18日钢材行情!钢价震荡趋强!2022粗钢供需平衡逻辑及预估分析

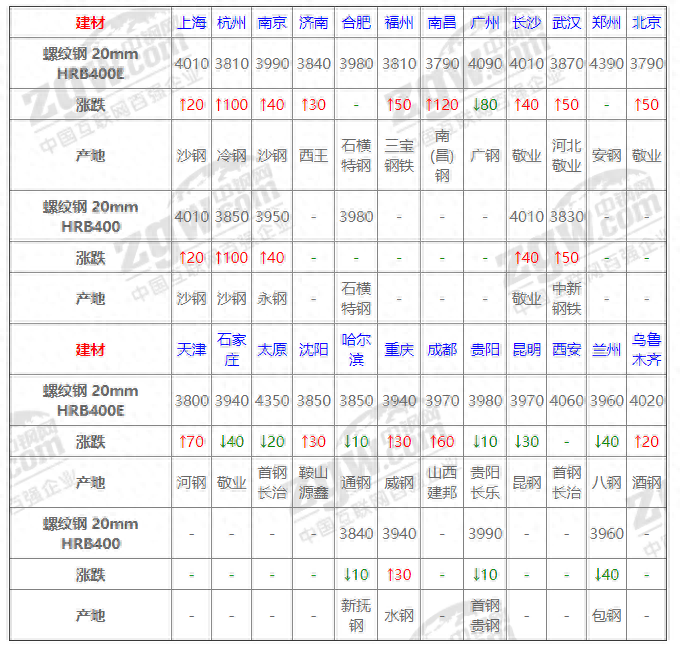

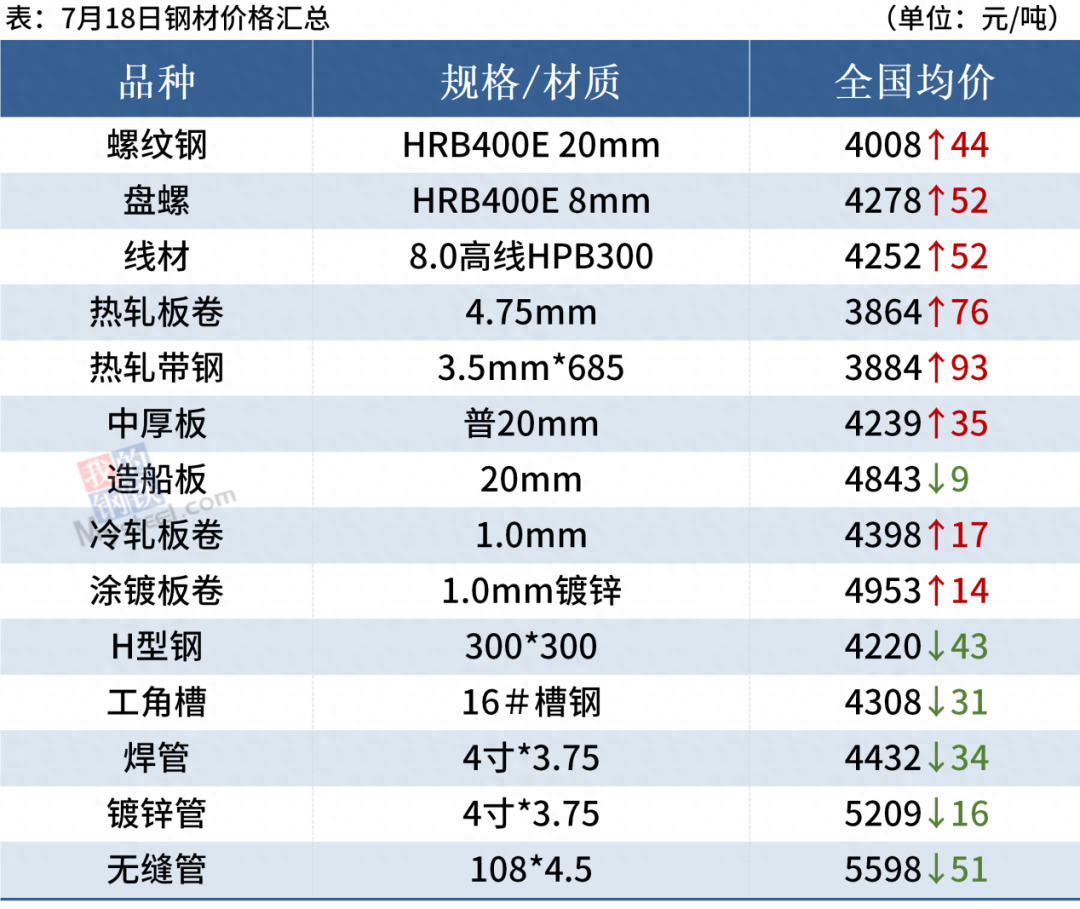

7月18日建材价格:涨跌互现; 今日建材价格有涨有跌,幅度在10-120。 螺类继续剧烈波动,市场价格维持周末价格,成交尚可,目前市场需求恢复仍较差。 钢厂纷纷停产检修,供应逐渐减少。 随着近期价格上涨,商家悲观情绪有所缓解,预计明日市场或将震荡运行;

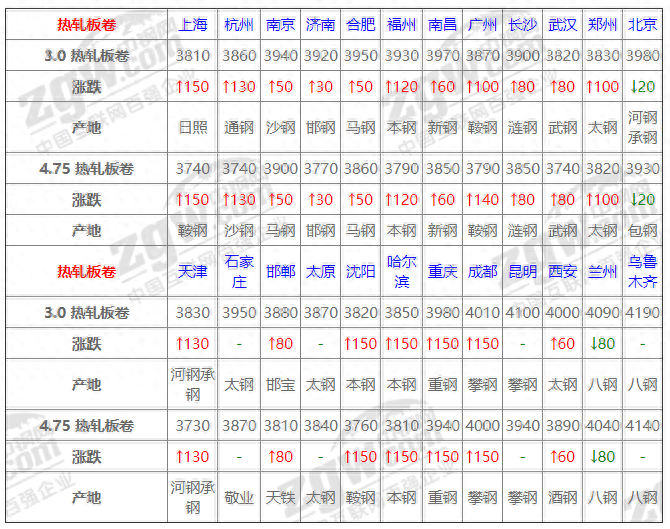

7月18日热轧板卷价格:上涨为主; 今日全国热卷价格以上行为主,幅度在30-150。 目前卷板价格维持冲高震荡,市场情绪有所好转。 商家仍以出货为主,但底部价格较为坚挺,市场成交有所好转,目前成本支撑尚可,下游需求尚未恢复。 考虑到目前相关期货表现尚可,预计市场价格稳中偏强;

