28日钢材价格行情!需求亢奋!钢价要涨!春节后钢铁行业走势如何

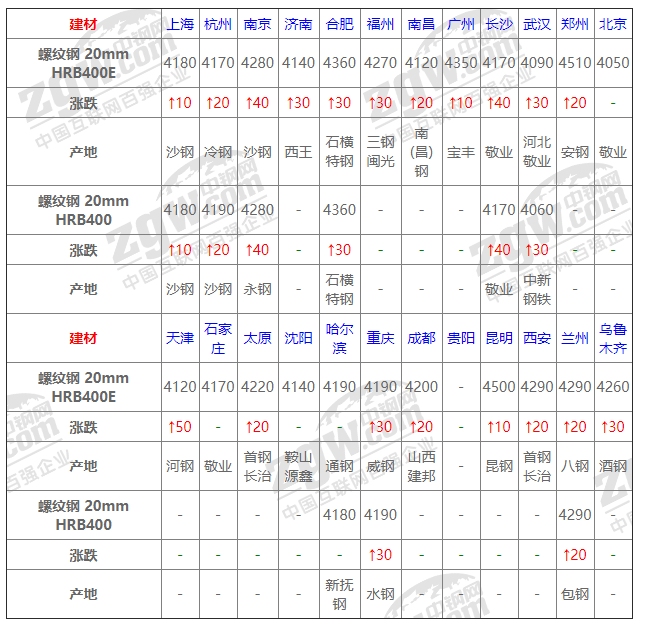

1月28日建材价格:偏强; 今日建材价格偏强,区间10-50。 开工首日,下游需求启动缓慢,市场成交仍处于半停滞状态。 随着需求端逐步恢复,商家推价意识较强,预计明日建材价格或将小幅上涨;

1月28日热轧板卷价格:整体上涨; 今日全国热轧板卷整体价格上涨10-80%。 商家陆续开始操作,市场报价低迷。 安钢整体资源不多,规格不全。 节日气氛依然浓厚,交易也已完成。 弱势,考虑成本较高,预计短期市场价格偏强;

1月28日冷轧板卷价格:稳中有涨; 今日全国冷轧板卷价格稳中上涨,幅度20-50。 今日市场以小幅上涨为主。 在成本的支撑下,商家提价的意愿更加强烈。 不过,目前市场尚未完全开市,大部分商家已在大年初八后陆续复工。 目前市场交投气氛低迷。 考虑到节后价格惯性上涨,预计明天冷轧市场价格将强势运行;

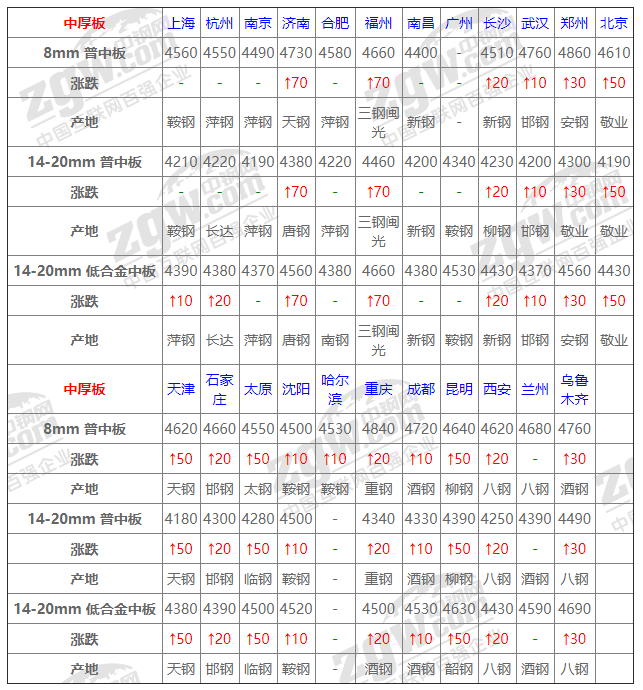

1月28日中厚板价格:上涨势头强劲; 今日全国中板价格强势上涨,涨幅在10-70之间。 市场逐渐开始开放,现货价格随着成本面的上涨而上调。 下游尚未全面复工,市场交投平淡。 整体交易量持平。 情况清淡,但春节期间市场有一定库存,预计短期偏强,观望为主;

1月28日热带价格:以上涨为主; 今日全国带钢价格以上涨为主,幅度在30-60。 周六日行情走势无预报,商家陆续入场等待,操作有限。 节前,北方至南方资源逐渐积累,但随着热卷价格走强,南方热轧带钢需求或将持续增加,预计旺盛。

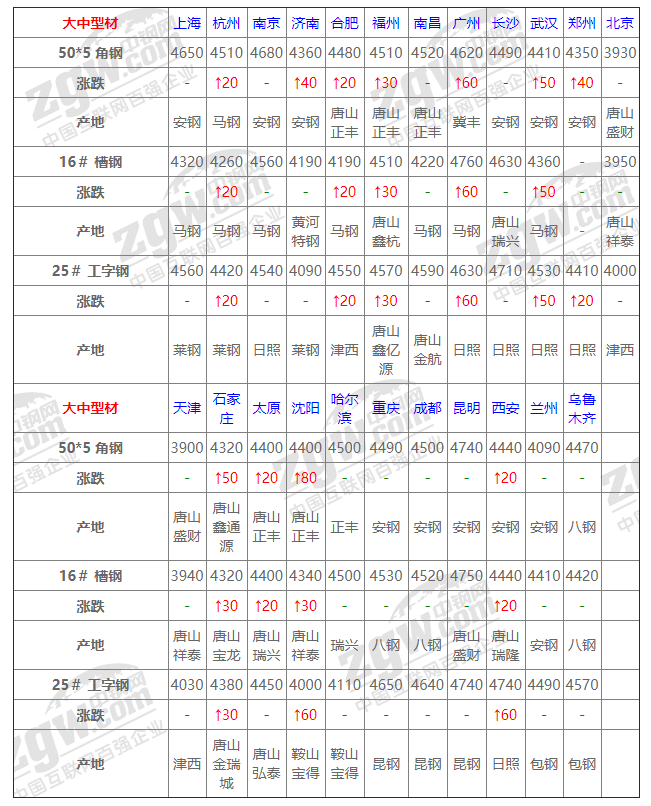

1月28日概况价格:个别涨价; 如今,全国型材价格已上涨20-80%。 市场部分商家已复工,但报价不多,尚未开始交易。 但在成本的强力支撑下,市场价格有所上涨。 主要是钢材市场整体对节后行情的预期尚可,涨价意愿明显。 预计短期市场价格将以强势为主;

