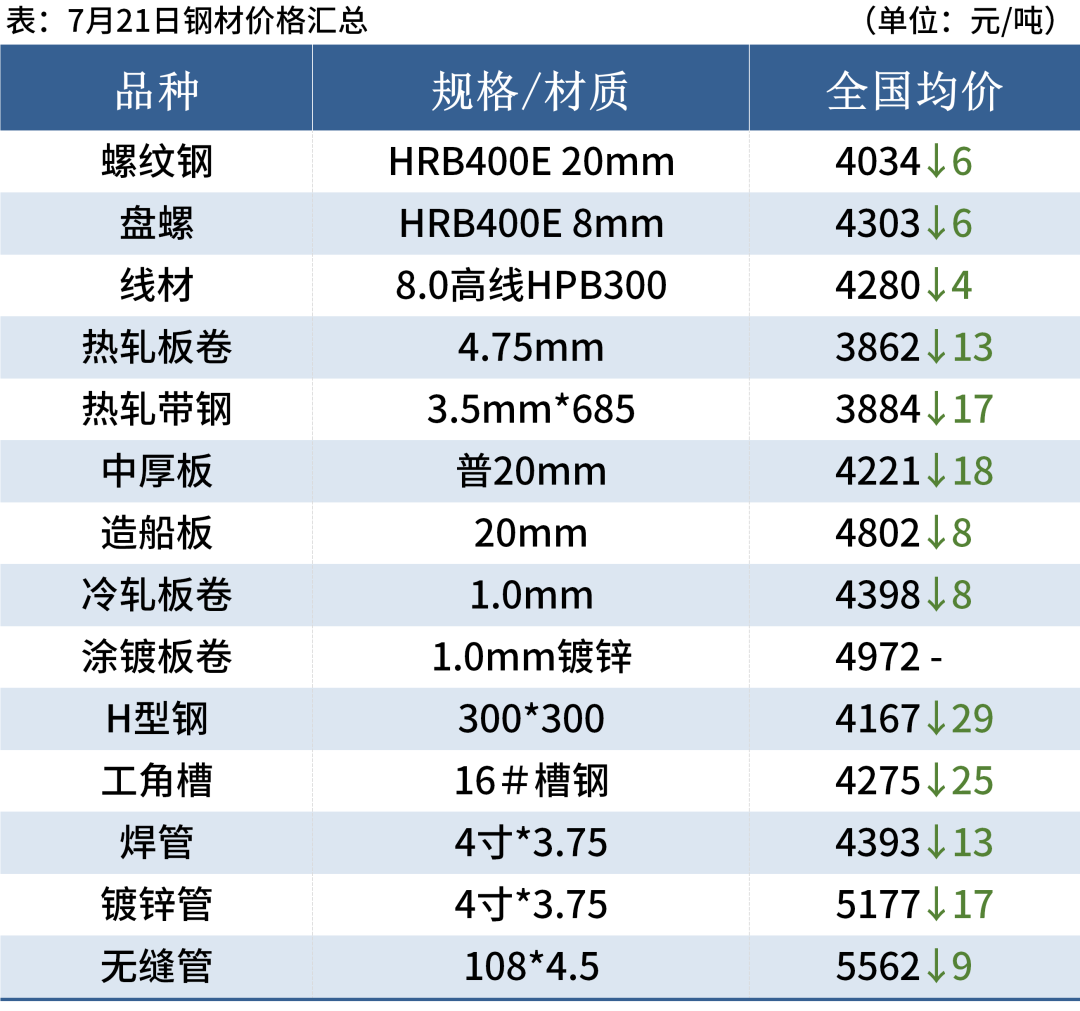

7月21日建材价格:总体稳定; 今日建材价格以稳为主,幅度在10-40之间。 目前贸易商库存压力过大且倒挂严重,下游需求依然疲弱。 在期货波动和加息背景下,预计短期价格将维持弱势;

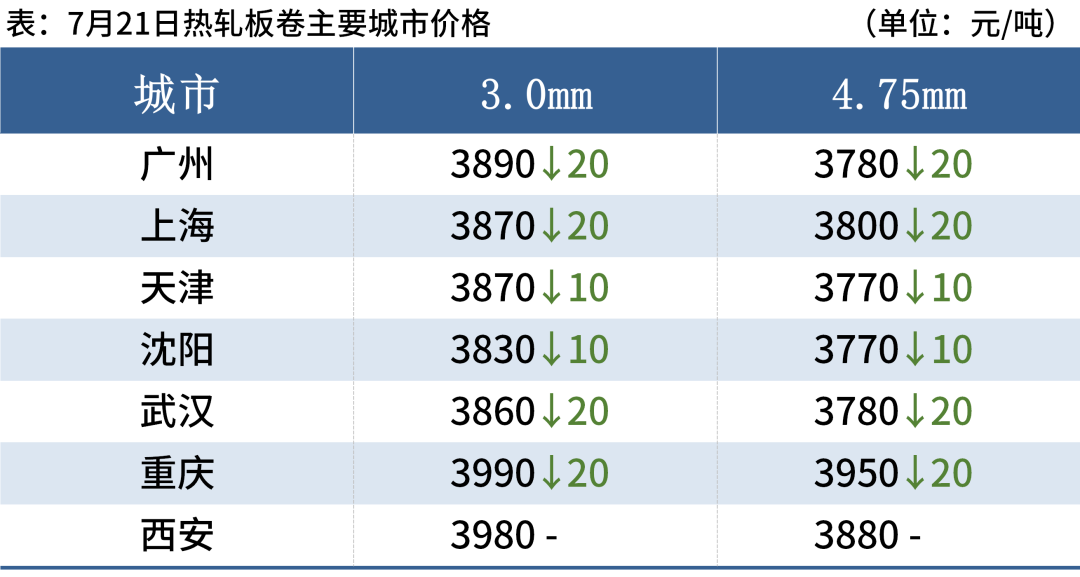

7月21日热轧板卷价格:窄幅调整; 今日全国热卷价格窄幅调整,幅度在10-30。 今日相关期货震荡,现货市场心态平平,商家抬价意愿不高,基本以成交为主。 市场投机气氛较弱,商家基本按需采购,目前成本支撑尚可。 预计下周市场价格将企稳盘整;