7月18日冷轧板卷价格:稳转坚挺; 今日全国冷轧价格稳转坚挺,幅度20-100元。 在期货和原材料带动下,商家小幅上调报价试探成交,但市场资源高位接受能力较差,整体成交跟进略显不足。 考虑到目前成本支撑,短期内市场价格有望企稳;

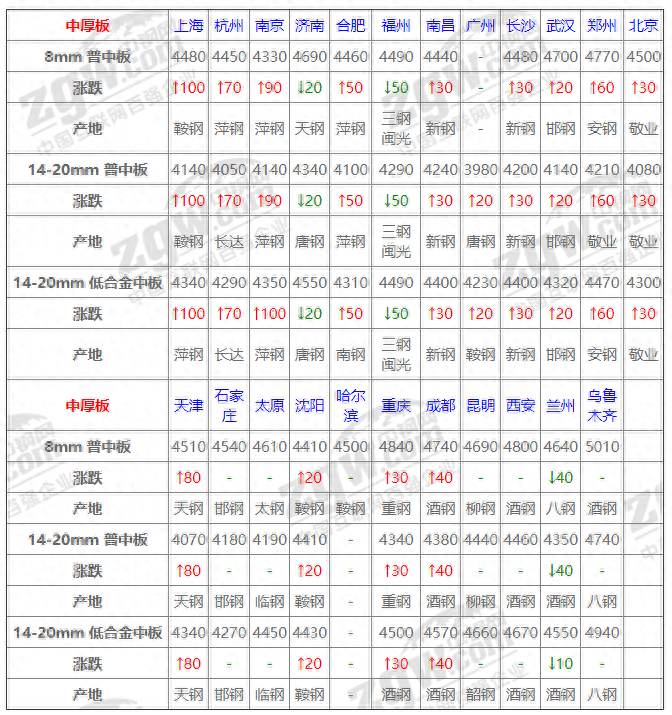

7月18日中厚板价格:涨跌为主; 今日全国中厚板价格以涨跌为主,调整幅度20-100。 上午市场气氛不佳。 盘中受期货提振,低迷情绪有所缓解,需求维持谨慎观望态度,平均成交量与预期短期价格窄幅盘整;

7月18日热带行情:运行强势; 今日全国带钢运行偏强,区间20-150。 期货市场维持红色,高位震荡。 交易者普遍跟随上涨。 但下游需求并未明显改善。 目前,由于近期市场形势出现宽幅调整,多数商家对后市持谨慎看空态度,因此投机需求也有所减少,淡季也难以好转。 预计市场将企稳盘整;

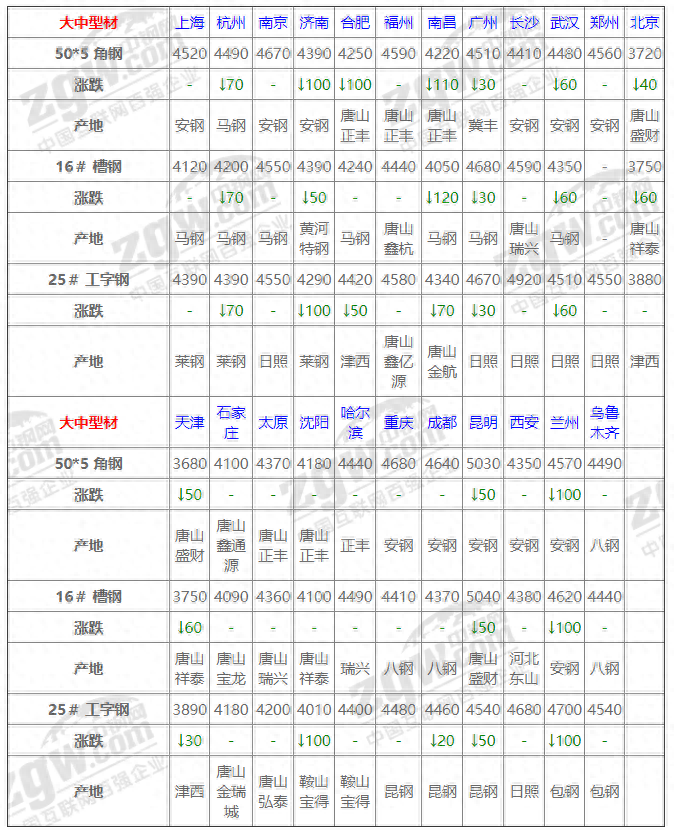

7月18日型材价格:弱势运行; 今日型材价格弱势运行,区间在30-100,需求持续疲软。 今日周初,部分地区弥补周末跌幅,需求持续疲软。 市场成交清淡,下游压力明显。 厂商继续观望;

7月18日管材价格:以下跌为主; 今日全国焊管价格整体下跌10-80%,期货震荡维持红色,市场心态依然恐慌。 虽然管材价格出现恢复性上涨,但目前淡季市场需求疲软。 今天管材价格有涨有跌。 贸易商普遍悲观,整体需求难以恢复。 实际成交惨淡,预计稳中下调。

(中国钢铁网)

2.价格调整:上涨60! 下降了80%! 21家钢厂调价!

中国钢铁网信息研究院数据显示,今日共有21家钢厂调整价格,其中:上调8家,占比38.1%,调价幅度为10-60元/吨,其中:涨幅最高的是大港重庆建材; 下调10家,占比47.6%,调价幅度20-80元/吨; 跌幅最大的是宏泰工字钢。 稳定的企业有3家,占比14.3%。 具体价格调整详情如下:

钢厂调价

今天共有10家钢厂宣布建材价格调整,其中包括:

上调8家企业,占比80%,调价幅度10-60元/吨。

下调价格1家企业,占比10%,调价幅度20元/吨。

其中稳定公司1家,占比10%。

今天共有11家钢厂宣布调整板材、模具和管材价格,其中包括:

调价企业9家,占比81.8%,调价幅度为30-80元/吨。

稳定的企业有2家,占比18.2%。

当今钢厂简析

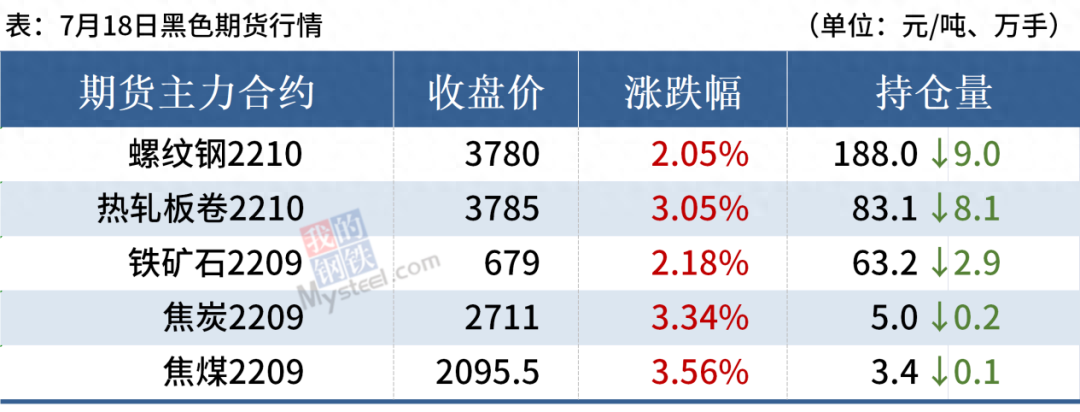

钢材期货市场价格

7月18日,国内钢材市场价格止跌回升,唐山普坯出厂价稳定在3500元/吨。 黑色期货明显走强,市场情绪好转,成交量大幅增加。

18日,黑色期货大幅上涨。 蜗牛主力合约收盘价上涨2.05%至3780,DEA和DIF均指向下方。 RSI三线指标位于32-33,沿着布林带下轨运行。

18日,四家钢厂上调建筑钢材出厂价10-50元/吨。

四大类钢材市场价格

建筑钢材:7月18日,全国31个主要城市20毫米三级抗震螺纹钢均价为4008元/吨,较上一交易日上涨44元/吨。 受周末钢坯大幅上涨以及期货价格上涨带动,早间国内建筑钢材价格普遍上涨。 从成交来看,市场心态好转,交投气氛浓厚,投机需求回升,全天成交明显好转。 短期来看,近期利空消息逐渐释放。 钢坯和蜗牛期货的反弹在一定程度上提振了市场信心,现货价格从超卖状况中反弹。 但短期仍需谨慎,当前市场需求并未明显改善。

热轧板卷:7月18日,全国24个主要城市4.75mm热轧板卷均价为3864元/吨,较上一交易日上涨76元/吨。 需求方面,受国内疫情蔓延以及高温多雨淡季影响,下游制造业整体拿货不积极,需求未见明显改善。 供给方面,当前持续亏损迫使钢厂加大高炉检修和减产力度。 但原材料的下降使得钢材整体减产幅度不及预期,当前供需矛盾尖锐。 市场低迷,拆仓压力大,主动拆仓情绪浓厚。 下游需求依然疲软,观望情绪较为浓厚。

冷轧板卷:7月18日,全国24个主要城市1.0mm冷板卷均价为4398元/吨,较上一交易日上涨17元/吨。 今日火爆的期货板卷市场止跌反弹,部分贸易商提价积极性较高。 目前,市场库存压力较大。 此外,疫情零星散发,部分地区处于封城阶段,对物流造成影响。 市场需求整体较为疲弱,供需矛盾依然存在。 尽管价格小幅上涨,但多数贸易商对后市仍不乐观。

中厚板:7月18日,全国24个主要城市20mm普通板均价为4239元/吨,较上一交易日上涨35元/吨。 华东地区今日涨幅较大,主要是上周明显超卖。 期货反弹后,现货价格也迅速回升。 其余地区小幅上涨,整体成交量有所改善。 目前钢厂产量仍较高。 需求方面,从周末开始,下游采购热情就被调动起来。 但由于终端订单不多,能否继续维持还有待观察。

原材料和燃料市场价格

进口矿:7月18日,唐山进口矿市场持续上涨,交投气氛冷清。 今日进口矿市场全天持续上涨,价格较前一工作日上涨15-35元/吨。 PB粉报价720-725元/吨,混合粉报价650元/吨,60.5%金布巴粉报价。 685元/吨,纽曼块价格830元/吨。 贸易商方面,受市场情绪影响,午后报价热情尚可,多数贸易商出货意愿相对较高; 钢厂方面,仍维持按需补货,进口矿价格周初上涨。 下午大多数交易员都持观望态度。 。 截至发稿,唐山地区获悉成交包括:京唐港AM PB粉708元/吨,曹妃甸AM 61%金布巴粉687元/吨。

焦炭:7月18日,焦炭市场弱势。 焦炭企业整体开工一般,现场库存继续低位运行。 经过三轮焦炭价格下跌,焦炭企业利润损失严重。 预计限产将再次加强,影响焦炭供应进一步收缩。 钢厂方面,钢厂高炉开工一般,整体需求疲软,采购节奏多为控制。 钢厂利润依然承压,市场依然悲观,钢厂减产检修意愿依然强烈。

废钢:7月18日,今日主流钢厂废钢价格保持稳定,个别钢厂小幅上涨。 今日蜗牛期货翻红,废钢走势也有所上涨。 这种现象是超跌后的正常反弹。 一些钢厂正在考虑低价收购废钢供应。 即使价格上涨,幅度也不会很大。 可见,市场人士仍持悲观谨慎态度。 钢厂整体涨价意愿缺乏动力,虽然现阶段市场出现明显亏损,但涨价动力充足,但幅度和速度较以往更为保守。

废钢价格调整信息

我的钢铁网讯:据我的钢铁APP显示,截至7月18日发稿,共有25家钢厂上调废钢收购价格,1家下调。

▎华北地区

7月19日,【天津天钢联合】上调价格50,执行价格为:钢筋球2580,2厚无镀锌花铁球2540,1厚无镀锌边线球2530, 1 用于包装胶带煤球。 厚度及以上非镀锌2530,不含税,单位:元/吨。

7月19日【河北唐山老东海】上涨50:优质A2560、优质B2540、优质C2520、重型A2500、重型B2460、重型C2420、冷板小料2480、08铝小料2420 ,短长材3厚以上2360,不含税,单位:元/吨。

7月18日【河北唐山老东海】上涨50:优质A2510、优质B2490、优质C2470、重磅A2450、重磅B2410、重磅C2370、冷板小料2430、08铝小料2370、短长料3厚2310以上,以此价格为准,政策不变,不含税,单位:元/吨。