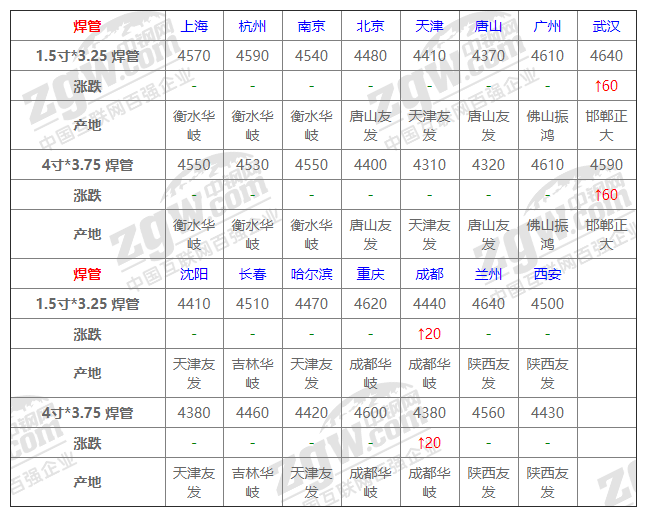

1月28日管材价格:稳中有涨; 今日全国焊管价格稳中上涨,幅度20-60。 如今商家逐渐回归市场,原料价格坚挺。 一些管厂也纷纷效仿,增加了60家左右。市场尚未全部恢复,但下游工地尚未开工,需求有限。 预计明日管材市场稳中有强。

(中国钢铁网)

2、调价:钢厂涨80%! 11家钢厂均在增产

今日开工情况良好,商家开始回归市场,原材料价格表现强劲,部分厂家上涨80%左右。 市场尚未完全恢复,下游工地尚未开工。 需求有限。 只有少数交易商开市。 因人气上涨,补货量较少,整体成交清淡。 未受期货市场影响,商家情绪尚可,在成本支撑下,预计明日钢厂价格稳中走强。

钢厂马钢建材上调50元/吨,重钢建材上调50元/吨,新富钢建材上调50元/吨,南钢螺纹钢上调50元/吨。 40元/吨,大钢重庆建材上调50元/吨,玉溪贤福建材上调。 上调50元/吨 云南德盛建材上调50元/吨 玉溪玉坤建材上调50元/吨 扬钢建材上调40-80元/吨 濮阳中厚板价格稳定 天钢板材上调20元/吨 中敬业 厚板价格上调20元/吨

钢厂调价比例

中国钢网信息研究院数据显示,今日共有12家钢厂调整了价格,其中包括:

上调企业11家,占比91.7%,调价幅度20-80元/吨;

1家公司保持不变,占比8.3%。

废钢价格调整信息

我的钢铁网讯:截至1月28日发稿,共有16家钢厂上调废钢采购价格。

华北地区

1月29日,【天津荣钢】废钢部分上涨50:钢坯头3140、法兰片3130、优质一级3140、优质二级3130、优质三级3100、钢板一级3130、钢板二级3120级、三级钢板3090、棒材球团3140、滚剪棒材球团3100,不含税。

1月29日【内蒙古宝新特钢】废钢采购价格上调70,现执行:精炉料2980,14日纯钢棒材球团2960,特一级2980,特二级2950,特二级2900 A级重废,B级2900。重废2850、10厚新钢板废钢2980、6厚钢板废钢2930、50规格内14寸钢筋头2930、6-12钢丝头2900,塔机混合安装2870,不含税。

1月29日【河北秦皇岛红星】精钢:3220、优质钢:3200、重废A:3140、重废B:3080、重废C:3020、硅钢片3040(三角、瓜子料)硅钢破碎料3040(球团、无面、无生铁)、冷板废料A3080、优质钢棒头3220、主流钢棒头3200、碎钢棒头3160、厚马蹄3160 6个、厚马蹄3130 4个、2个厚马蹄铁3100,新床单3220,不含税。

1月29日【河北秦皇岛百工】部分增加30个,调整后:普通废钢A3160、普通废钢B3100、特种破碎料3080、一级冲件3090、一级冲件3230、二级冲件3170 、切头一级3200,钢头3230,铁销2780,不含税。

1月28日【河北秦皇岛安丰】所有物资种类涨价20元。 调整后:圆钢头、四厚冲孔豆3250、模具钢3230、大槽钢3130、塔梁3030、马碲铁3130、防锈小定转子2950元、防锈大定子3100、冷板小料3070,三角硅钢片3070铁豆3190,钢头品质3250,不含税。

1月28日【河北秦皇岛隆安】废钢采购物资全部上调70,执行价格为:钢轨、圆钢头、钢坯头、模具钢、火车轮、厚角、法兰3200、重型废钢3140-3180、塔机铁3000、马蹄铁3100-3150、20厚工字钢3170、15纯工字钢厚3120-3160、10工字钢厚3050、短槽钢小材3120-3140、丝杠3150-3160。