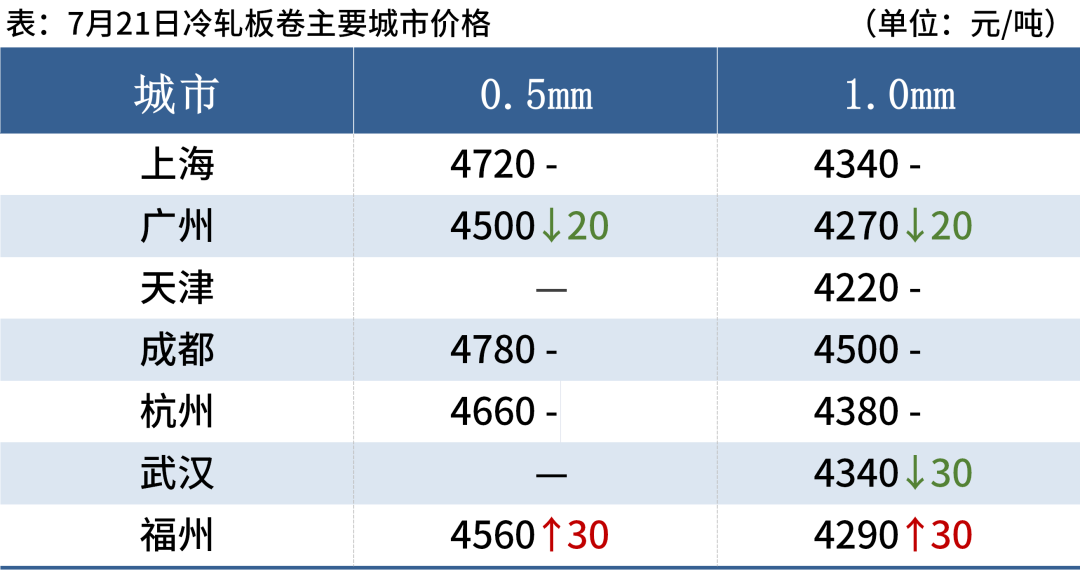

7月21日冷轧板卷价格:小幅调整; 今日全国冷轧价格小幅调整,幅度10-60元。 目前下游市场观望心态较多,按需采购较多。 整体表现一般,预计明日市场价格窄幅震荡。 幅度调整;

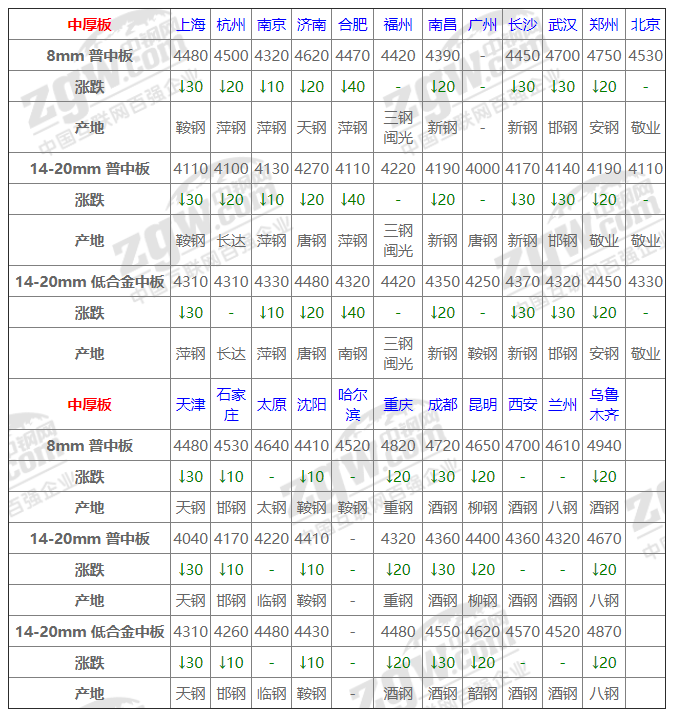

7月21日中厚板价格:主流下跌; 今日全国中厚板主流价格下跌,调整幅度10-40。 期货市场震荡,市场观望情绪占据主导。 需求未见明显释放,商家多出货回撤资金。 主要是整体成交情况一般,预计短期弱势平稳运行;

7月21日热带价格:主要下跌; 今日全国带钢价格以下跌为主,跌幅在20-30之间。 午后市场低位宽幅震荡,收跌。 虽然提振了心态,但遗憾的是实际需求并不好。 上升动力不足。 整体库存消化仍有限,市场对钢厂减产消息的接受程度普遍,预计明日企稳盘整;

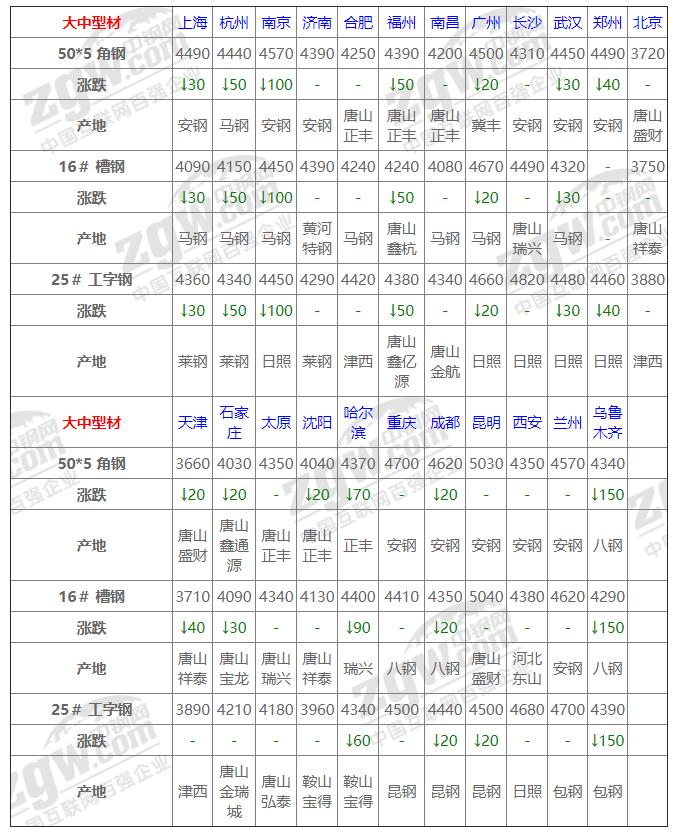

7月21日型材价格:个别下跌; 今日型材价格个别下跌,幅度在20-150。 今日钢坯暂稳,而期货螺蛳盘整,市场心态不稳,市场成交清淡。 传统淡季,下游倾向于按需补充库存,厂家以出货和减少库存为主。 整体成交依然疲弱;

7月21日管材价格:稳中有跌; 今日全国焊管价格以稳中走为主,幅度20-50。 今日期货波动较大,不稳定,商家愈加谨慎。 在成本面的强力支撑下,出货量罕见下调。 市场信心不佳,贸易商观望态度浓厚。 他们只专注于根据需要低水平补充库存。 在需求支撑不足的情况下,预计明天管材市场将以平稳调整为主。

(中国钢铁网)