7月18日【河北唐山东海特钢】上涨60,调整后:重B2520、重A2560、优质钢2590、优质钢2650、轻薄料、爆炸品、掺假重罚、油类和油脂拒绝,4 车辆厚度低于此标准的,将暂停收集。 注:国六及以上车型正常进出厂。 严禁使用国V或改装车辆前端进厂。

7月18日【河北唐山寿唐宝盛】涨130,执行价:初级破碎料2630,二级破碎料2480,短长度切割1-2mm 2480,3-5mm 2580,6件以上2610,8件2630,镀锌钢丝球2440、铁丝球2340、面包铁2540、生铁散热器2540、发动机机体2470,不含税,单位:元/吨。

7月18日8:00起【河北唐山东华钢铁、春兴特钢】重A调涨20元至2450元,优质加起来120元。

7月18日【河北唐山正丰】增100,废钢2-3厚2530,3-5厚2580,6厚以上2610,8厚以上2630,小钢筋煤球2600新钢丝2440新冷板煤球2440新型铁丝煤球2340新型镀锌小料2540初级破碎料2630二级破碎料2480,一般销售2180,生铁散热器,面包铁2540,发动机本体2470,初级剪切2510,二级剪切2490,不含税,单位:元/吨。

7月18日【河北唐山玉田锦州】最新价格:1-2厚2480、3-5厚2580、6厚2610、8厚2630、钢头2630、钢筋煤球2600、新款冷板小料2540、新款镀锌小料料2540、08铝散片2460、特种破碎料2680、一级破碎料2630、生铁散热器2540,不含税,单位:元/吨。

7月18日【河北秦皇岛百工】增加100:普通废钢A2730,八厚,普通废钢B2650,四厚,特级废钢2690,厚度≥2.0mm,无镀锌料,长度最长

7月18日【河北邯郸新金钢厂】增加30个,现执行:圆钢头、钢坯头、锤头3020、角槽3020、钢板废料3050、法兰3020、小管头3020、大管头3020 ,含税,单位:元/吨。

7月18日【河北沧钢集团】增100:龙门切割2300、1-2厚2360、2-3厚废钢2410、3-5厚废钢2470、6-厚废钢2500、8-厚2540、钢头2590 、小钢棒2500、法兰片2370、钢屑2270、散热器2330,不含税,单位:元/吨。

7月18日18:00起【河北沧州大理铺】废钢收购价执行:4厚重型2510、2-4厚中型2410、1-2厚均匀料2260、煤球级2235、钢筋切割头2680、不含税,单位:元/吨。

7月18日【敬业】废钢执行价:钢筋球2625,花铁球2634,中型1 10厚2634,中型2 6厚2598,重型3型15厚2634,重型4型20厚2647,不含税,单位:元/吨。

▎华东地区

7月19日【江苏连云港亚鑫钢铁】增50:1.钢板、模具钢2500; 2、12毫米厚优质重废钢A2470; 3. 6毫米厚重废钢B2380,4. 4毫米厚中废新料2250-2280,不含税,单位:元/吨。 如果厚度小于3毫米,将被拒绝。 如果车面和车底等级不同,则按掺假处理。 规格:50×50。

7月18日【江苏连云港亚鑫钢铁】涨50:钢板、模具钢,报价2450; 12mm厚优质重废A,价格2420; 6mm厚重废B,价格2330; 4mm厚中废新料,价格2200-2230。 不含税,单位:元/吨。

7月18日【江苏扬州华航】涨100,调整后:新钢板2440、优质权重2410、马蹄2400、棒钢头2410、生铁2300-2350、重废2300-2350、精炼炉料2220-2260 ,钢丝绳1800,粉碎钢刨花2150-2200,粉碎数控刨花2010-2080,粉碎普通刨花1960-2010,不含税。

7月18日,【江苏扬州勤友】上涨50,调整后执行价格为:棒材球团、冲头2500,钢板2500,模具钢2500,重废2430,机械生铁2400 、硅钢片2420、汽车2420。 切割材料2450元,不含税,单位:元/吨。

7月18日【江苏镇江宏泰】上涨100,调整后执行价为:新板2390,重磅及棒材头2360,马蹄2320,棒棒煤2290,冷材2300轧制、热轧、冲压,硅钢片2250,重废料2300,破碎料2010-2250,剪切料2160-2190,钢屑1890-1940,不含税。

7月18日【江苏徐钢集团】增30。调整后:优质钢板2610、钢板12560、精炉料12560、炉料12440、优质重废2560、重废2460、轮毂2290、钢筋压球2460,钢板压球2510,钢筋球团2580,辊剪钢筋球团2500,详情见价格表(破碎原料不收),不含税,单位:元/吨。

7月18日【山东德州金冠(丽辉)】涨50,调整后6mm以上新板价格2570,钢筋切割2620,重废5-6厚2530,中废3-4厚2470 -2510、减振板2490、剪切农铁2320-2410、铁屑2210、木屑块2270、机铁2310、初级破碎料2490、二级破碎料2240,不含税。 单位:元/吨。

7月18日【山东莱钢永丰】废钢采购公告:临港收集三级废钢I(颗粒钢)1920,热熔煤球2005,单位:元/吨,不含税。

7月19日【福建新武行】全部废钢价格上调50元。

▎华中地区

7月18日【河南民源钢铁】增30:厂废2560-2630、硅钢片2420、片状废钢2420、特级料2630、马蹄2530、精废2410、重废2490-2610、普废2230—— 2360,冲孔豆2560-2630,钢筋切头2630,钢筋头2510-2610,钢筋煤球2460,未加工羊毛2080,不含税,单位:元/吨。

▎华南地区

7月18日【广东河源粤东】废钢价格上涨40元:重废2400元,切削料2370元,不含税。

7月18日【广东河源龙川航辉钢业】增40,生铁重废2380-2400,工业冲压废钢2350-2380,风切料(60厘米)2340-2370。 不含税。 请注意,不允许携带密封件等危险物品。

7月18日【广东金盛蓝】增40:钢筋球团2600,纯钢筋头2540,钢筋压块停止,清废钢2520,锻材2520,优质重废钢2520,重废钢2480-2500,重废钢2 2450中废料2350-2400切削材料2140-2190冲头2460,所有汽车材料2360-2410生铁2420-2470,钢刨花,CNC 2090-2140,普通刨花和切屑不收,不含税。