1月28日【河北邯郸武安新汇】涨50,钢头3100,普废3010。

1月28日【河北邯郸武安新金】增50,执行:钢板3100,优质精矿3145,含税。

1月28日【河北邯郸濮阳】8块以上废钢混合3030,煤球3050,钢筋切割3150。

1月28日【河北唐山寿唐宝盛】废钢涨150,执行价:初级破碎料3080,二级破碎料2950,短边切割1-2mm 2930,3-5mm 3030,6件以上3060, 8块3080、镀锌钢丝球2910、铁丝球2840、新08铝球3030、碎生铁2960、生铁散热器3010、面包铁3010、发动机本体2970,不含税。

1月28日【河北唐山燕钢】废钢收购价上调20-40,执行:优质3250、重型A3210、重型B3110、A3170、B3070、优质铸铁3090、普通铸铁2890、大剪3190、一炉3110,二炉3090,三炉2990,四炉1610; 一级剪切材质为3040,二级剪切材质为2920,三级剪切材质为1540,不含税。

1月28日【河北唐山纵横】废钢收购价上涨20:模具钢3140法兰片3140、大转子弓板3070、优质一级3160、重型A3070、优质铸铁2880、钢板滚剪材3140 ,钢板一级3160,钢筋球团3140,钢筋压块3060,不含税。

1月28日,【河北东海特钢】增加30个,重B3020、重A3060、优质钢3100、精钢3140、轻薄料、爆炸品、掺假重罚、含油含脂钢拒绝,小于4厚则停止采集。

1月28日【石家庄鹤岗石钢】废钢调整,具体参见价格表:炉精料:重型≥20mm3079重型≥15mm 3079重型≥10mm 3079重型≥6mm 3079、中型≥3mm 3052、小型≥1mm 2980、轻薄材料≤1mm 2748,不含税。

1月28日【内蒙古包头亚鑫一期】废钢采购价格上调70,现执行:精炼炉料3030,棒钢球团化停止,一级重废12mm以上2980,二级重废10mm以上2950,机器零件2900,3级重废料6-8mm2900,不含税。 如果料种太大,每吨会扣除30-50的加工费。

1月28日【内蒙古包头亚鑫二期】涨价70,现执行:6-8厚角槽2900,塔机混装40-60厘米2900,4-5中废2850,桥梁模板2900 ,不含税。

1月28日【山西兴化】废钢价格上调30,执行价格:剪切料2990、专用破碎料3220、中型1 3160、中型2 3210、重型3 3240、重型4 3270、钢轨、火车轮3280,精炉料6-8mm 3180,毛料一级3-5mm 2680,含税。

1月28日【山西长治金业】废钢采购价格上调50,调整后:优质A3100、优质B3060、重废A3080、重废B3060、中废3030、普废2860、混合2630、一级剪2580把,直钢筋3030把,彩钢瓦1880把,特种破碎料2960把,不含税。

华东地区

1月29日,【扬州华航废钢】正式收货:新钢板2870、重磅2840、马蹄铁2830、棒钢头2800、生铁2810-2860、重废钢2730-2780、炉精料2650-2690 ,粉碎钢刨花2540-2620,粉碎数控刨花2490-2540,粉碎普通刨花2440-2490,不含税。

华南地区

1月29日【广西柳钢】废钢上涨50:现配重1型3390,配重2型3360,冲孔1型3260,冲孔2型3390,冲孔3型3390 ,冲孔4型为3330,压块1型3350,压块2型B3060,压块3型2640,剪切1型3350,剪切2型3310,剪切3型3250,剪切4型3090,含税。

1月28日【广东揭阳国信】废钢收购执行价:7厘米钢筋颗粒2950元/吨(10厘米以上),模具2950元/吨(80厘米以内),注塑机厚拖板料2930元/吨(80厘米以内)生铁2920元/吨,纯钢棒材包2870元/吨,切割材料厚度6厘米以上2890(50厘米以内),切割材料厚度3厘米以上2770 (50厘米以内),不含税。

华中地区

1月29日【湖北嘉鱼金盛蓝】废钢最新价格:切粒钢条3040,纯钢条头2990,全彩废钢(新钢片)2990,火车配件、火车车轮、轨道钢( 1米以内)、锻件、马蹄铁、红冲材2940、优质废钢2940、新型硅钢片、新型硅钢片2940、酸洗板2940、重废一2940、重废二2890、废钢球2890、冷轧、热轧、08铝球2940、新钢板球(边角料)、钢筋球2940、镀锌白铁球2840、不含税。

1月29日【湖北嘉鱼顺乐】废钢最新价格:冲头及板材2890,镀锌冲头/板材2840,重废1 2940,重废2 2890,中废2840,剪板2740,机械生铁2890,废钢丝棉1 2790、废钢丝棉2 2690、钢刨花2690、数控刨花2590、普通刨花2540,不含税。

西南地区

1月28日【四川雅安鞍山】废钢采购价格:预热精料:电话面议(与任何重废钢混合,按优质重废钢定价),8厚2880、7厚2860、6厚2840、5片每片2820厚、4片2800厚、3片2770厚、2片2720厚、1.5片2630厚、1片2500厚、0.5片2370厚、彩钢瓦切割材料为2200,彩钢瓦毛为2130,民用压块2180,花煤球2080,纯钢件:6厚件售价,纯生铁:5厚件售价,发动机变速箱4厚件售价,刨花(大、中)厚)2690。(中国钢铁网、我的钢铁网)

3、预测:需求旺盛! 钢材价格上涨!

明日钢材价格预测

春节期间,部分地区价格小幅上涨,涨幅在10元至60元不等,总体价格波动变化不大; 钢坯价格主要锁定在3830元/吨,废钢上涨110元/吨,国外矿业新加坡掉期指数收涨0.48%。 126.60 美元。 春节期间,钢铁产量跌至年内绝对低位。 节后,生产将逐步回升,但库存压力较往年有所减轻。 明天钢价走势如何? 继续阅读...