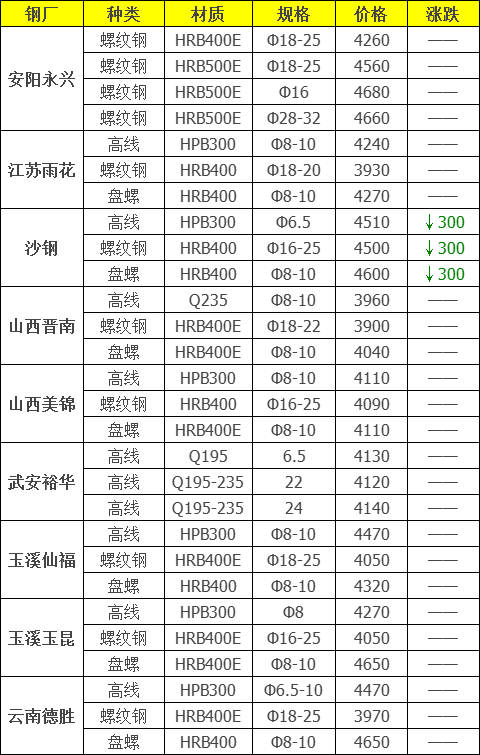

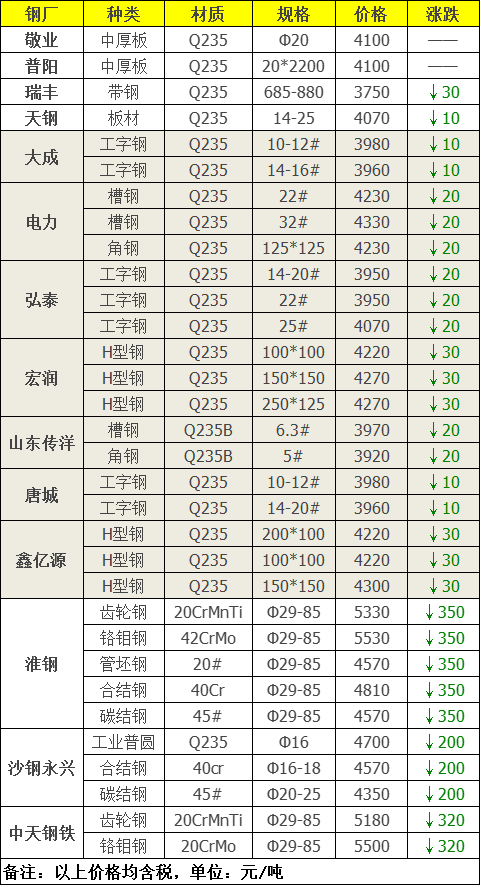

2、调价:暴跌350! 22家钢厂价格变动!

中国钢铁网信息研究院数据显示,今日共有22家钢厂调整价格,其中:12家下调,占比54.5%,调价幅度为10-350元/吨,其中:跌幅最大的是淮钢; 稳定的有10家,占54.5%。 超过45.5%。 具体价格调整详情如下:

今日,共有9家建筑钢厂和板材钢厂宣布价格调整,其中包括:

下调1家企业,占比93.3%,调价幅度为20元/吨。

稳定企业8家,占比6.7%。

今天共有13家钢厂宣布型材价格调整,其中包括:

调价企业11家,占比84.6%,调价幅度10-350元/吨。

稳定的企业有2家,占比15.4%。

当今钢厂简析

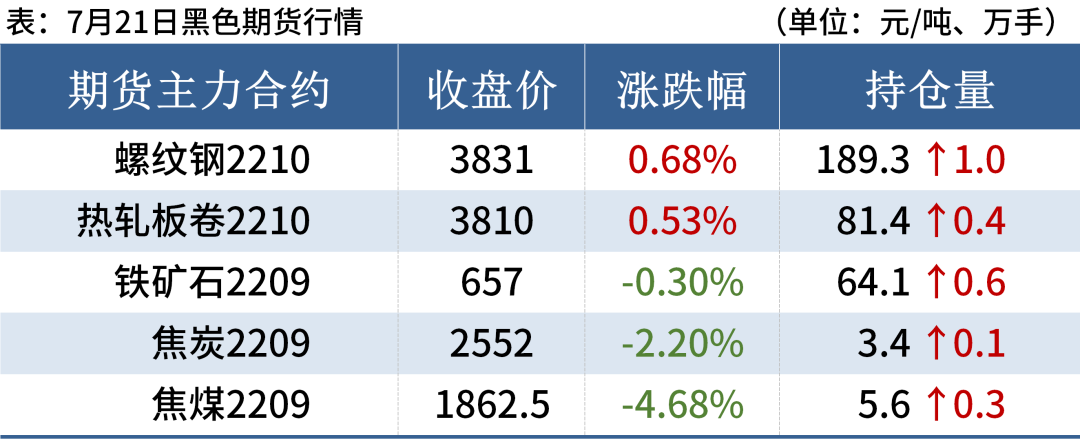

钢材期货市场价格

7月21日,国内钢材市场价格波动弱势,唐山前安普钢坯出厂价稳定在3550元/吨。 目前商家继续减少库存规避风险,下游采购积极性不高,市场情绪以观望为主。

21日,蜗牛期货主力震荡,收盘价3831上涨0.68%。 DIF继续向DEA上行,RSI三线指标位于36-41,运行于布林带下轨与中轨之间。

21日,国内5家钢厂下调建筑钢材出厂价格。 其中沙钢、中天钢铁7月下旬出厂价分别下调300元/吨、400元/吨。

四大类钢材市场价格

建筑钢材:7月21日,全国31个主要城市20毫米三级抗震螺纹钢均价为4034元/吨,较上一交易日下跌6元/吨。 随着近期钢厂停产、检修力度加大,本周产量继续下降,库存持续减少,表观消费有所改善。 短期来看,当前市场需求面不稳定,价格上涨乏力。 同时,随着钢厂利润的恢复,部分地区钢厂可能随时恢复生产。

热轧板卷:7月21日,全国24个主要城市4.75mm热轧板卷均价为3862元/吨,较上一交易日下跌13元/吨。 当前市场心态偏弱,短期内难以扭转,成交并未提供支撑。 但从本周数据来看,热卷产量下降5.23万吨,工厂仓库增加5000吨,社会仓库增加6400吨。 表需求略有回升。 目前钢厂利润明细后没有保证金。 钢厂逐渐放慢生产节奏,检修减少量逐渐增加。 但目前减产步伐缓慢。 正值淡季,需求疲软,库存下降缓慢。 加之持续快速下滑,导致市场信心不足,商家资金压力加大,订单承接依然极其疲弱。

冷轧板卷:7月21日,全国24个主要城市1.0mm冷板卷均价4398元/吨,较上一交易日下跌8元/吨。 据Mysteel最新统计,目前冷轧钢厂库存为41.08万吨,较前一周增加5400吨。 社会库存138.79万吨,较前一周增加6万吨。 总库存179.87万吨,较前一周增加6000吨。 库存压力依然存在。 市场方面,由于黑色期货波动运行,现货市场价格波动较小,涨价意愿不明显。 目前商家的经营仍以成交和去库存为主。 随着钢厂结算周期临近,商家对结算价不抱太大希望,预计仍以亏损为主。

中厚板:7月21日,全国24个主要城市20mm普通板均价4221元/吨,较上一交易日下跌18元/吨。 从供应来看,由于钢厂订单情况不理想,面临亏损,后期钢厂有调整生产节奏的计划。 从流通量来看,由于今日交投疲软,交投气氛不佳,成交量明显萎缩。 目前贸易商多以减少库存和出货为主,对后市并不乐观。 他们通过减少库存来规避风险。 下游采购积极性不高,按需采购。

原材料和燃料市场价格

进口矿:7月21日,山东进口铁矿石现货市场价格震荡下行,市场交投气氛不佳。 截至发稿,山东地区获悉部分成交情况:青岛港:PB粉660,663元/吨;青岛港:PB粉660,663元/吨; 日照港PB粉660、665元/吨。