7月18日【广东江门宝丰】上涨70:特级重量、钢筋头2420、纯钢筋压制2420、随机钢筋2380-2410、重废2390、硬钢、生铁2390、冷轧冲头2370 -2400,冷轧冲孔板2350-2370,中剪2330,一级废钢2100,普通刨花2000-2060,原材料1900-2000,不含税。

7月18日(第二次)【广东河源中鑫华丰钢铁】加仓80,合计加仓120:重废2480,空剪材2450,中剪2280。自提,不含税,注意密封件等危险品不允许携带

7月18日(第二次)【广东河源德润钢铁】再增60张,累计增100张:废钢、新板2530张; 纯钢棒头、直钢棒2510; 模具钢、头圆钢、轨道钢、火车车轮2510; 硅钢片停止; 冷轧、热轧、废冲头2460; 优质重量 2490; 锻造材料,马蹄铁2510; 重废物2460; 机械生铁、高碳钢、铸钢件,生熟混合包装2460; 厚剪2410,不含税。

7月19日【广西梧州义马】增加50:钢筋冲孔2460根; 新钢板2460; 模具钢2460; 热轧冲头、冷轧冲头、汽车冲孔板2440; 机加工生铁 2410; 汽车车轮2410; 汽车前后桥2,400; 热轧和冷轧冲孔板2,400; 硅钢片2,440; 空切材料 2,360; 剪切材料 2,330; 旧法兰 2,410; 不含税,单位:元/吨。

7月18日【广西贺州特钢】涨50:精重2440、生铁硬钢2440、模具废料2440、钢筋头2440、重废厚剪2440、中厚料2410、中剪2360、薄剪停止收集,冲切屑2380,边角料2380,刨花2030-2110,所有材料不收集,不含税,单位:元/吨。

▎西南地区

7月18日【云南牧光废钢公司】废钢采购价格调整:钢筋头2480,洁净重废钢料尺寸指定30cmx30cm,一级铁2400。机械铁尺寸60cmx60cm,一级铁2400不含税,单位:元/吨。 低于上述水平每下降半级,扣30元。 轻薄材料和镀锌材料受到严格控制。

▎东北地区

7月18日【辽宁鞍山源鑫】减150,0.5-1厚1750-1850,1-2厚1890-1940,1-3厚1940-1990,(纯)2-4厚加工500内1980-2020 ,(纯)3-5厚加工500以内2040-2080,(纯)4-6厚加工600以内2130-2160,(纯)6-8厚加工600以内2170-2200,生铁钢件600以内2050 - 2100年,钢丝绳加工700以内,1820-1870,纯铁丝小煤球,400以内,1920-1970。 (中国钢铁网、我的钢铁网)

3、预测:钢材价格将继续...

导航

近期的上涨给一度低迷的市场信心增添了一剂“兴奋剂”,悲观情绪有所缓解。 未来钢材价格将走向何方? 让我们拭目以待……

1、钢材市场影响因素如下:

周末河北唐山普碳方坯价格出现反弹,部分市场建筑钢材价格低位回升。

周末,河北唐山钢坯出厂价上涨100元至3500元/吨,较上周日下跌320元。 周五晚间,受黑色系反弹影响,国内部分建筑钢材价格在操作市场低位回升。 其中,华北、华东地区部分钢厂补跌,各地超低价资源主动拉涨。

分析师观点:上周唐山钢坯库存高位,总量创历史新高。 上周钢价继续下跌,市场恐慌情绪发酵。 周五,部分商家大幅降价后锁定价格。 随着宏观经济数据的公布,市场情绪得到提振。 周末河北唐山普碳方坯价格上涨,部分市场建筑钢材价格低位反弹。 但市场成交并未增加,表明当前信心依然疲弱,终端需求低迷仍是钢价持续回升的最大制约因素。 这波涨势能否持续,取决于市场交易量的变化。

预计欧洲央行下周加息25个基点

机构分析:预计欧洲央行将在7月将全部三大关键政策利率上调25个基点,在9月上调50个基点,随后在10月、12月、2月和3月加息25个基点。 基点。 最后,预计欧洲央行将在 2023 年 6 月仅将存款利率提高 25 个基点。

分析人士观点:年初爆发的俄乌冲突对全球经济尤其是欧元区经济造成巨大影响。 由于严重依赖俄罗斯油气供应,能源价格飙升不仅扰乱了欧洲供应链,还进一步加剧了通胀威胁。 欧元区经济目前面临滞胀危险。 一旦加息,欧元区的通胀压力可能会得到缓解,但同时消费、投资、进出口也会受到一定程度的抑制,从而抑制全球经济的复苏进程,也会对全球经济的复苏进程产生影响。对我国经济复苏造成一定负面影响。

第四轮焦炭整治即将开始

19日0时起,河北、山东、山西等地区部分钢厂计划联合上调焦炭采购价格200元/吨。 本次为第四轮增减,累计上涨800元/吨。

分析师观点:近期,焦炭企业与钢铁企业围绕焦炭价格展开了激烈的竞争。 但随着成品钢价大幅下跌,焦炭价格也被迫进入下行通道。 此次焦炭价格上涨,一方面源于钢铁企业减产导致需求萎缩。 另一方面,也反映出钢铁企业及市场对于需求预期的悲观态度。 短期来看,钢价仍受成本中心下移的拖累。

央行实现净投资90亿元

央行:今日进行120亿元7天期逆回购操作,中标利率2.10%,与前期相同。 由于今日30亿元逆回购到期,当日实现净投资90亿元。

多家钢企探讨未来生存之道:行业形势极其严峻

回顾2022年上半年,受疫情影响,宏观经济数据大幅回落,下游需求低迷,带动钢价下跌。 同时,俄乌冲突等因素导致上游原材料价格高位,钢厂和市场利润微薄,部分钢企停产检修。

2022年6月全国钢材产量

2022年6月,重点统计钢铁企业累计生产粗钢7102.28万吨,同比下降3.86%,日产量236.74万吨,较上期下降4.68%。

2、现货市场

螺纹钢弱势运行

上周末钢坯大幅上涨,期货市场早盘大幅波动,钢厂出厂价小幅上涨,市场信心提振,现货市场价格回落至低位。 商家悲观情绪略有好转。 价格持续下跌后的反弹符合市场预期。 但目前下游需求难以支撑价格彻底逆转。 预计近期价格在上涨后将进入小幅震荡。

热卷运行疲软

本期成交量高位波动,商家悲观谨慎,市场需求持续疲软,询盘极少。 下游客户采购谨慎,整体成交不佳。 预计短期热卷价格将稳中偏强。

强大的中板整理

今日午盘行情稳中补跌,相关期货走势震荡走强,但需求释放不足。 市场整体交投气氛不活跃,商家处于僵持状态,观望为主。 午后低位成交部分好转,预计短期价格将稳固盘整。

带钢稳定性维护及整理

目前,带钢在价格下跌后成交表现依然一般。 中宽钢现货价格反复上下调整。 厂家态度谨慎,涨价热情一般。 他们显然愿意高价出货,主要是补涨价。 整体交投清淡。 Considering that wait-and-see sentiment dominates, it is expected to maintain stability.