1、钢材市场影响因素如下:

美国PCE涨幅创一年来最低水平

美国商务部1月28日公布的数据显示,12月扣除食品和能源的个人消费支出(PCE)核心价格指数同比上涨4.4%。 整体PCE同比增长5%。 核心PCE和整体PCE均有所增长。 为2021年底以来最低。数据公布后,美国股指期货收窄跌幅,美国国债收益率小幅下跌。

2023年全球钢铁需求可能小幅增长

根据全球和地区经济发展及钢铁需求分析,预计2023年全球钢铁需求量将达到18.01亿吨,同比增长0.4%。

乘联会:2022年皮卡市场销量将达51万辆

乘用车协会皮卡市场信息联席会议数据显示,2022年12月皮卡市场销量4.3万辆,同比下降26%,创近五年来新低水平。

今年,房企以“保交”为主,销售和投资规模呈现由低到高的趋势。

“保交货”仍是多数企业的主要任务,多数城市以“稳需求”为主。 低迷的市场情绪将延续到2023年,上半年全国商品房市场整体销售规模仍有可能萎缩,但好的一面是需求改善将支撑整体规模小幅复苏下半年。

中汽协:汽车出口同比增长54.4%

据中国汽车工业协会统计分析,2022年汽车出口将继续保持较高水平,月度屡创新高。 8月以来,月均出口量突破30万辆,全年出口量突破300万辆,有力带动了行业整体增长。 。 2022年,汽车企业出口汽车311.1万辆,同比增长54.4%。

分析师观点:由于乌克兰与俄罗斯国际战争暂停,美国经济通胀放缓,美联储或放缓加息速度,国际资本投资预期提振。 加之国内疫情变化,汽车制造业有所复苏,出口量连续创月度历史新高。 同时,在宏观政策的帮助和强烈预期的支撑下,国内经济逐步复苏,钢材需求有望增加,利好钢材价格走势。

春节期间,钢厂停产检修。

春节期间,全国87家独立电弧炉厂基本停产检修。 只有7家钢厂维持正常生产。 其中,76家纯建材电炉厂已全部停产检修。 大多数计划恢复生产的电炉厂预计将在1月份恢复生产。 分2月31日至2月1日和2月5日至2月6日两个时间段恢复生产。

分析师观点:虽然国家发改委等监管部门三度“打铁”,但铁矿石现货、期货价格依然疯狂,在高成本支撑下,钢厂利润空间收窄,社会库存持续增加积累,需求跟进不够。 但积极助推国家宏观经济政策的目标没有改变。 预计终端钢材采购量将增加。 钢厂停车检修,产量持续下降,利好钢价走势。

可口可乐成本端支撑强劲

春节期间,山西焦炭市场春节期间焦炭价格保持稳定。 钢厂接货正常,目前暂无贸易商找货。 焦炭企业生产基本正常,开工率与节前基本持平。 部分焦炭企业限产,限产仍保持20%-30%。 受春节影响,物流运力大幅下降。 春节期间煤矿放假,焦炭企业暂停采购。 1月27日,部分钢厂提出上调焦炭采购价格,但主流钢厂和焦炭企业尚未表态。

分析师观点:春节期间煤矿放假,焦炭企业暂停采购。 与此同时,部分焦炭企业限产20%-30%,焦炭产量持续下降。 受高成本影响,钢铁企业加大停产检修力度,钢材产量维持低位,市场商家对后市预期增强,在宏观政策积极推动下。 基建、房地产项目待开工,国内消费逐步恢复,带动市场需求,利好钢价。

2、现货市场

螺纹钢:稳定至强

交叉口螺纹钢需求基本停滞,库存积累抑制了钢厂生产积极性。 节前钢厂集中检修,供应处于低位。 市场供应压力较往年有所减轻。 春节后,国家将加大基础设施投资力度,支持新型基础设施重大项目建设。 再加上目前成本高、产量低、利润低的现状,钢厂和贸易商更愿意支持涨价。 预计明日价格仍有小幅上涨空间。

热卷:稳定到强劲

目前热卷社会库存虽有所积累,但增幅较往年同期较小。 在节后预期强烈的背景下,部分需求开始逐步释放。 国家对2023年房地产市场给予了支持政策,因此很多人对后市持乐观态度。 但考虑到节前商家已有库存,节后补货的意愿并不大。 预计明天热卷价格小幅上涨,但幅度有限。

中盘:上行主导

节日期间,大部分中板钢厂生产正常,没有新增检修或复产情况,资源配置正常。 但多数钢厂以安排节前订单为主,市场资源到货较少。 尽管假期期间市场成交稀少,但市场气氛仍维持节前的高涨情绪。 贸易商对节后市场价格相对乐观。 预计明日中厚板市场价格震荡走强。

带钢:稳定增长

期货市场仍休市,市场缺乏提振市场的信心。 断面钢材库存被动增加,但整体销售压力不大。 下游地区施工持续进行,运输恢复,货源逐步向周边扩散。 春节过后,随着疫情以及各类投资的加剧,国内建设将比往年活跃很多,需求表现值得期待。 预计明天价格将窄幅运行。

简介:稳定、更强

长流程钢厂假期期间产量并未饱和。 钢厂产成品库存有一定增加,工厂仓库和社会仓库有一定积累。 但与近几年相比,整体增幅并不大。 市场复工后,去库存压力较小。 目前轧钢厂仍能接受订单,补充原材料库存较为积极。 预计大年初八后开工率将大幅提升。 预计明天价格将窄幅运行。

管材:主体运行平稳

部分小厂正月初六开始开工,但多数厂家暂时没有报价,市场交易气氛不活跃。 许多管厂都计划在正月初八开始生产。 美联储2月加息25%的概率较大,但在稳经济增长政策的支撑下,市场库存不高,没有压力。 近期我国大部分地区降水稀少,总体有利于货运,商家涨价意愿明显。 预计明天管材价格将走强。