焦炭:7月21日,焦炭市场继续弱势运行。 今日主流钢厂下调焦炭采购价格,湿熄下跌200元/吨,干熄下跌240元/吨。 第四轮焦炭降价已基本落实。 四轮累计跌幅900-940元/吨。 焦炭企业生产积极性偏弱,整体开工率持续下滑,焦炭库存小幅积累,整体库存低位运行,出货正常。 第四轮登陆市场悲观情绪正在蔓延,焦炭企业限产范围有扩大之势,影响焦炭供应进一步收缩。 钢厂方面,钢厂多控制到货,以按需采购为主。 目前下游终端市场尚未明显好转,钢厂成品利润倒挂,导致检修、减产增多。

废钢:7月21日,全国45个主要市场废钢均价为2270元/吨,较上一交易日上涨15元/吨。 具体来看,近两日建筑钢材成交量数据低位震荡,今日废钢市场上涨趋势也有所放缓。 随着焦炭、铁矿石、建材价格均大幅下跌,废钢上涨空间收窄,市场转下行。 势头正在增强。 但同时,近期钢厂到货量较低,中小企业废钢采购需求依然存在。

废钢价格调整信息

我的钢铁网讯:据我的钢铁APP显示,截至7月21日发稿,共有19家钢厂上调废钢采购价格,8家下调采购价格。

▎华北地区

7月22日,【河北沧州大沥铺】废钢价格上涨40%,成型价格维持不变。

7月21日【河北秦皇岛红星】减40,调整后:精钢2660、优质钢2640、重废A 2570、重废B2500、硅钢片2460、三角、硅钢片2460、瓜种子冷板废料B2460,冷板废料A2480,硅钢片破碎料2460,硅钢片破碎料2310块,钢棒煤球2290停止收集,花铁球2290停止收集,一般销售2级1700~1750,一般销售一级1780~1800,小钢屑1930~1950,大钢屑2030~2050,不含税,单位:元/吨。

7月21日【河北秦皇岛安丰】减少40,调整后:圆钢头、轨头43公斤以上、20mm厚板材废料、四厚冲孔豆2730、模具钢、大法兰片、50厚上重型2710、大槽钢(纯)、大H型钢、火车梁(纯)2610、塔吊梁2510、2厚马碲铁2610、不锈小定转子2430元、不锈大定子2580 、冷板小材2530三角硅钢片2530二厚铁豆2670钢筋头质量2730不含税,单位:元/吨。

7月21日,【河北唐山燕山钢铁有限公司】降价60-80元。 执行价格为:优质2680、重型A2630、重型B2530、中型A2590、中型B2490、优质铸铁2510、普通铸铁2310、大型剪板2610、炉料一2630、炉料二2610、炉料三2510、炉料四1130,一级剪切料2630,二级剪切料2510,三级剪切料1130,不含税,单位:元/吨。 收款人17367519998

7月21日【河北唐山东海特钢】废钢收购价:钢筋球2680,花铁球2660,特种破碎料2710,不含税,单位:元/吨。

7月21日【河北石家庄奥森】废钢最新执行价格:一级花铁球2700,二级花铁球2550,钢筋球2680,重A152700,重A10为2680,重A6为2660,重B15厚2700,重B10厚2680,重C二级2550,不含税,单位:元/吨。

7月21日【内蒙古武钢】废钢收购价格现执行:重类1:≥15mm 2645,中类4≥8mm 2570,中类2≥6mm 2520,中类3≥4mm 2400,钢筋// 6mm 2555,花铁球2555,不含税,单位:元/吨。

▎华东地区

7月22日【江苏徐州兴达】部分上涨50,调整后:精炼炉料2600-2640,冷板煤2720,普通刨花2280,钢刨花2420,冲孔材料2780-2830,不含税,单位:元/吨。

7月22日【江苏扬州华航】上涨50,调整后:新钢板2490、优质权重2460、马蹄2450、棒钢头2460、生铁2350-2400、重废2350-2400、精炼炉料2270-2310 ,钢丝1850,粉碎钢刨花2200-2250,粉碎数控刨花2060-2130,粉碎普通刨花2010-2060,不含税。

7月22日,【江苏扬州恒润海洋重工】增加130辆。调整后:废料一2580、废料二2540、废料三2500、重废一2510、重废二2470、重废三2420、钢筋压块2510。不含税,单位:元/吨。

7月21日,【江苏扬州勤友】上涨50,调整后执行价格为:棒材球团、冲头2550,钢板2550,模具钢2550,重废2480,机加工生铁2450 、硅钢片用2470、汽车用2470。 切割材料2500元,不含税,单位:元/吨。

7月21日,【江苏常熟龙腾】废钢价格上调80,重废价格2800,含税出厂。

7月21日【江苏无锡新三洲特钢】涨50-60,最新报价:钢板10以上2950,模具钢2890,马蹄2840-2890,重废6厚2780-2840,钢筋砍头2970,含税13%。

7月21日,【江苏连云港兴鑫】上涨100,调整后执行价格:钢板模具最高收费2500,10厚以上重废料最高收费2470,高- 8厚以上优质重废料为2430,6厚以上重废料最高收费为2400,4厚重废料为2300,3层及以上新中废料按2200收费,钢筋球团收费2550,不含税,单位:元/吨。

7月21日,【江苏连云港赣榆华鑫废旧物资回收有限公司(宾鑫钢铁)】涨100,调整后执行价格:精炼炉料(新钢板、模具钢等)2410- 2500,重废2150-2320,中废2070,硅钢片停,破碎料停,洗豆,钢筋截头停,不含税,单位:元/吨。

7月21日【江西泰鑫】下调30,执行价:重废一2420 重废二2390 中废2350,小废2130-2230,统一料1700-1850,加工料2090-2350,包装料1710- 2270,刨花2160,数控刨花2110,普通刨花2040,钢筋球团暂停,生铁2460-2490,不含税,单位:元/吨。

7月21日,【福建老武黄】省内外各类废钢上涨50。

▎华中地区

7月21日【湖北广水华鑫(坤业)冶金】涨30,执行价:棒钢头2470、模具钢2470、钢板2470、一级重废2440、二级重废2400、生铁2320 ,铸钢2380,粉碎原料1920-2020,不含税,单位:元/吨。

7月21日【湖北大冶华新】增30:精一级重废2690、精二级重废2640、精三级重废2590、一级重废12厚2650、二级重废废料8厚2600,三级重废料2600,级重废料2550,机械生铁2550,钢筋切割头2710,破碎料破碎切割材料一级冲床和二级冲床停止收集,钢筋2430,锻材2430,不含税,单位:元/吨。

7月21日【河南民源钢铁】涨50-100:厂废2660-2730,硅钢片2480,薄钢废2520,特级料2730,马蹄2630,精废钢2510,重废2590-2710 ,总材料废钢2330-2460,冲孔豆2660-2730,钢筋断头2730,钢筋头2610-2710,钢筋煤球2560,原毛2180,不含税,单位:元/吨。

▎华南地区

7月21日,【广东河源龙川航辉钢业】降价30:生铁重废2410-2430,工业冲压废钢2380-2410,风切材(60厘米)2370-2400。 不含税。 请注意,不允许携带密封件等危险物品。