Stable operation of profiles

The billet market is temporarily stable, demand remains weak, transactions are light, and the market mentality continues to be pessimistic. It is expected that profile prices will run stably in the short term.

Pipes are firmly organized

Today's futures trend is strong and volatile, and the cost-end price support is insufficient. After the rebound over the weekend, the spot market of pipes and tubes has mostly maintained stability and declined. However, the market trading has been mediocre. The pessimism has not dissipated after the oversold rebound. Merchants are more cautious and the actual demand is still weak. Supporting the sharp rebound trend, in the short term, the pipe market is expected to be strong and consolidate.

3. Raw material market

Billet shock operation

At present, the contradiction between supply and demand in the market still exists. The mainstream of local finished steel products is stable. Steel mills are willing to explore the rise. However, spot transactions are not followed up enough. High-end resources have fallen. The overall trading performance is average and there is no significant increase in volume. Considering that the current blank factory is still in a loss-making state, and the black screws are holding on to the red trend today, it supports the mentality of manufacturers to support prices and hope for an increase. It is expected that steel billet prices will fluctuate in the short term.

Iron ore runs weakly

In some areas, the decline of steel companies has expanded. The state of large-scale ore processing has been suspended for maintenance for the time being. Market resources have decreased. However, buyer procurement demand is also not high. Steel companies have significantly reduced production. Most of them maintain on-demand replenishment, and trade has also increased. Mainly wait and see, dare not make rash operations, the market is generally deserted, and the short-term ore price is expected to be stable but weak.

Coke weakly stable operation

Coke companies have suffered large losses, low production enthusiasm, and may continue to increase production restrictions. Moreover, downstream demand for coke is weak. Some coke companies have slowed shipments and accumulated inventory slightly. However, the overall inventory is running at a low level, and downstream steel plants are generally operating. , terminal demand has not improved significantly, steel mills have suffered serious losses, and maintenance has continued to increase. The overall demand for coke is weak, mainly rigid demand, and the coke market is expected to operate weakly and stably in the short term.

Scrap steel mainly consolidates

In this issue, the market sentiment is gradually stabilizing. After the previous rounds of sharp declines in scrap steel, most merchants are no longer willing to ship. Very few steel mills arrived over the weekend. Some steel mills slightly raised the purchase price of scrap steel due to production needs, but the finished steel products Market demand is still sluggish, and the rebound this time will not be too large. Please grasp the rhythm of shipments. 预计短期内废钢将保持稳定运行。

Pig iron's weakness is hard to change

The domestic pig iron market fell sharply and transactions were bleak. The third round of coke reduction has been fully implemented, and some steel mills plan to start the fourth round of reduction. In addition, the prices of scrap steel and steel billet have been falling recently. The mentality of merchants has been affected, and downstream procurement is scarce. The quotations of various subway plants have been significantly reduced. It is reported that some Iron plants have stopped production or are planning to stop production, and businesses are pessimistic. It is expected that the short-term pig iron market will be weak and difficult to change.

4. Comprehensive Suggestions

At the opening today, the snail futures market continued to fluctuate strongly, and traders' mentality changed. They tentatively pushed up quotations and saw high volume of transactions at low prices. The price of snails continued to rise on Monday, with prices at the bottom of the market rising. Terminals and intermediaries increased their purchases in the afternoon, and the mainstream transaction prices in the market rose slightly again. It is expected that steel prices will fluctuate and strengthen tomorrow. (China Steel Network)

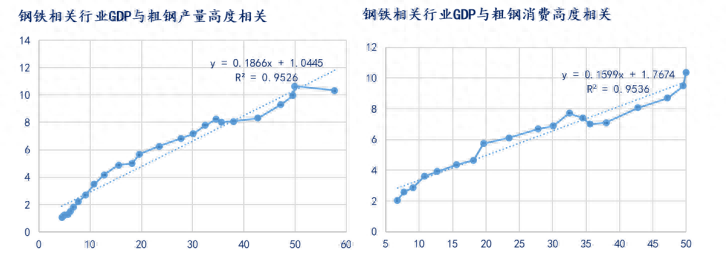

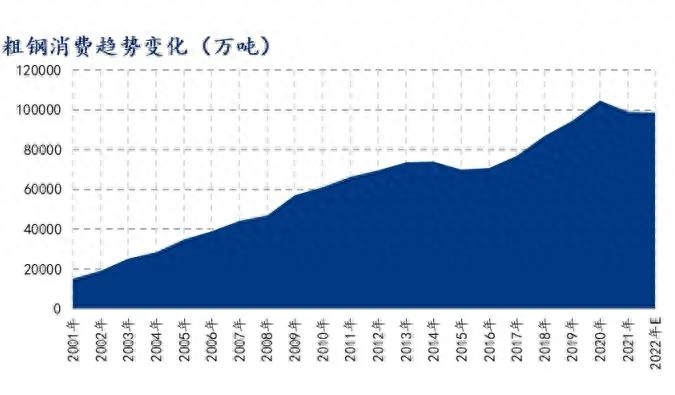

4. Logical deduction and forecast analysis of crude steel supply and demand balance in 2022

1. Prediction model logic description and result display

1. Logic description of demand model

The GDP of the four major industries is highly correlated with crude steel production and sales. Steel is known as the "Mother of Industry". With the development of my country's economy, the total amount of steel is also expanding rapidly, and the demand for crude steel continues to rise. By observing the changes in GDP and crude steel demand in historical years, we can find that the two are related Very strong. The two not only have a certain close connection, but also influence each other and have certain growth and operation rules. Therefore, we can use model methods to deduce the changes in GDP and crude steel demand in 2022 by studying the historical data of the two.

2. Demand estimation results

The four major industries are used to calculate GDP (variable X) and crude steel demand (variable Y) to establish a VAR model, which shows that the two prediction models are:

LNX=0.765958067885*LNX(-1)+0.250213291544*LNY(-1)+ 0.260232480346;

LNY=0.0816088567618*LNX(-1)+0.768751394858*LNY(-1)+ 1.60347532434.