3、原材料市场

钢坯:稳转强

原材料价格回落,钢厂利润回升。 但个别成品利润倒挂,部分钢厂仍以钢坯销售为主。 节前贸易商多以正式操作为主,钢坯社会库存积累加速,创近五年来社会钢坯库存历史新高。 对于钢坯供给高、库存高的现实仍需警惕。 但考虑到节后市场整体预期依然良好,预计明天钢坯价格将呈现平稳上涨走势。

铁矿石:稳步上涨

现阶段铁矿石市场处于供需疲软的局面。 供应方面,来自澳大利亚和巴基斯坦的出货量出现季节性下降,到达港口的数量也有所减少。 短期内供应量呈下降趋势。 需求方面,由于当前钢厂利润不稳定,表面需求持续下降。 铁矿石需求支撑较弱。 目前市场报价以稳定为主。 考虑到钢企假期消耗库存,节后刚性需求,市场心态向好。 预计明天铁矿石价格将稳中上涨。

可口可乐:运行暂时稳定

焦炭企业库存持续积累,部分焦炭企业限产,抵制焦炭增减。 随着节后生产持续恢复,钢厂生产成本高企,经营利润较差。 钢厂更愿意从成本端获取利润。 近期原料焦煤价格或将继续下跌,焦炭成本面支撑或减弱。 目前市场采取观望态度,预计明日焦炭市场弱势平稳运行。

废钢:主要平稳运行

春节期间,市场基本处于停滞状态,大部分钢企也在生产和回收中消耗库存。 法定假期已经结束,但预计废钢市场还需要一到两周的时间才能恢复正常。 由于节后前期钢铁企业和基地仍处于恢复阶段,返工期间市场废钢流通仍较缓慢。 预计明日废钢市场价格将维持稳定。

生铁:主要稳定且协调

多地生铁企业停产,下游企业仍处于停产放假阶段。 市场成交较少,公司报价稳定。 春节假期后,部分企业计划恢复生产,生铁资源供应有望增加。 但原材料成本支撑依然较强,企业不愿低价出货,目前需求尚未明显释放,因此企业持观望态度。 预计明日生铁市场价格将维持稳定。

4、综合视角

春节期间,全国87家独立电弧炉厂基本处于停产检修状态,仅有7家钢厂维持正常生产。 其中,76家纯建材电炉厂已全部停产检修。 春节期间,市场到货相对集中,钢厂库存快速增加。 与往年相比有所放缓,但前期库存增幅略高于节前预期。 年内库存已反弹至较高水平,但与往年相比压力并不大。 当前产量低、成本高、库存低的基本面影响之下,市场对节后消费全面复苏的预期较为强烈,预计节后价格将延续节前的强势走势。 预计明日钢价强势,幅度20-30元。

操作建议:“强预期、高成本、弱现实”主线依然主导钢价。 对于尚未备货的人来说,节后观望为主。 激进的贸易商仍可适量拿货,但需要短线操作思路。 (中国钢铁网)

4、春节后钢铁行业走势如何?

预计2023年抑制生产政策将减弱,

形成市场化供需调节

The 14th Five-Year Plan once again emphasizes market-oriented supply and demand adjustment, deepens the restructuring of production capacity, focuses on expanding domestic demand, reduces energy-consuming exports, and continues to unswervingly achieve phased results in total carbon emissions by 2025. The revision of the pace of the dual carbon targets and the demand to ensure supply and stable prices have weakened expectations for the production reduction policy. However, as the overcapacity of finished products has led to a deterioration in steel mill profit expectations, the industry is expected to return to the production capacity clearing stage. It is expected that the overall situation in 2023 will still be spontaneous. Production reduction is the main focus, and profits remain low without administrative policies. In terms of rhythm, it is important to note that the economic pressure is still great in the first half of the year or to maintain high-load production as much as possible. However, the supply-side structural reform still restricts the supply of traditional industries, and the finished product production capacity will still be Facing constraints, policy regulation pressure is still there, and structural adjustment, energy consumption reduction, ultra-low emission transformation, etc. will be the main directions of regulation in the later period.

Iron ore: increasing supply, decreasing demand, or heading towards surplus.

The price center of gravity will shift downward

Iron ore prices will experience a roller coaster ride in 2022. The reduction in Ukrainian iron ore output has become one of the biggest variables on the supply side throughout the year. Domestic mining production has also been affected by mine safety accidents, resulting in mines in some areas being suspended for more than a month. Ultimately, the total domestic supply has Expectations at the beginning of the year were significantly reduced. Against this background, iron ore prices once exceeded US$150, exceeding market expectations at the beginning of the year.

As the international macro situation gradually improves in 2023, demand is expected to grow slightly. Domestic demand for iron ore may continue to decrease slightly due to the comprehensive impact of factors such as capacity replacement and elimination, real estate drag, and poor profits.

Scrap steel: supply decreased year-on-year,

Good development prospects

In 2022, the cumulative supply of domestic scrap steel will decrease by 28.4% year-on-year, with the arrival situation rising first and then falling. The main reason is that the sluggish terminal consumption has led to a decline in processing scrap resources, the downturn in the real estate industry has led to a decrease in construction and demolition, and the periodic outbreaks of epidemics in many places have hindered the logistics and transportation of depreciated scrap steel. The supply of scrap steel is expected to increase by about 10 million tons in 2023, and the pace is ahead. suppress and then rise.

As people's awareness of environmental protection increases, the scrap steel industry is also developing rapidly. At present, some large enterprises have begun to invest in the scrap steel industry and have achieved good results. It is expected that the scrap steel industry will continue to maintain growth momentum in the next few years and is expected to become an important pillar of our country's economy. However, due to the relatively small scale of demand, there is limited room for scrap price increases. In addition, there are other risk factors in the market, such as rising raw material costs and insufficient recycling and processing technology, which will affect the further development and growth of the scrap steel industry. In short, at present, the scrap steel industry has good development prospects.

Coal coke: There is sufficient supply of raw coal,

However, the increment is limited.