7月21日,【广东河源中鑫华丰钢铁】降价20:重废2440,空剪材2410,中剪2240。 自提,不含税,注意禁止携带密封件等危险品。

7月21日,【广西桂林品钢】废钢减10,重废2470,不含税。 具体价格以表为准。

7月21日【广西鑫茂再生资源回收有限公司(万钢)】生铁、重废、细剪料、普剪料等采购价格上调50:生铁2240-2300,重废料2210-2250,一级钢筋颗粒2470,二级钢筋球团2450,钢筋压块达2370,切割料2-4粗1980,不含税,单位:元/吨。

7月21日【广西柳钢】增加70:现配重1型为2680,配重2型为2650,冲孔1型为2550,冲孔2型为2680,冲孔3型为2680,冲孔4型为2620,剪切1型2520、剪切型2 2480、剪切型3 2440、剪切型4 2410、压块型1 2690、压块型2 2350、压块型3 1870,含税,单位:元/吨。

7月21日【广西防城港广钢有限公司】增加70个,现配重1型为2810,配重2型为2780,冲孔1型为2660,冲孔2型为2810,冲孔3型为2810、冲孔4型为2740、1型煤球2810、2型煤球2430、3型煤球1930、1型剪切料2600、2型剪切料2570、3型剪切料2530、4型剪切料2490、加工大料1 2120类,大料加工料2类1970,含税,单位:元/吨。

▎西南地区

7月21日【渝钢】增200:重废一号2590、重废三号2550、中废2520、边角料一号2610、边角料二号2580、工业薄料压块2530、钢筋压块2610、炼钢碎废钢2520、统一废钢2200、铁屑压饼2280、冲头2610、马蹄2580,不含税。

7月21日【重庆祖航钢铁公司】增加50:(6-8厚)2550-2600、(4-6厚)2500-2550、(2-3厚)2390-2440,汽车已被移走。 发动机2570,车壳2050左右,中上中市场2140-2190,罐头彩钢瓦1670-1770,汽车废料2340。注:隐形煤球不会接受,含油汽车废料不接受。 严禁进货中夹带封条、轮胎、易燃易爆危险品(塑料袋、地灰),一经发现将处以严厉处罚。

7月21日【重庆长寿永航钢铁】上涨50:一种或多种重废钢。 钢头2640 两个。 (6-8)厚切料2590 三. (4-6)厚切料2490-2540 四. (2-3) 厚切削材料2370-2420。 毛料:槽角2540、桥梁模板2540、厂货2410、中上2230、中2160、车削屑2340。 注:不接受隐形煤球,不接受油腻的汽车废料。 严禁进货中夹带塑料袋、地板灰、封条、轮胎、易燃易爆危险品,一经发现将处以严厉处罚。

▎东北地区

7月22日,【辽宁鞍山保德】开始接收废钢。 执行价格为:剪切料2380,不含税,单位:元/吨。

7月22日【辽宁抚顺新钢】减291:厚度≥20、长度≤600*800 2703、厚度≥12、长度≤600*800 2673、厚度≥8、长度≤600*800 2633、厚度≥ 6、长度≤600*800 2573,切割钢筋2843,不含税,单位:元/吨。 (中国钢铁网、我的钢铁网)

3、预测:钢材价格将...

导航

今日夜盘期货虽上涨,但早盘跳水,呈现震荡下行走势。 未来钢材价格将何去何从? 让我们拭目以待……

1、钢材市场影响因素如下:

螺纹钢产量、社会仓、工厂库持续下降,表面需求由降转增

分析师观点:螺纹钢产量、社会仓库、工厂仓库持续下降,表面需求由减转增,表明当前钢材需求总体疲软,但疲软之中有边际改善趋势。 加之近期钢厂检修和减产规模扩大,钢材供应收缩预期有望加强,中长期利好钢价。

沙钢7月下旬下调建材价格300元

分析师观点:沙钢建材价格大幅下调,不仅说明当前钢企压力巨大,也反映出钢企对未来市场需求释放信心不足,将产生较大负面影响对钢材价格的影响。

统计局:上半年全国省市粗钢产量出炉 河北下降8.47%

近日,国家统计局数据显示,2022年6月全国粗钢产量9073万吨,同比下降3.3%; 1-6月,全国粗钢产量52688万吨,同比下降6.5%。

从省份数据看,2022年上半年10个省市粗钢产量同比下降10%以上。 其中,山东下降19.34%、河南下降10.87%、四川下降16.28%、云南下降11.62%、天津下降13.51%、吉林下降11.56%、上海下降19.41%、浙江下降12.83%其中,重庆下降20.90%,贵州下降20.32%。 。

分析师观点:从数据来看,上半年粗钢同比降幅已达到去年降幅水平。 但今年的需求远低于去年。 需求惨淡,供需矛盾扩大,导致二季度钢价大幅下跌。 据国家发改委等部门4月20日消息,今年粗钢产量将继续减少。 考虑到政策的连续性,下半年粗钢至少将继续维持目前的跌势; 若下半年需求恢复仍缓慢,钢材供应或将继续面临较大压力,为维持钢材市场供需平衡,促进供需适应,粗钢产量或将面临较大压力。更大的下降。

央行开展30亿元7天期逆回购操作,实现零投入、零回笼

7月21日,央行进行30亿元7天期逆回购操作,中标利率2.10%,与此前相同。 由于今天30亿元逆回购到期,实现了零投入、零回笼。

全国货运物流主要指标恢复向好

昨日,全国货运物流运行有序,主要指标持续回升。 全国公路上行驶的货车730.99万辆,环比增长0.91%。

中国7月1年期贷款市场报价利率(LPR)维持不变

展望未来,业内人士认为,本月LPR虽无动作,但实际贷款利率仍有进一步下降的空间。

2、现货市场

螺纹钢继续弱势

今日开盘尾盘,螺震荡走弱,商家情绪偏空,现货价格小幅松动。 今日成交表现一般,中间商入市积极性较低,终端采购以刚需为主。 由于钢厂产量持续下降,本周建材库存小幅下降,对现货走势有一定提振。 预计明日建筑钢材价格将小幅波动。

热轧稳定精加工

全国热轧板卷主流价格稳中有涨、稳中有跌。 今日相关期货震荡,现货市场心态平平,商家抬价意愿不高,基本以成交为主。 市场炒作氛围较弱,商家基本按需采购,目前成本支撑尚可。 预计明日市场价格将企稳盘整。

中盘弱势稳定。

今日市场情绪依然谨慎,需求不佳。 为完成出货,商家以小量控量操作为主,整体交投气氛一般。 虽然本周中板供需基本面有所改善,但五大类中板供给收缩乏力,市场信心不足。 预计明日中板市场价格弱势稳定。

带钢继续弱势稳定

全国带钢运行弱势平稳,整体形势总体略差。 中宽现货价格弱势调整。 市场主要是低价资源,但高价资源就很难应对。 厂家信心仍显不足,成交表现疲软。 考虑到需求释放缓慢,预计仍将弱势稳定。

轮廓弱化操作

今天市场开市。 在某些地区,型材价格稳定并走软。 市场上有很多低价现货资源。 贸易商正在认真谈判。 需求端无明显改善,整体成交持续疲软。 目前成本钢坯提价意愿不强,部分品种承压,市场心态较为悲观。 综合来看,预计短期内型材价格将走弱。

管道稳定但脆弱

今日期货波动较大,商家趋于谨慎。 在成本面的强力支撑下,管材现货价格相对稳定,出货量少有下调。 市场信心不佳,贸易商观望情绪浓厚,仅需要低位按需补货。 主要是需求支撑不足,预计明日管材市场稳中偏弱。

3、原材料市场

钢坯运行弱势

市场方面,黑螺走势波动较大,贸易商趋于谨慎。 In terms of raw materials, the fourth round of price reductions has been implemented today, and the cost-end prices have moved downwards. Currently, steel billet profits are at a loss. In terms of downstream finished products, the overall transaction performance was poor. Towards the end of the month, the financial pressure on steel companies has become more and more obvious, and manufacturers are more likely to give up profits and sell goods. It is expected that steel billet prices will be stable and weak tomorrow.