Since the four major industries are not only related to the steel industry, but also contain many influencing factors, the values based on the model backtest and the actual values will have a slight error every year. On the one hand, taking into account the current background of declining crude steel production, and on the other hand, considering that the central government's determination to live in housing rather than speculate on housing, on the other hand, this year's crude steel demand data theoretically needs to be revised downward appropriately. We believe that the downward revision can be based on past deviations, and crude steel consumption this year will decrease by approximately 2.9% compared with the same period last year.

2. Three scenarios in which demand pushes back supply

1. Scenario 1: A year-on-year decrease of less than 2%

Under the current economic situation, the domestic value-added space for the 5.5% GDP target is likely to be concentrated in emerging industries. In addition, the foreign environment is not stable, and the "policy ceiling" of raw material prices represented by iron ore has arrived. In other words, in order to curb the rapid rise in raw material prices, the government may reduce crude steel production more than expected.

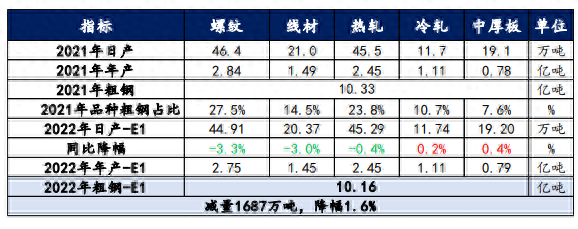

From the perspective of the main steel-consuming industries, the real estate industry continues to be weak and infrastructure support is limited, which has been pushed back to the supply side, resulting in a year-on-year decline in construction steel production. In terms of plate materials, the supply and demand performance is slightly better than that of building materials. The domestic demand in the manufacturing industry has been digested and the decline in external demand and exports has been limited. The demand from industries such as automobiles, home appliances, machinery, shipbuilding, and steel structures has been guaranteed. Therefore, the overall reduction in plate supply is not high. This resulted in a crude steel supply reduction of 16.87 million tons in 2022, a decrease of 1.6%.

2. Scenario 2: Year-on-year decrease of 2%~3%

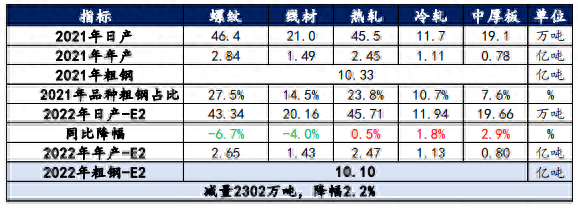

This scenario will further expand the differentiation between building materials and panels, and the end demand for building materials will be expected to be weaker year-on-year, while the performance of panels will still be better than that of building materials.

From the first half of 2022, the newly started area, sales area and funding situation of real estate have not improved. Infrastructure development cannot support the demand for building materials due to the extension of the funding period, which in turn makes the digestion of building materials ineffective, and steel companies have successively begun maintenance/production reduction; For sheet metal, manufacturing performed slightly better.

As of May 2022, China's Manufacturing Supply Index (MMSI) was 157.42 points, a year-on-year decrease of 8.72% and a month-on-month increase of 6.60%. Among them, automobile production and sales showed obvious recovery growth. The automobile supply index was 117.97, a month-on-month increase of 27.81%; the home appliance supply index was 141.11, a month-on-month increase of 1.1%; the construction machinery supply index was 164.06; a month-on-month increase of 31.58%; the shipbuilding industry supply index was 119.63, A month-on-month increase of 20.07%.

Therefore, the reduction of the five major steel varieties in building materials has been expanded, and the overall plate products have slightly increased, which will reduce the supply of crude steel in 2022 by 23.02 million tons, a decrease of 2.2%.

3. Scenario 3: A year-on-year decrease of more than 3%

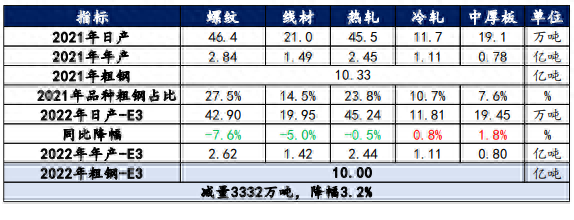

On the basis of Scenario 2, demand estimates for building materials and hot-rolled products are even more pessimistic. Judging from major industry data, April's automobile production and sales figures have also become the lowest monthly figures for the same period in the past decade, and are also the lowest in the past decade. Except for the unexpected second low in February 2020, production and sales in May still fell by 5.7% and 12.6% year-on-year, respectively. The overall improvement was limited. For the home appliance industry, the impact of the epidemic on the supply chain of the home appliance industry has weakened, and corporate production has returned to normal levels; for the machinery and shipbuilding industry, strong overseas demand and the successive start of infrastructure projects have also supported the increase in demand for excavators, and the national shipbuilding industry has basically The resumption of work and production has been achieved, and the production and operation of the shipbuilding industry have gradually stabilized and rebounded.

Therefore, the reductions for the five major steel varieties, building materials and hot-rolled products, were increased, while cold-rolled and medium-thick plates increased slightly, resulting in a reduction of crude steel supply of 33.32 million tons in 2022, a decrease of 3.2%.

3. Crude steel supply and demand forecast balance sheet in 2022

Based on the previous analysis of demand forecast results, crude steel consumption in 2022 will decrease by approximately 2.9% year-on-year. On this basis, looking back at the three scenarios of supply reduction, the year-on-year reduction in crude steel supply was below 2%, 2% to 3%, and above 3% respectively.

Although crude steel fell by 8.7% year-on-year from January to May 2022, pig iron and crude steel are still hitting new highs. Since June, the contradiction between supply and demand has become more and more prominent. The proportion of steel companies losing money has remained high. The reduction of crude steel has been implemented one after another. The release of demand has not yet been reflected. The pressure on inventory has become more obvious. The off-season atmosphere of the market has become stronger. Therefore, Steel companies have begun to reduce production intensively. However, judging from the GDP growth rate and the order performance started in July, crude steel production and sales are likely to show a decline in the first half and then a high performance, and the overall market sentiment will gradually improve in the second half of the year. Based on this, the author will analyze the supply and demand balance under the scenario that the year-on-year decrease in crude steel production and sales is 2% to 3%.