Against the background of increasing production and ensuring supply, my country's raw coal output has grown steadily. However, as domestic new coal production capacity in the past two years has mainly been concentrated in thermal coal, the growth rate of raw coal production has lagged relatively behind. The deeper reason behind the slow growth of coking coal production lies in the scarcity of coking coal resources. China's coking coal reserves account for 26.25% of the world's total reserves, with identified resource reserves reaching 276.5 billion tons and basic reserves of 126.3 billion tons. However, coking coal reserves only account for 7.65% of my country's total coal reserves, and high-quality coking coal is even less. Based on the current consumption of raw coal for coking, my country's coking coal can only meet the coking demand in recent decades. On this basis, it is expected that the increase in domestic coking coal supply in 2023 will be relatively limited.

Steel: The average price level is not high.

The amplitude of the shock is limited and demand is expected to improve.

According to data calculations, the national crude steel output in 2022 will decrease by about 2% year-on-year. Against the background of steady release of domestic demand and continued shrinkage of imports, it is expected that there is not much room for crude steel production to continue to decline in 2023. It is estimated that the national crude steel output may reach 1.01 billion tons in 2023, with a year-on-year change of about 1%.

It is expected that the steel market may maintain a trend of first high and then low in 2023. If the epidemic is relatively under control before and after the Spring Festival, traders will stock up for the winter in an appropriate amount. There will be a marginal improvement in demand during the peak season from March to May, and prices will fluctuate upward in a narrow range, from 9 to 11 The monthly peak demand season is approaching, the market may usher in an upward trend, and the overall average steel price in 2023 may not be high. But whether it is the global economic recession or the improvement of the domestic epidemic, steel will return to reasonable demand.

Strengthen the transformation and upgrading of the manufacturing industry,

Investment and consumption drive economic recovery

Manufacturing is the foundation of a country, the foundation of a strong country, and the lifeblood of the country's economy. 推动制造业高质量发展是建设现代化经济体系的内在要求。 The manufacturing industry is the main carrier of national innovation and the guarantee department of national security, and can absorb employment of various skilled personnel. Manufacturing is an important component of the industrial chain and supply chain system. It interacts externally with agriculture, service industries and other industrial fields, and internally covers a series of links from raw materials and intermediate products to the production and circulation of final products. The healthy development of the manufacturing industry is the main symbol and basic prerequisite for the safety and stability of the industrial chain and supply chain. The manufacturing industry provides a steady stream of products and elements for the industrial chain and supply chain cycle, and provides indispensable material guarantees for the stable operation and healthy development of the economy and society.

After the release and implementation of the "16 Financial Regulations" and the shooting of the "Three Arrows" in the real estate market, the relaxation of developer financing policies is conducive to ensuring delivery work and re-establishing market confidence. The shift in epidemic policies and preferential home purchase policies also help the real estate market return to normal. The healthy state provides good conditions. The real estate debt crisis will be resolved in 2023. Next year, some private real estate companies are expected to gradually get out of the woods and start acquiring land, and residents' confidence in home buying is also expected to gradually recover. It is expected that in the first half of 2023, new construction starts will continue to decline and completions will rebound sharply. In the second half of the year, the decline in new construction starts is expected to gradually narrow, and sales may improve by the end of the year. The supply and demand of crude steel will be basically in balance throughout the year, and there will be no obvious contradiction between supply and demand throughout the year. (Integrated by China Steel Network)

5. Iron ore breaks through $100! Steel price breaks through 4,000, is about to usher in a "big rise"?

Led by strong expectations, the steel market has had a "good start" after the holiday. Iron ore and steel prices continue to rise. Singapore's iron ore futures trading index has also exceeded US$100, which is the highest level since the beginning of this year. Related steel products have also benefited from this, and steel prices have risen accordingly. Many steel companies have increased prices, with steel prices exceeding 4,000 yuan/ton.

China Central Broadcasting Network Beijing reported on January 24 that during the Spring Festival, many projects across the country continued to work, boosting steel consumption. An analysis of the development trends of the steel industry in 2023 recently released by the Melting Iron and Steel Industry Research Institute predicts that my country's steel industry will see a trend of optimization and upgrading of the demand structure. Among them, energy transformation and manufacturing upgrading will bring new demand growth points.

Many construction sites across the country are still busy with construction during the Spring Festival, including a large number of new energy industrial park projects and high-end manufacturing projects such as new energy vehicles, new materials, and equipment manufacturing. Wang Lianzhong, chief expert of the Melting Iron and Steel Industry Research Institute, predicts that improving quality and reducing quantity will become the biggest feature of the development of the steel industry this year. The total demand for steel may decrease, and the structure will continue to be optimized and upgraded. Energy transformation and manufacturing upgrading will become new driving forces for steel demand.

In the final analysis, the rise in iron ore and steel prices is the result of the government's macro-control. Recently, due to the repeated epidemics, it has had a great impact on social and economic development. In order to stimulate the vitality of the market, relevant government departments have launched various measures in the hope of stimulating domestic demand and stimulating market enthusiasm. This is of great significance to the entire market. For steel prices, it is undoubtedly a shot in the arm.

In this regard, the China Securities Regulatory Commission's policies once again demonstrate its determination to stabilize and optimize the regulation of the domestic property market. Whether it is bonds, credit, stock financing, or the real estate industry, there is good news. This is also good news for the steel industry. The prices of steel and iron ore have begun to rise under this positive influence.

But no matter what the policy is, the price of steel will not skyrocket because of this good news. The current real estate market continues to be sluggish, facing high housing prices, low demand, low population and other problems, and the development prospects of the real estate market are still not optimistic.

Steel is also involved in many industries, such as railways, automobiles, machinery, military, infrastructure, etc. However, after entering winter, due to the emergence of masks and the slowdown in social and economic development, steel demand continues to decline. Further rise in steel prices will require the support of related industries. The development of these downstream industries will also affect whether steel prices can continue to rise.