Iron ore runs weakly and stably

The iron powder market is operating stably for the time being. Although most ore dressings are currently suspended for maintenance, some mining companies are willing to ship. However, due to trade and other buyers, many buyers have a wait-and-see attitude towards the market. Inquiries are deserted and there are few operations, resulting in the mining industry. There is a certain pressure to select shipments, and combined with the recent increase in blast furnace maintenance at steel plants, it is expected that market demand will be difficult to pick up in the short term, and ore prices will generally run weakly and steadily.

Coke runs weakly

Steel plants continue to suffer losses, and some steel plants have increased blast furnace maintenance and production suspensions, and even total production suspensions. The fourth round of coke lifting has come to an end. The coke market is expected to run weakly in the short term.

Scrap steel fluctuates within a narrow range

In the short term, scrap steel may rebound from oversold conditions, but the space is limited. At the same time, the fundamentals of raw materials are weak. The fourth round of price cuts for coke has been implemented. Steel mills have increased maintenance and production cuts. The demand for scrap steel has a further downward trend. It is increasingly difficult for prices to break through upward. However, There is a risk of falling at any time. It is recommended that the site operate with caution. It is expected that scrap steel will mainly fluctuate within a narrow range in the short term.

Pig iron runs weakly

The domestic pig iron market is declining steadily, with light trading volume. The fourth round of coke reduction has gradually come into effect, ore and black futures have weakened, pig iron costs have dropped again, and business mentality has been suppressed again. Coupled with sluggish demand, the quotations of iron plants in some areas have been lowered again. Currently, iron plants, steel plants, and foundries are starting to operate. The rate continues to decrease, the cost and demand of pig iron are both weak, pig iron is in a downward channel for a long time, downstream inquiries and purchasing intentions are lower, and pig iron continues to operate weakly in the short term.

4. Comprehensive Suggestions

The market opened today. In terms of market, futures rose in night trading and plunged in early trading, showing a volatile downward trend. Affected by this, the market quotations were weak and fell slightly, and the overall transaction volume was average. At present, traders have high inventory pressure and serious inversion, and downstream demand is still weak. Blast furnace plants have increased their efforts to reduce production. Inventory pressure can be alleviated to a certain extent, and supply and demand can also maintain a relative balance. However, in the context of the uncertainty of the Federal Reserve's interest rate hike and the volatile futures market, most traders are taking a wait-and-see attitude towards the market outlook and are more cautious in their operations. 总之。 Overall, steel prices are expected to weaken tomorrow. (China Steel Network)

4. China Jiao Association: The industry has reached a life-or-death situation

After three rounds of promotions and reductions, how long can Jiaoqi survive?

According to industry insiders, on the afternoon of July 18, the China Coking Association Marketing Committee held a market analysis meeting via video. Businesses attended the meeting. Participants reported that the current business situation is very serious, the entire industry has suffered serious losses, and has reached a life-or-death situation. Increasing production restrictions and striving for cash flow are the only way for companies to successfully survive the current difficult period.

Why would Jiao Qi accept continuous promotions and decreases from steel companies? An industry analyst engaged in black futures trading said: "At the beginning, several Jiao companies did not agree, but if it finally comes to fruition, they will definitely have to agree. The China Jiao Association said that they would jointly boycott, but in the end they still couldn't twist their arms. Relatively speaking, the steel mills are definitely harder, but even so, the steel mills still cannot change the situation of still losing money after the increase or decrease."

From "hot" to "cold"

From "scalding hot" to "cold", what has coke experienced?

In April this year, coke was still a hot "target darling" in the futures market. Affected by factors such as coal prices, its transaction price once soared to 4,284 yuan/ton. But in the following three months, the price of coke, which was as "hot" as freshly baked, began to "cool", and its transaction price continued to decline. The increase and decrease of steel companies played a certain role.

Following the first round of promotions and reductions by steel companies, the second round of promotions and reductions by steel companies was soon fully implemented. Faced with a market environment in which every ton sold results in losses of hundreds of yuan, after steel companies reduced prices by 200 yuan in the second round, some small and medium-sized coking companies began to request steel mills to increase prices by 100 yuan. However, according to industry insiders , Jiaoqi's rise has always been ignored. Not only that, industry insiders said that the third round of improvements and reductions by steel companies has also been fully implemented in the near future, and the losses of Jiao companies will undoubtedly further expand.

In this context, the China Jiaojie Association reached a consensus on four points with the participating Jiaoji enterprises at the market analysis meeting: first, all participating enterprises will limit production by more than 50% from now on, and encourage enterprises in the same region to jointly limit production; secondly, Second, immediately stop or reduce all coal purchases; third, due to a significant reduction in coke supply, give priority to shipping to customers with good credit and high prices; fourth, adhere to the "no payment, no sale" principle to prevent market risks.

These four points of consensus have been supported by Jiaoqi enterprises. On July 19, coking coal auctions in many places failed. Affected by this, the main coking coal prices also began to decline, closing down 1,974.5 yuan/ton that day, a daily decline of 2.57%.

Not only have they begun to stop purchasing coal, some coking companies have also issued a special document stating that they will begin a complete shutdown of customers to jointly resist the improvement and reduction of steel companies. An insider of a large coke company said, "Just a few days after the measure was implemented, some coke companies began to resume supply to old customers, but stopped taking orders from new customers."

Industry analysts said that Jiaoqi's sales model has also changed. "In the past, coke delivery to steel mills was basically done on credit. The coke was delivered first and then the steel mills got the money back. However, due to the current market environment, many steel companies are very slow to get their money back. This is why the China Coke Association wants to pay back the coke." Companies insist on 'no sales, no payment', because there are indeed some who delay payment and have a great impact on the cash flow of key companies."

If losses continue, is it possible that Jiao Enterprises will further suspend production? Industry analysts believe that a complete shutdown is unlikely. "It takes time to stop production. It takes time to stop production lines and turn off furnaces. This is a gradual process. The main reason is cash flow pressure. Although some coke companies are still losing money, they can last for a long time as long as they have cash flow."

Steel companies gradually suspending production

Not only the coke enterprises, but also the steel enterprises that have been raised and lowered three times in a row are having an increasingly difficult time.