Note: The five major varieties are rebar, wire rod, hot-rolled coils, cold-rolled coils, and medium and thick plates

4. Sub-item description

1. Supply side

From January 2022 to the present, crude steel production has continued to be low year-on-year. 主要有三个原因。 One is the high price of raw materials, the greater pressure on steel mills' production costs, and the proportion of steel companies losing money has gradually increased; the other is the impact of the spread of the epidemic across the country. , Northeast China and East China even had cities closed, which in turn led to logistics and transportation being blocked. The inventory pressure of steel companies gradually became prominent, and the downstream demand performance was not sustainable, which in turn led to low enthusiasm for production by steel companies. Thirdly, the National Development and Reform Commission stated that it would continue to carry out nationwide crude oil production. The steel production reduction work will ensure that the national crude steel production will decrease year-on-year in 2022.

In the long term, the general environment for domestic crude steel reduction remains unchanged, and the policy goal of “dual control of energy consumption” will still be effectively implemented and implemented. Although most steel companies have reduced production on a large scale since January, this does not mean that steel companies will actively resume production in the future. Each province will effectively control production and reduce production based on the production capacity base. Recently, two major provinces have begun to implement this year's reduction plan. First, the four departments of Shandong Province jointly issued a crude steel production control plan for 2022, requiring that the overall crude steel production should not exceed last year. The specific reduction and production reduction plans have not yet been clarified. The second is that the Tangshan Municipal People's Government website issued a notice on the issuance of the "Tangshan Steel Industry "1+3" Action Plan", requiring the complete shutdown of blast furnaces below 1,000 cubic meters and converters below 100 tons before the end of the year.

To sum up, it is a definite fact that crude steel has been reduced year-on-year. However, in the coming time, based on the logic of production based on sales, dynamic production will be carried out within the upper and lower limits, and different variety structures will be deployed.

2. Import and export

In terms of the forecast of import and export for the whole year, there are no long-term absolute positive factors in terms of the overall macro environment and rigid demand performance at home and abroad. In addition, international frictions are frequent, so we have formulated a strategic approach of domestic and international dual circulation to reduce the impact of international market fluctuations on our country.

另外,今年以来,俄罗斯、菲律宾、印尼等国因斋月、军事、复活节等各类因素影响,1月至今钢坯及钢材的进出口表现均低于往年同期水平,因国内供需存在同比下降的预期,因此内需和外需的资源消化均存在同比下降的预期。

3、需求方面

粗钢直接消费主要体现在一次材的供应和出口两大方面,其中一次材主要包括螺纹钢、线材、盘螺、圆钢、无缝管、热轧板卷、中厚板、带钢、工角槽、型钢等。但究其最终用途上,还是应用在房地产、家电、汽车、造船等终端行业。分行业来看,建筑用钢通常可分为钢结构用钢和钢筋混凝土结构用钢筋,其中至少百分八十使用的是钢筋混凝土结构用钢筋,涉及品种主要为螺纹钢、线材和盘螺。而钢结构用钢主要有普通碳素结构钢和低合金结构钢,涉及品种主要有角钢、槽钢、工字钢等,使用量与钢材总量相比占比偏少。那么除了建筑用钢之外,其余中厚板、热轧、冷轧、涂镀等等品种则主要用于机械、家电、汽车、造船、能源化工等行业。

但从当前行业发展预期来看,房地产销售疲软,资金回笼情况偏弱。基建托底必要性稍降,资金下放的流畅度不佳,因此对建筑用钢需求支撑力度有限,同比大概率持偏弱状态。另外,虽受疫情影响,制造业投资增速小幅下滑,但整体仍维持预期内的行业景气度,叠加在国家留抵税退政策的鼓励下,制造业用钢需求或有稍好表现。

4、库存方面

基于以上对供应、需求和进出口预估及说明,供应全年同比降幅明显低于需求表现,叠加外需长期表现预期恢复有限,因此未能及时消化的资源将以库存方式累积在市场及钢厂仓库,甚至是表外。因此,对于下半年库存压力角度来说,若供需同样降幅在2%~3%之间的话,二者之间的平衡将决定整个市场的承压能力,一旦失衡,将再次导致六月出现的产业链复反馈现象,致使钢价回调超预期,影响整个市场的心态和交易氛围。

5、结论分析:以销定产,动态平衡

综上所述,在历经2016年至2019年的供给侧改革之后,国内针对落后产能已经进行了一次洗盘,但是伴随着国内人口红利逐步消散,国际和国内对绿色环保的大力倡议,钢铁行业优化升级迫在眉睫,粗钢压减的政策实施不可避免。因此在2020年之后,国家提出“能耗双控”的口号,并开始强制性执行压减政策,在碳排放的重点行业,如煤炭、电力、天然气、钢铁等重点行业开始执行相措施。其中在钢铁行业中粗钢压减是重中之重,并在近两年里,在京津冀、长三角等重点省市表现尤为突出。

2022年开端至今,钢铁行业影3-4月东北和华东疫情再度爆发且扩散,需求表现持续性较弱。随后转变至成本支撑逻辑,致使钢价下跌有底。但是二季度中下旬伴随着疫情逐步好转,消费起速较慢的结构下,逐步转变成消费预期落空,钢价开始大幅回调。

在这一系列的供需矛盾逐步突出的发展下,粗钢日产和生铁再创新高也引起市场广泛关注,这与国家发展改革委、工业和信息化部、生态环境部、国家统计局四部门的统筹管理下将在2022年继续开展全国粗钢产量压减工作是相互冲突的,因此倡导钢企减产的呼声愈发强烈,促进行业动态平衡,以达到保供稳价的目标。

基于此,在2022年粗钢供需动态平衡的考量下,Mysteel预估2022年粗钢产销同比降幅或在2%~3%幅度之间,分别达到2.2%和2.9%的同比降幅。

另外,对于粗钢压减节奏来说,“以销定产”是一个核心规律,粗钢压减是依据今年需求变化规律而适当调整,结合上述从需求释放和原料基本面角度对粗钢压减的周期进行推演可见,与往年情形类似,在二季度末期至三季度周期内执行动态的压减政策是一个理想化的时间段。这不仅为需求表现不佳,进而为钢企主动减产创造一个良好的前提条件,并在供需之间产生一个良性循环。由于原料的需求体现在成品材的生产水平上,因此钢材出现减量,原料需求受挫,基本面呈弱势表现,或使得价格在周期内呈现弱势运行,进而辅助钢企选择性备库,为以后恢复生产做准备。(我的钢铁网)

转载请注明出处:https://www.twgcw.com/gczx/1051.html