As for the future direction of steel prices, industry insiders said that there is not much room for steel prices to rise in the future. First of all, the supply of iron ore is sufficient, steel production will not decrease, and the demand for steel will not increase. When the relationship between supply and demand is not significant, short-term fluctuations caused by macro-control alone are unsustainable.

Another very important factor is that if the price of steel rises, it will inevitably have a certain impact on downstream industries. Industries such as home appliances, industrial machinery, construction, and especially real estate will inevitably raise prices, transferring the pressure of steel prices to consumers, thereby weakening the vitality of the market. This is contrary to the original intention of macro-control. I believe the government will issue corresponding measures. policy to regulate this.

Regarding the changes in steel prices, Wang Lianzhong predicts that the overall steel market prices will stabilize and rebound this year, and may show an N-shaped trend throughout the year, rising in the first half of the year, falling in the third quarter, and rising again in the fourth quarter. Of course, changes in iron ore prices are an important factor affecting steel price trends. Since November last year, iron ore prices have risen rapidly, and the National Development and Reform Commission and other departments have stepped up supervision to maintain normal market order.

Wang Lianzhong believes: "Relevant national departments have taken active actions to guide the iron ore circulation industry and iron ore trading industry in China and abroad to prevent people from raising iron ore prices through various abnormal means and incorrect methods. So I still We are optimistic about the overall trend of supply and demand development in the iron ore market."

At the policy level, regarding the control of steel production capacity and output, Wang Lianzhong suggested giving full play to the decisive role of the market in resource allocation, comprehensively considering energy constraints, environmental constraints and carbon emission constraints, promoting the survival of the fittest among steel companies, and accelerating the iterative upgrading of the steel industry. (China Steel Network)

6. The secondary replenishment of coal and coke stocks in February will have a phased rebound.

My Steel Network News: Looking back on the coal and coke market in 2022, the overall trend was high and then low. The full-year average of the low-sulfur main coking coal price index is 2710, an increase of 12.4% from the 2021 average of 2411. The full-year average of the quasi-first-grade coking coal price index is 3009, an increase of 4.6% from the 2021 average of 2878. Market conflicts have remained concentrated in the past year. above coking coal, so the growth rate of coking coal is obviously better than that of coke.

In January 2023, the trend of double coke was weak. Coke ushered in two rounds of declines totaling 200 yuan/ton at the beginning of the year. Coking coal also began to correct shortly afterwards, with the average decline also around 200 yuan/ton. This wave of decline before the Spring Festival was mainly caused by its own accumulated inventory and the downward pressure brought about by shrinking profits of downstream steel mills. Looking forward to the market in February, the economic recovery after the peak of the epidemic is very obvious, and the macroeconomic expectations continue to improve, and the profits of steel mills are also constantly repaired. The double focus will stop falling and is expected to usher in a slight rebound.

核心思想:

1. Regarding the market trend in the first half of 2023, the macro impact will be greater than the fundamental impact. The strengthening of macro expectations may cause the overall coal and coke price to be in a high and volatile trend. The trend for the whole year of 2023 is expected to be high and then low;

2. Coking coal will continue to operate at low inventories in the first quarter. Coal prices are not yet ready for a sharp decline. Moreover, the coal mine holiday during the Spring Festival this year is longer than in previous years. There will be a secondary replenishment demand for downstream recovery after the holiday. Double coking is expected to usher in a phased period. rebound market;

3. The supply increase of imported coal from Mongolia and Australia has been confirmed, but water from afar cannot quench the thirst for nearby coal. The impact of the increase in imported coal may not be felt until the second quarter;

In April and February, there will be a phased rebound in the double focus.

1. Macroeconomic policies will continue to exert force in the first half of the year

Starting in November last year, the Central Economic Work Conference after the 20th National Congress of the Communist Party of China emphasized the importance of economic development and issued a series of measures to support economic recovery. With the optimization of epidemic prevention and control policies, major domestic commodities have experienced a wave of rising prices.股市也被外资重新点燃,2023年1月北向资金净买入量1125亿,直接超越了2022年全年净买入量900亿,2021年净买入量4322亿,2020年净买入量2089亿,2019年净买入量3517亿。

同时,对房地产市场作为中国经济支柱产业的认定等一系列旨在恢复房地产市场活力的政策和措施出台,无疑对大宗商的需求是极大的利好。虽然房地产政策利好不断袭来,但基本面数据暂时并未改善,12月房地产投资完成额同比-12.2%,新开工面积同比-44.3%,销售面积同比-31.5%,政策的利好似乎并未重拾购房者的信心,对大宗商品的需求利好也仅仅还停留在“预期向好”层面,但即使是这样,市场也更愿意相信后面会出台更多的利好政策。

所以能看到近期市场虽然现货成交疲软,但期货的热度明显高于现货热度,普遍出现了期货价格带着现货加速上涨的情况。从这里明显能感觉到来自宏观面的“强预期”要明显好过于基本面的“弱现实”。或许2023年上半年我们还要继续承受来自灵魂拷问:对GDP5.5%有没有信心?对230的铁水有没有信心?