On July 18, Puyang Steel's official WeChat public account stated in a “Letter to All Employees”: “From frequent production restrictions in the first quarter to the epidemic lockdown in April, downstream demand shrank, market expectations weakened, and raw materials Prices have risen, finished product prices have plummeted, inventories have been warned of long-term high levels, a large amount of working capital has been occupied, steel companies' ability to withstand market risks has declined, and steel mill profits have shrunk by more than 50%. In May, one-third of the companies in the industry suffered losses, and in June Losses continue to increase, and almost all industries fell into losses in July. Why did steel prices plummet? The essence is that demand decreased and production increased. In the third quarter, the high temperature weather of "seven ups and eight downs" ushered in the traditional off-season , demand may continue to be weak, and a new round of brutal market competition has arrived.”

In this regard, Puyang Iron and Steel has put forward a series of requirements for employees to "based on their positions, strictly implement economy, reduce costs and increase efficiency, and reduce and reduce all non-essential expenses", and stated that it will adhere to the principle of "producing more for those who make money, and reducing production for those who lose money" "No production, everything is market-oriented" as our operating policy.

Compared with Puyang Steel, which is operating well, other steel mills are having a tougher time. An insider in the steel industry said, “Many steel plants in Shandong and Shanxi have begun to suspend production for maintenance, and some steel plants far away from the origin of raw materials have begun to widely restrict production. Only steel plants in Tangshan and Handan have not yet widely restricted production. ”

Affected by such news, multiple rumors appeared in the market. A "Notice on the Holidays of Jiangsu Binxin Steel" was misunderstood by some industry insiders as a "holiday for all employees" of Binxin Steel. According to the survey results, the above news is actually: Affected by the decline in industry profits, Jiangsu Binxin Steel has recently taken the initiative to Production is under control. Currently, the three blast furnaces in the plant are operating normally, but the overall hot metal output has declined.

Also affected by the rumors is Jilin Jigang Iron and Steel Group. On July 15, there was news in the market that "Xiamen Guomao Pallet has 10,000 tons of steel billets and Jianfa Beijing Pallet has 20,000 tons of snails + strip steel. Because the steel mills have fallen below the margin, they have not replenished the stock. The current situation is no longer sufficient. To pay off the debt, the company is theoretically in bankruptcy." However, Jishan Iron and Steel Co., Ltd. quickly responded negatively to the incident and attached a police receipt, saying that it would be handed over to the judicial authorities for handling.

Although the rumors have been clarified, the sluggish steel industry is still going further and further on the road of limiting production. According to information provided by industry insiders, Sansteel Minguang, a listed steel company in Fujian, recently announced a production reduction plan, stating that it will "control the output of molten iron. The two-rod production line will be suspended for 15 days starting from the 23rd, one rod will be produced in small quantities, and a blast furnace will be stopped at the headquarters." 。

But the sluggish steel market is not without improvement. After continuous plummeting in the past month, thread has experienced a market reversal. As of July 19, it has risen from the lowest of 3,588 yuan/ton to the highest of 3,872 yuan/ton, with a rebound of nearly 300 yuan/ton.

The turnaround for steel companies has appeared. How will the fate of Jiaoqi companies develop in the future? Industry analysts said: "High coal prices will not always exist. Under the influence of current policy controls and market rules, stabilization of coal prices may occur as soon as the second half of the year." (China Steel Network, China Times, etc.)

5. [Interpretation of Steel Industry Data] Supply shrinks at an accelerated pace and inventories continue to decline

【Comprehensive conclusion】

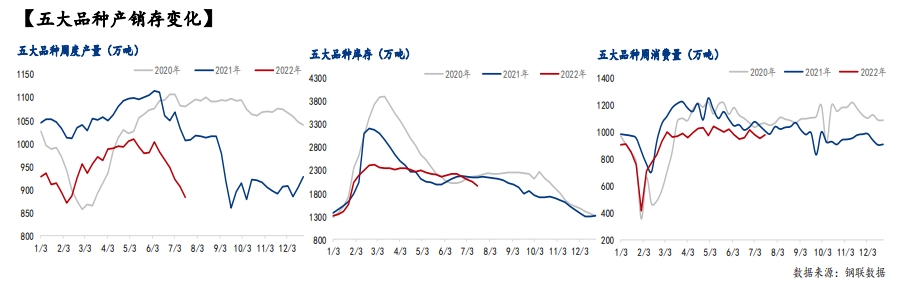

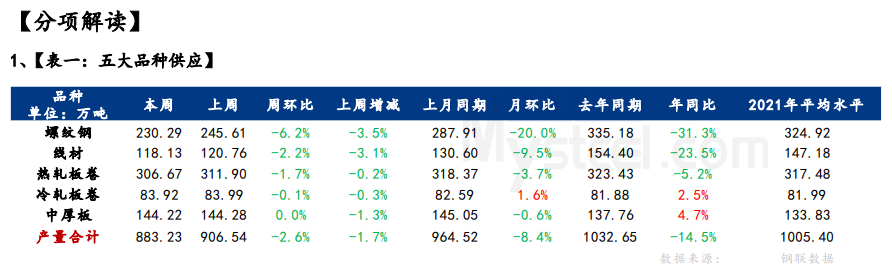

In terms of supply, the supply of the five largest steel products dropped to 8.8323 million tons this week, a decrease of 233,100 tons, or 2.6%. Among them, the month-on-month decrease of building materials was 180,000 tons, a decrease of 4.9%; the month-on-month decrease of plate materials was 53,600 tons, a decrease of 1%.

The main steel products continued this week. The five major steel products continued to reduce production by about 1.2 million tons in the past six weeks. Among them, the production of building materials has been reduced for six consecutive weeks and the production of flat steel products has been reduced for three consecutive weeks. Judging from the latest news recently, due to the impact of losses and market sentiment, some state-owned enterprises/central enterprises plan to carry out maintenance, mainly of coiled plate varieties. In addition, at this stage, it is the general consensus among steel mills that "there is no production at a loss, little production at small profits, and high production at profit". From the perspective of current product profits, ordinary steel no longer meets this condition, and state-owned enterprises/central enterprises have joined the initiative to reduce production. /In the process of maintenance, there is still room for decline in steel supply levels in the later period.

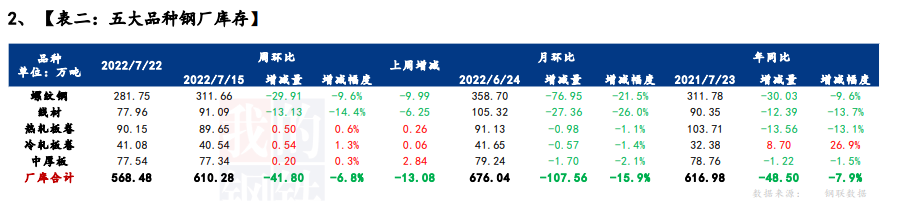

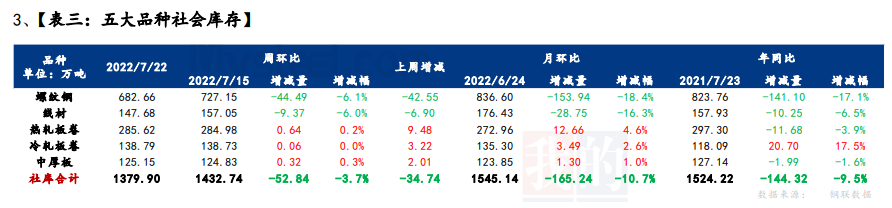

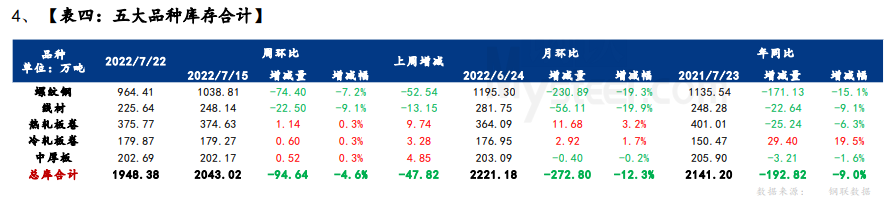

In terms of inventory, the total inventory of the five major steel products continued to be reduced month-on-month, falling to 19.4838 million tons, a week-on-week decrease of 946,400 tons, a decrease of 4.63%. Among them, building materials inventory decreased by 969,000 tons, a decrease of 7.5%; plate inventory increased by 22,600 tons, an increase of 0.3%; in terms of sub-indicators, the inventory of the five major steel product varieties decreased by 418,000 tons, a decrease of 6.8% month-on-month; the social inventory of the five major steel varieties decreased by 528,400 month-on-month. tons, a decrease of 3.7%.

At this stage, the inventory reduction continues in the off-season, but building materials and plates are divided. Among them, building materials have been reduced in inventory for 5 consecutive weeks, with a total inventory reduction of approximately 2.87 million tons in July; plates have been accumulated in the past three weeks, and a total of 140,000 tons have been added in July. Taken together, the trend of inventory reduction in the off-season is likely to continue. There are two main reasons: one is that at this stage, with the increasing efforts to reduce and suspend production of steel plants, steel companies are actively selling early inventory; the other is that coil plates have begun to join the ranks of supply contraction. Inventory pressure may ease hedging, market confidence has been boosted, and merchants' mood for purchasing goods has improved.

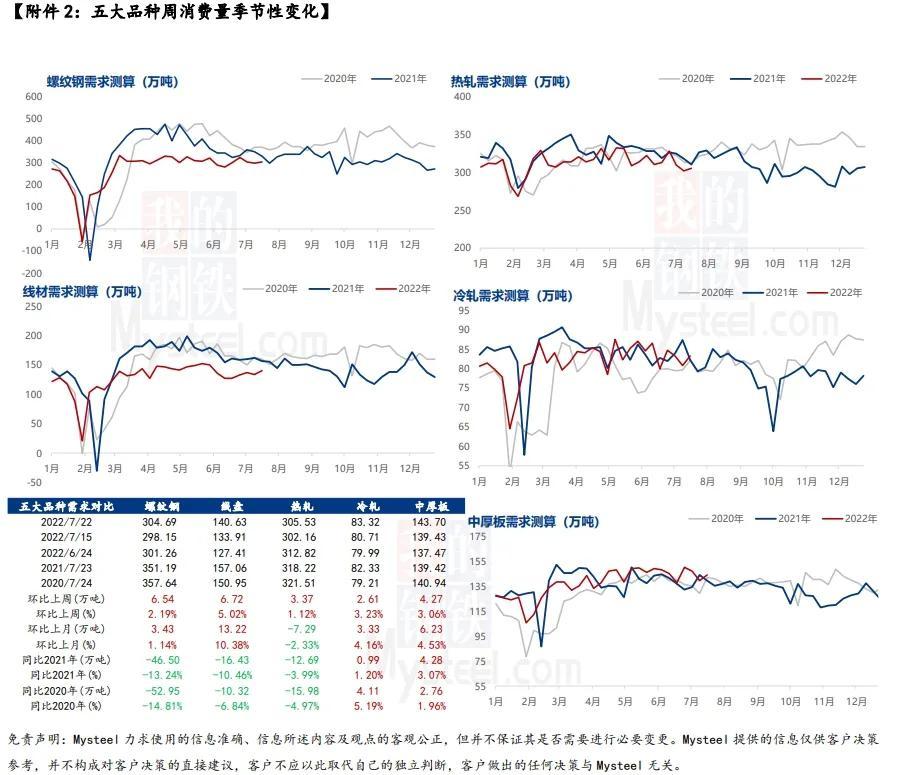

消费方面,本周五大品种周消费量增幅2.5%;其中建材消费环比增幅3.1%,板材消费环比增幅2.0%。

从本周成交表现来看,建材周均成交增至16万吨左右,环比增加3万吨;热轧周均成交3.4万吨左右,环比增加约1万吨,可见本周市场情绪环比略有好转。从周消费表现来看,建材上月同期周消费量约429万吨,月环比增4%,环比去年均值低7%左右;板材上月同期周消费量约530万吨,环比增0.5%,同比去年均值低0.3%左右。由此可见,现阶段建材和板材消费虽仍处淡季,但月环比已有逐步修复和好转。

据Mysteel统计,建材方面,,分品种来看,本周螺线供应降幅扩张。其中螺纹钢品种除华中,其余区域均有减产;线盘品种除西南,其余区域均有减产。综合建材来看,华东和华北为主要减产区域,减产原因集中于长流程生产企业持续性检修,以及主动控产,以减少亏损比例和响应政策号召。

热卷方面,本周热轧产量小幅下降,华北、华南地区部分钢厂开始主动减产,目前钢厂亏损加剧,市场价格承压,接单情况不好,导致钢厂减产有所增加。

据Mysteel统计,建材方面,本周建材库存环比延续去化,降幅较上周略有扩张。综合建材来看,除东北厂库微增,其余区域厂库仍有下降,其中江苏、四川、云南、山东、安徽等为主要降库省份。从现阶段降库原因来看,主因仍在于供应持续性减量,入库资源减少,叠加钢厂延续厂库前移操作,出库节奏有所保证,因此整体库存环比下降。

热卷方面,本周钢厂库存小幅降库,主要降幅地区是华北地区,主要是钢厂供给下降发货加速导致;主要增幅地区是华中地区,因接单情况较差,代理商提货积极性不高。

据Mysteel统计,建材方面,以螺纹钢为例,从三大区域来看,本周华东、南方和北方环比分别减少12.1万吨、18.59万吨和13.8万吨;从七大区域来看,各区域库存均有降库,且以华东和华北表现突出,降库城市以杭州、上海、南昌、北京、天津等城市为主。

热卷方面,从三大区域来看,本周华东和北方环比分别增加2.06万吨和0.33万吨,南方环比减少1.75万吨;从七大区域来看,除华南和东北,其余区域均有不同程度累库,但增库幅度均不大。从城市来看,上海、邯郸和无锡为主要增库城市,乐从为主要降库城市。

据Mysteel统计,本周五大品种库存总量为1948.38万吨,周环比减少94.64万吨,降幅4.63%。其中建材库存减少96.9万吨,降幅7.5%;板材库存增加2.26万吨,增幅0.3%。上期库存总量为2043.02万吨,周环比减少47.82万吨,降幅2.3%。其中建材库存减少65.69万吨,降幅4.9%;板材库存增加17.87万吨,增幅2.4%。

(我的钢铁网)

转载请注明出处:https://www.twgcw.com/gczx/1179.html