二、焦煤短期低库存问题难以缓解

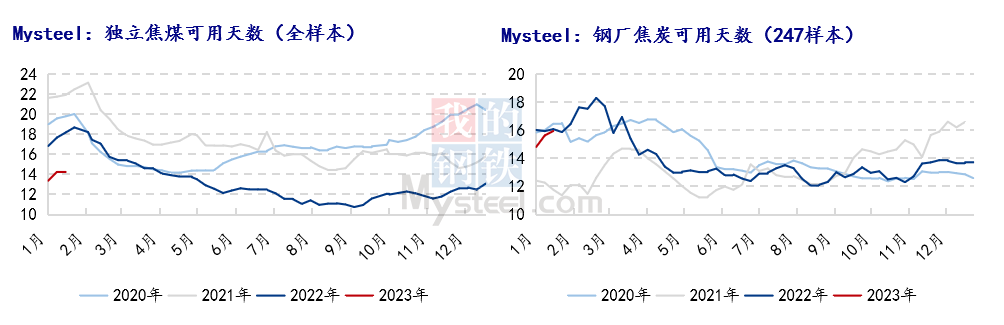

节前焦化和钢厂该补的库存已经基本补给到位,但今年的冬储补库明显要弱于往年,煤焦整体依然低于往年同期水平。截止春节前一周,Mysteel调研的全国独立焦化焦煤可用天数为14.34天,比去年同期减少4.35天;247钢厂样本焦炭可用天数为13.83天,比去年同期减少1.12天。今年春节下游库存之所以会这么低,主要是由于节前市场对年后的价格走势预期偏悲观,以及下游企业利润低甚至很多企业都出现亏损以至于不敢过多补给库存,多数企业均有保持合理库存维持正常生产即可的想法。

此外,今年煤矿春节放假时间较长,煤矿自身就没有多少货供下游补库,前三年受疫情影响,多数煤矿倡导工人就地过年,平均放假时长在7天左右,今年年底疫情管控政策相继放开,工人提前返乡过年不在少数,2023年春节煤矿平均放假时间为10.9天,相较前两年普遍延长2-4天,2021年和2022年疫情形势严峻,就地过年的企业较多,今年疫情管控调整,不少企业提前安排放假。

三、进口蒙煤、澳煤供应增量确定

2023年预计焦煤的供应会持续得到改善,除了国内为增产保供核增、新增了一批产能以外,进口的增量也不容忽视尤其是在疫情防控政策优化后,进口蒙煤有望恢复至疫情前的通关水平,另外,进口澳煤的逐步恢复也将给国内焦煤市场供应带来一定的增量。

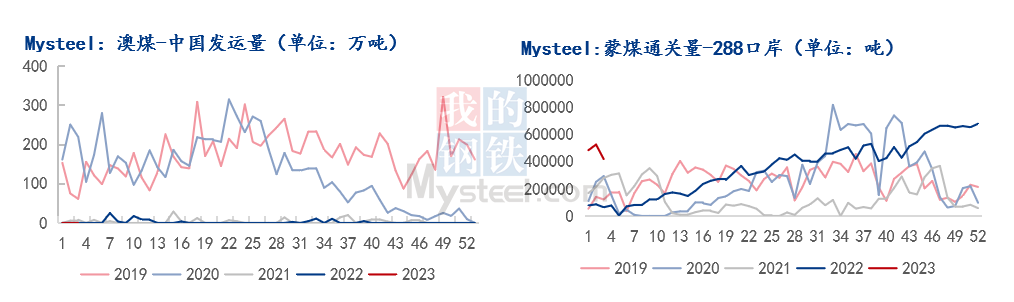

过去三年在疫情影响下蒙煤的通关效率大幅下降,根据海关数据显示,2022年我国进口蒙煤总量2561万吨,较2021年的1404万吨增长82%,2020年进口蒙煤2221万吨,2019年进口蒙煤3377万吨(疫情前水平)。2023年没有了疫情防控的阻碍,蒙煤通关大概率会超过疫情前水平,全年进口量预计将突破4000万吨。从春节后首日的通关情况来看,288口岸2023年春节后首日通关640车,其中AGV120车,较节前最后一个工作日(1月21日)增加520车,相较于2022年春节后首日(2022年2月5日)通关车数增加617车。进入二月份后,甘其毛都口岸通关车数有望超过900车,随着节后贸易商的复工,通关突破1000车只是时间问题。

此外,沉寂了两年多的澳煤进口也在2023年迎来了曙光,随着对大唐,华能,国能和宝武这四家企业点对点进口放开进口澳洲,可以预示到后续对其它贸易企业的限制也会逐步放松。但从政策的调整周期以及澳煤发货的周期来看,进口澳煤想要起量预计也要到二季度之后了,一季度也仅有宝武的一些订单能到港,对市场影响有限。所以短期来看恢复澳煤进口对国内焦煤市场影响有限,但长期来看澳煤进口的增加已经十分确定。

值得关注的是恢复澳煤进口后对市场的影响,尤其是对俄煤的影响,由于品质的差异俄煤相较于澳煤有天然的劣势,恢复澳煤进口后势必会对俄煤价格形成压力。此外恢复澳煤进口后对国内高硫主焦煤影响也会较大,近两年在没有澳煤的补充情况下,沿海的钢厂焦化都换了煤比配方,国内的高硫主焦煤成了代替品,高硫高强度的主焦煤一度成为市场的香饽饽,高低硫价差明显缩小,恢复澳煤进口后国内高低硫主焦煤的价差也将重回合理区间。

四、2月份双焦会有阶段性反弹行情

今年春节煤矿放假时间较往年偏长,矿上也基本没有多少库存,造成了今年春节后焦煤供应暂时偏紧的局面。年前市场比较悲观,冬储补库量也少于往年同期水平,造成了今年春节后下游库存普遍偏低的现状。而需求端也在疫情防控政策优化后逐渐得到改善,年后仍有一小部分钢厂高炉有复产计划。而进口煤虽有增量预期,但远水终究难解近渴。

综上,2月煤焦市场仍以宏观预期向好为主,基本面暂时偏强为辅,节前的低迷走势或在节后迎来转机。两会之前,在国内煤矿还未完全复产以及进口煤还未起量之际,焦煤有望止跌企稳甚至小幅反弹。同样焦炭在经历2-3轮下跌后,节后也有望听到焦企再度提涨的声音。总之,暂时对煤焦市场还需保持一定的乐观,2月份双焦仍有阶段性反弹的机会。但长期来看,焦煤价格依然要承受来自进口煤供应增量的压力。(我的钢铁网)

转载请注明出处:https://www.twgcw.com/gczx/1146.html